KPMG Third Party Intelligent Diligence

KPMG Third Party Intelligent Diligence

A cognitive, real time solution for your due diligence needs.

Understanding third parties (including customers) has never been more important. Geopolitical and financial volatility combined with high levels of regulator intervention demand the highest levels of third party risk management.

The current paradigm with a multitude manual processes and sequential processing of point intime data is unsustainable. This can lead to significant cost, inconsistent and variable quality and poor outcomes.

Customers, suppliers and distributors all recognise the need for third part risk management, but also want a seamless, quick and efficient process. This is often not happening and research shows that slow processing and burdensome KYC information requests will influence where they bank.

A new way is needed to process millions of pieces of client data simultaneously, provide ongoing and near real-time monitoring and accelerate on-boarding processes. Technology exists now to make this happen.

Our solutions

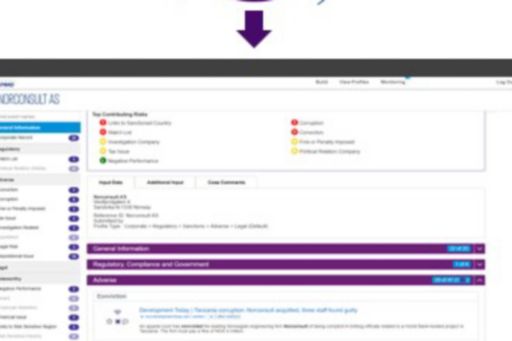

KPMG Third Party Intelligent Diligence is a new way to understand risk. Using millions of data sources and searching in multiple languages it can collect client due diligence data and perform regulatory risk and adverse press reviews in minutes.

Next generation AI and machine learning enables the sorting, de-duplication and structuring of data in asummarised and readable format which significantly increases analyst efficiency. This scalable tool can batch process hundreds of thousands of third parties per month, substantially reduce onboarding times and enhance the customer experience.

This tool can be deployed same day in urgent situations and integrated into most workflow platforms, its output can also be linked directly into your third party technology.

The benefits

KPMG Third Party Intelligent Diligence completes due diligence searches in matter of minutes, de-duplicates and organises information smartly to help significantly reduce the time needed to review each third party.

- Cheaper - Speed and de-duplication mean time spent collecting and reviewing data can be significantly reduced (on average 8 hours to 1 hour);

- Broader - There are no known constraints on the amount of data or number of sources that can beanalysed.

- Scalable - Large volumes of requests can be processed quickly without constraint.

- Flexible - It can be normally be customised to reflect client policy or regulatory changes in a few days.

- Smart - Artificial intelligence technology replicates the way human analysts conduct research faster and more consistently, reducing false positives and auto-adjudicating out the noise.

- Ongoing monitoring - Daily alerts to risk events across a third party population. Periodic reviews end here.

© 2024 KPMG LLP a UK limited liability partnership and a member firm of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organisation please visit https://kpmg.com/governance.