e-Tax alert 152 - MOF announced Draft Amendments on TP Assessment Rules

e-Tax alert 152 - MOF announced Draft Amendments on TP

In response to the global development trends and the mitigation of disputes in relation to transfer pricing audits, the Taiwan Ministry of Finance announced draft amendments to certain provisions of the Regulations Governing Assessment of Profit-Seeking Enterprise Income Tax on Non-Arm's-Length Transfer Pricing on August 18, 2020.

In response to the global development trends and the mitigation of disputes in relation to transfer pricing audits, the Taiwan Ministry of Finance (“MOF”) announced draft amendments to certain provisions of the Regulations Governing Assessment of Profit-Seeking Enterprise Income Tax on Non-Arm's-Length Transfer Pricing (hereinafter referred to as “TP assessment rules” ) on August 18, 2020. With reference to the amended "OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations" (hereinafter referred to as the "OECD TP Guidelines") released by the OECD in July 2017, the TP Assessment rules have incorporated relevant guidelines for the evaluation of the economic substances and behaviors and the transactions involving the use of intangible asset with the aim to provide guidance for value chain arrangements of multinational enterprises (“MNEs”). The main revisions of the amendment are discussed below:

The evaluation of comparable circumstances or comparable transactions shall be based on the actual economic substances and behaviors of the transaction

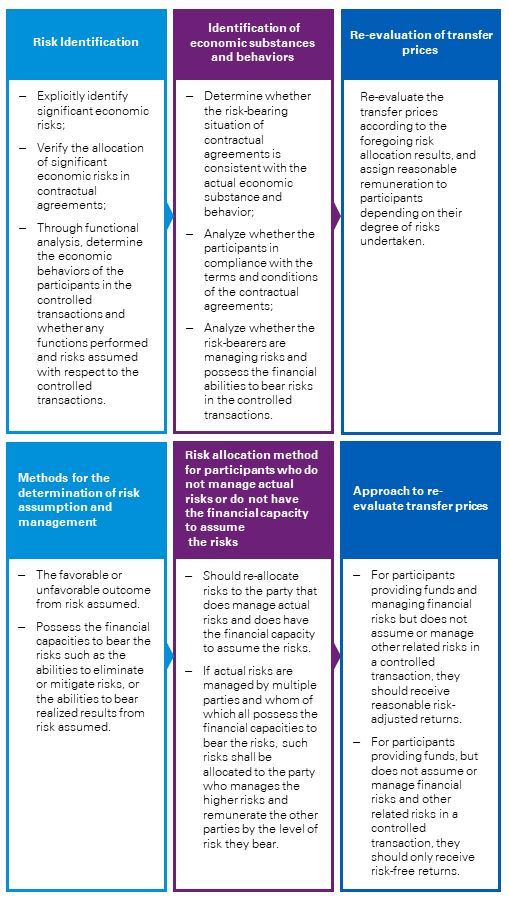

The following steps should be followed when evaluating comparable transactions based on the actual economic substances and behaviors of the transaction:

Data of Comparable Uncontrolled Transactions

When internal or external comparable uncontrolled transactions methods are adopted and the uncontrolled transaction of the profit-seeking enterprise undertaking with its unrelated party is highly comparable to the controlled transactions, the arm’s-length result derived from a single comparable uncontrolled transaction may be used if one of the following conditions is met:

‒There is no substantial difference on the impact of public market prices between the profit-seeking enterprise and unrelated parties, or between the controlled transaction and an uncontrolled transaction made between unrelated parties

‒If substantial differences exist on the aforementioned factors, a reasonable adjustment shall be made to the prices or profits in the comparable uncontrolled transaction taking into account the impact of such differences.

Transactions involving intangible assets

Explicit definition of intangible assets

Explicitly define that intangible assets should meet the following conditions:

‒“capable of being owned or controlled for use in commercial activities”

‒“whose use or transfer would be compensated had it occurred in a transaction between independent parties in comparable circumstances”

Additional comparability characteristics of intangible assets

Include additional factors to be considered when evaluating the degree of comparability of intangible assets such as the terms of transfer, stage of development, rights to future enhancement, revisions and updates, uniqueness and period for which it remains unique and the remaining duration of economic benefits.

