e-Tax alert 153 - Investing in Renewable Energy Business – Key Tax Issues in Taiwan

e-Tax alert 153 - Investing in Renewable Energy Busines

Taiwan is dedicated to the development of renewable energy because promoting renewable energy as an energy transition is a global trend.

Taiwan is dedicated to the development of renewable energy because promoting renewable energy as an energy transition is a global trend. Taiwan aims to increase the proportion of renewable energy from 5.65% in 2019 to 20% in 2025 and becomes the green energy development center of Asia. Among them, solar energy and wind energy are the most critical renewable energy.

The amendment of the Renewable Energy Development Act passed in 2019 which enables Taiwanese enterprises to purchase the green energy through corporate power purchase agreements (“PPA”) directly. In addition, on June 19, 2020 Energy Bureau of the Ministry of Economic Affairs announced the draft act for the third phase - offshore wind farm “block development”. With the support of the foresaid policies, foreign investors are attracted to come to Taiwan to know more about the investment opportunities and show their strong interests to invest in renewable energy business in Taiwan.

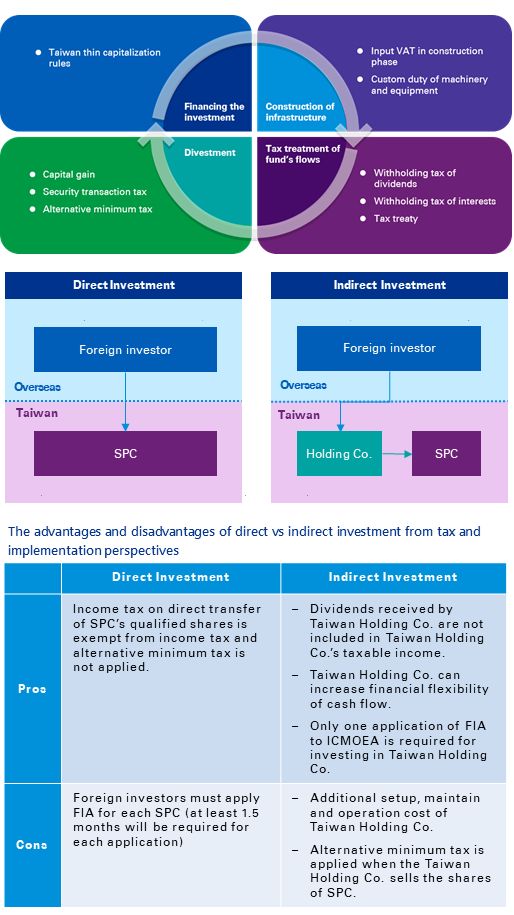

The initial construction cost of renewable energy power plants is high, and it takes a long time to recover the funds. Take offshore wind farm for example, the revenue could not be made until the electricity is sold under a 20-year feed-in-tariff after the commercial operation date. As a result, foreign investors who invest in renewable energy in Taiwan usually need to consider the exit mechanism when entering the market. For example, investors may sell the shares at a proper time after the power plant starts to operate in order to return their capital that could be used to invest in another new projects. There will also be huge funding arrangement needs during the investment process. Therefore, the key tax issues raised by foreign investors involved in four aspects including financing the investment, construction of infrastructure, repatriation of earnings and divestment of the project into consideration when deciding the investment and holding structure.

Financing the investment

When raising funds for constructing power plants, the special purpose company (“SPC”) could have a project financing from financial institutions, issue green bonds or borrow from related parties. According to Income Tax Act, if the loan is provided by related parties, or provided by non-related parties (e.g. banks) but being guaranteed and jointly liable for reimbursement by related parties, the tax-deductible interest expense allowed on such debt is capped at a prescribed intercompany debt-to-equity ratio of 3:1. The portion of interest expense on intercompany debt which exceeds the stipulated threshold is non-deductible.

Construction of infrastructure

Considering the complexity of marine works of offshore wind power plant and the long preparation time, under prevailing tax rulings of Article 39 of Value Added Tax (“VAT”), the input VAT paid by SPC on construction period before the completion of tax registration is refundable. Furthermore, the custom duty of the relevant machinery and equipment imported by the SPC and used for the construction or operation of renewable energy, providing that the equipment has not been manufactured and supplied in Taiwan, could be exempt after non-domestically manufactured certificate issued by the Ministry of Economic Affairs is obtained.

Tax treatment of funds’ flows

When the SPC distributes dividends to foreign shareholders, 21% withholding tax applies. If there is a tax treaty between the foreign shareholder's resident country and Taiwan, shareholders could provide the certificate of residence issued by the tax authority of the resident country, the statement of stating that the income receiver is the beneficiary owner of the distributed dividend, and other supporting documents to the Taiwan withholding agent as the basis for preferential withholding tax rate. If the SPC pays the interest on loans to a foreign company, it shall withhold 20% tax. As mentioned above, the certificate of residence issued by the tax authority of the resident country, the statement stating that the income receiver is the beneficiary owner of the interest income, and other supporting documents shall be provided, so the Taiwan withholding agent could withhold tax at a preferential rate accordingly.

Divestment

If a foreign investor does not have a fixed place of business or a business agent in Taiwan, income tax on the direct transfer of SPC’s shares is exempt, and only 3‰ security transaction tax will be levied on the transaction price. It should be noted that share certificates of the SPC must have been duly certified by the a qualified bank according to the Company Act. Moreover, some foreign investors may invest in SPC through a Taiwan holding company. If the domestic holding company sells the shares of the SPC, income basic tax (i.e. alternative minimum tax) will also be applied in addition to 3‰ security transaction tax.

Besides the above issues, there are other considerations when deciding whether to invest directly or indirectly. For example, if the foreign investor invests in SPCs directly, it must obtain foreign investment approval (“FIA”) of each SPC from the Investment Commission of Ministry of Economic Affairs (“ICMOEA”) in advance. The following table summarizes the advantages and disadvantages of direct vs indirect investment from tax and implementation perspectives.

KPMG Observations

Foreign investors should make proper evaluations and planning before doing the investment as their investment in the renewable energy industry in Taiwan involves a wide range of tax aspects which influence each other at all phases of investment. In addition, due diligence of tax, finance and law should be conducted against SPCs to improve the overall operating performance of investment projects and reduce risks if the shares of SPCs are acquired by purchase.

Authors

Rita Yu Partner

Tina Ho Associate Director

© 2024 KPMG, a Taiwan partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

上列組織及本文內任何文字不應被解讀或視為上列組織之間有任何母子公司關係,仲介關係,合夥關係,或合營關係。 上述成員機構皆無權限(無論係實際權限,表面權限,默示權限,或任何其他種類之權限)以任何形式約束或使得 KPMG International 或任何上述之成員機構負有任何法律義務。 關於此文內所有資訊皆屬一般通用之性質,且並無意影射任何特定個人或法人之情況。即使我們致力於即時提供精確之資訊,但不保證各位獲得此份資訊時內容準確無誤,亦不保證資訊能精準適用未來之情況。任何人皆不得在未獲得個案專業審視下所產出之專業建議前應用該資訊。