e-Tax alert 134 - New amendment to TSI Guidance on Taiwan source income calculation for foreign corporations

e-Tax alert 134 - New amendment to TSI Guidance on TW

Under the current Taiwan Income Tax regime, foreign companies without PE in Taiwan that derive Taiwan source income, under the category of service income or business profits, would be subject to withholding tax. The Taiwan companies, which makes the underlying payment to foreign companies, are obligated to make withholding if falling within the types of income subject to withholding tax regime.

Under the current Taiwan Income Tax regime, foreign companies without PE in Taiwan that derive Taiwan source income, under the category of service income or business profits, would be subject to withholding tax. The Taiwan companies, which makes the underlying payment to foreign companies, are obligated to make withholding if falling within the types of income subject to withholding tax regime.

While the relevant income tax rule allows foreign companies to claim costs/expenses incurred offshore, if the foreign company have been subject to income tax/withholding tax, however, in practice the tax authority tends to raise challenge against offshore expenses and subject to strict scrutiny.

On September 27, 2019, the Ministry of Finance (MOF) has announced an amendment to the TSI Guidance and allows the foreign companies to apply advance confirmation with the tax authority on income calculation under Article 15-1. Pursuant to such amendment, foreign companies without PE in Taiwan can now adopt a “deemed profit” approach to calculate their taxable Taiwan sourced income as an alternative option, instead of trying to claim actual costs and expenses incurred and apply for refund on the overpaid withholding tax afterwards. To utilize such treatment, foreign companies would need to first seek advance confirmation from the tax authority.

The detail rules on such application has also been announced under “Directions for Foreign Profit-seeking Enterprises Applying for Issuance of Assessment Permission of Applicable Net Profit Ratio and Domestic Profit Contribution Ratio for Calculation of Income from Sources in the Republic of China” (“Directions for Art. 15-1 TSI Guidance Application”).

The aforementioned amendment is effective immediately and the main points are summarized below:

1. What is covered under Article 15-1 of TSI Guidance

In accordance with Article 15-1 of the TSI Guidance, foreign companies without PE in Taiwan, which derives Taiwan source income under the category of services income or business profit, can apply to the tax authority to adopt deemed profit ratio and contribution ratio to calculate its taxable income in Taiwan. To adopt such calculation of taxable income, foreign companies would need to make the deemed profit and contribution ratio application to the tax authority prior to receiving the income.

2. The calculation of Taiwan sourced income

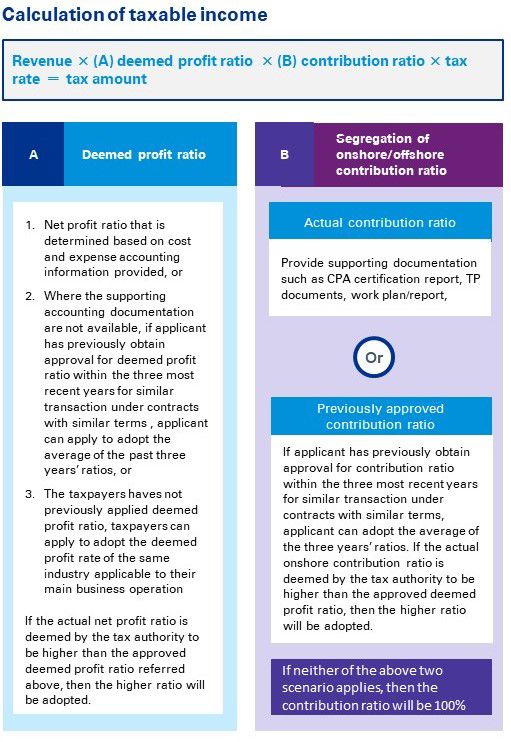

In terms of the calculation of the taxable income, Article 15-1 allows the foreign companies to adopt a deemed profit ratio to calculate the taxable income rather than pay the withholding tax on the gross amount.

In addition, the tax regime also allows the foreign companies to claim a contribution ratio, which determines how much of revenue derived is attributable to onshore activities and offshore activities.

Please refer to the attachment for illustration of the calculation.

3. Documentations to be submitted in the application

Applicants are required to submit the following documents along with the application:

a. the relevant underlying contract, which needs to be signed (with Chinese translation)

b. explanation of the applicant’s main business operation and relevant transaction flow/stages (both onshore and offshore transaction steps)

c. Documents illustrating applicant’s main business operation

d. previous approval letter (within the three most recent years) issued by the tax authority on the use of deemed profit and contribution ratio (if previously granted)

e. letter of authority (if applicant is appointing an agent to file the application)

other supporting documents requested by the tax authority

KPMG Observation

1. Prior to the announcement of the Art. 15-1 of TSI Guidance, the tax authority tends to place strict scrutiny when reviewing the offshore costs/expenses claimed by taxpayers; this often creates practical difficulties for foreign companies to substantiate the offshore costs/expenses claimed for calculation of taxable income in Taiwan which defeats the original intent on TSI Guidance. With the new amendment and release of the Directions for Art. 15-1 TSI Guidance Application, it provides more flexible options for foreign companies to calculate the taxable income; furthermore, the use of deemed profit ratio also mitigate the uncertainty associated with substantiation issue and administrative burden of post payment refund process.

2. Among the different options of reducing the withholding tax costs, currently the more frequently used mitigation options are business profits exemption provided under treaty or the Article 25 of Income Tax Act for technical service fee (which is not applicable to China companies). While Taiwan has relatively limited treaty network, this new rule can apply to payments to foreign companies located in non-treaty countries, including China companies (where the double tax agreement still not yet effective and Article 25 treatment does not apply to China companies). So this offers an alternative option to reduce the withholding tax burden.

3. The utilization of the deemed profit ratio and contribution ratio stated in the Directions for Art. 15-1 TSI Guidance Application is an advance confirmation effective after the announcement and not applicable retroactively to payment already been subject to withholding tax. We suggest companies should revisiting the related payments for future period and submit the application with the tax authority to secure the reduced tax treatment going forward. Note that if the companies do not seek the advance approval, they are still eligible to claim the actual costs and expenses incurred and apply for withholding tax refund afterwards.

Authors

Lynn Chen, Partner

Chuck Chiu, Associate Director

Ethan Hsieh, Associate Director

© 2024 KPMG, a Taiwan partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

上列組織及本文內任何文字不應被解讀或視為上列組織之間有任何母子公司關係,仲介關係,合夥關係,或合營關係。 上述成員機構皆無權限(無論係實際權限,表面權限,默示權限,或任何其他種類之權限)以任何形式約束或使得 KPMG International 或任何上述之成員機構負有任何法律義務。 關於此文內所有資訊皆屬一般通用之性質,且並無意影射任何特定個人或法人之情況。即使我們致力於即時提供精確之資訊,但不保證各位獲得此份資訊時內容準確無誤,亦不保證資訊能精準適用未來之情況。任何人皆不得在未獲得個案專業審視下所產出之專業建議前應用該資訊。