Special considerations when evaluating transactions involving intangible assets

‒Introduction of the DEMPE functions:

By referring to the OECD TP Guidelines, economics activities such as the development, enhancement, maintenance, protection and exploitation (DEMPE) shall be considered when evaluating the respective contribution of participants in transactions involving intangible assets to ensure the allocation of profits is consistent with the DEMPE functions each participant performs

‒Special considerations for risks:

•Development Risks

•Product Obsolescence Risk

•Infringement Risks

•Product Liability Risks

•Exploitation Risks

‒Framework for evaluating the results of intangible asset transactions:

Introduction of a new arm’s-length method for intangible asset

‒Include the “income approach” set forth in the No.7 Statements of Valuation Standards (SBS) as one of applicable arm’s-length transaction methods for evaluating transactions involving the transfer and use of intangible asset .

‒The following assumptions shall be considered when evaluating the applicability of the income approach:

•The accuracy and reliability of financial forecasts;

•Future growth rates;

•Discounted rates;

•The remaining duration of economic benefits;

•The assumption of tax effects.

•Other assumptions affecting the valuation of intangible assets

Definition of undisclosed transaction

‒Controlled transactions that are not disclosed in the related party disclosure forms B4 and B5 specified in the current year of Profit-Seeking Enterprise Income Tax Return and Assessment Certificate.

‒Controlled transactions that are not disclosed in the relevant transfer pricing documentations.

Penalty provisions for undisclosed transactions subject to transfer pricing adjustments

If an increase in taxable income of the undisclosed controlled transactions and assessed by the tax collection authority is more than 5% of the annual taxable income of the enterprise; and more than 1.5% of the annual net operating revenue, the following provisions apply:

‒Where a profit-seeking enterprise who has filed the corporate income tax return, any tax omission or under-reporting of income taxable hereunder shall be subject to a fine of no more than twice the amount of the tax evaded.

‒Where a profit-seeking enterprise who fails to file the corporate income tax return and is found by the tax collection authority to have income taxable hereunder, the collection authority shall, in addition to determining the tax payable, impose a fine of no more than three times the amount of tax determined as payable.

‒Where a profit-seeking enterprise, due to tax exemption provided under the incentive statute or because of business deficit, shall not have a taxable income even though the amount of income omitted or under-reported is added to it, a fine shall be imposed separately at prescribed times according to the preceding two paragraphs on the taxable omission and under-reporting of income calculated at the profit-seeking enterprise income tax rate applicable in the current year. The amount of the fine, however, shall not exceed NTD 90,000 or be less than NTD 4,500.

KPMG Observations

In recent years, while the global perception and theories of transfer pricing continue to develop and evolve, ambiguities and disputes may still inevitably exist on certain issues during the process, which brings about uncertainties for profit-seeking enterprises in terms of transfer pricing compliance. Given such, MOF has made amendments on the TP Assessment Rules by referring to the OECD TP Guidelines to put forward a more specific and clear guidance to assist MNEs with relevant planning in order to manage risks of cross-order tax disputes more effectively.

However, it should be noted that the despite the issues covered in this amendment are made as explicit as possible, certain issues such as whether arm’s-length remunerations are given to risk-bearers and the accurate evaluation of future growth rates and discounted rates of intangible assets, still require subjective and complex judgements. As such practical issues may easily lead to cognitive differences in subjective judgments, enterprises should evaluate transactions involving intangible assets between related parties prudently and observe the subsequent development of international practice.

In addition, this amendment also included penalty provisions for undisclosed transaction subject to transfer pricing adjustments. MNEs should review their intercompany arrangements as soon as possible to determine if certain transactions have not been disclosed to avoid possible tax payments and penalties that may arise.

Authors

Chris Lin Partner

Waylon Chang Associate Director

© 2024 KPMG, a Taiwan partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

上列組織及本文內任何文字不應被解讀或視為上列組織之間有任何母子公司關係,仲介關係,合夥關係,或合營關係。 上述成員機構皆無權限(無論係實際權限,表面權限,默示權限,或任何其他種類之權限)以任何形式約束或使得 KPMG International 或任何上述之成員機構負有任何法律義務。 關於此文內所有資訊皆屬一般通用之性質,且並無意影射任何特定個人或法人之情況。即使我們致力於即時提供精確之資訊,但不保證各位獲得此份資訊時內容準確無誤,亦不保證資訊能精準適用未來之情況。任何人皆不得在未獲得個案專業審視下所產出之專業建議前應用該資訊。