Market Update: Oil & Gas - August 2016

Market Update: Oil & Gas - August 2016

Oil Rally: Sustainable or Speculation Driven?

Oil Rally: Sustainable or Speculation Driven?

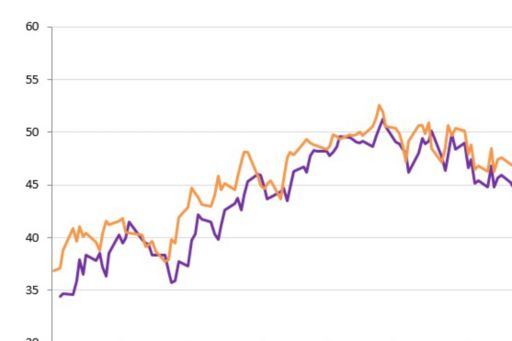

Oil prices have risen in the past weeks, with ICE Brent prices topping US$50/bbl briefly. Despite supply and demand fundamentals remaining similar to last month (when oil prices waned), oil prices seem to have rallied due to political factors. Speculation that the oil cartel OPEC will come to a uniform decision to freeze productivity levels has been rife. Due to the complexity and various national interests involved, a cautious approach must be adopted as to the likelihood over such a freeze, particularly since such promises have come and gone previously in the year.

Gas: Narrowing Benchmark Spreads

In a dramatic reversal of escalating natural gas prices since Brexit, the last few weeks have seen US Henry Hub (HH) front-month gas price drop sharply to under US$2.59 per mmBtu. Shaped by a milder than anticipated few weeks and high productivity level in the U.S., price momentum has shifted downwards. Similarly, UK National Balancing Point (NBP) front month prices settled at US$4 per mmBtu in mid-August, bringing the NBP-HH spread to around US$1.34 per mmBtu. The narrowing of the two price benchmarks could thwart ‘trans-Atlantic' price arbitrage opportunities this winter. With US prices expected to grow this winter due to a balancing of supply and demand and colder temperatures, any growth of European gas imports from the US will be dictated by the winter weather in Europe.

Dutch oil and gas suppliers diversifying into adjacent sectors

Producers in the oil and gas producer industry are continuing to refocus and reposition themselves. The Dutch oil and gas sector, like other parts of the world oil ecosystem, has been impacted by the current price levels. Lower oil prices are expected to persist in the near future and hence are still exerting heavy pressure the bottom line of oil producing entities. The Dutch energy industry has a reputation for its entrepreneurial and exploratory nature, both within the business strategy and the organization structure.

On the business strategy side, we see more activity coming from the Maintenance and Asset integrity related activities versus new build / capex driven projects. Additionally, we see active forays into new business areas of decommissioning and off-shore wind. The cost costs levels for off-shore wind has reduced, driven by imbalance in oil and gas supply and demand, which has resulted in a decrease in the overall cost across the network. In addition government and financial support is enabling increased development of off-shore wind assets.

On the organization structure side, companies have been shedding excess capacity in a manner similar to ‘peeling the onion’. The easier and outer layers have already been shed. There is a revised focus on taking tougher decisions and repositioning capabilities aligned with new market opportunities and offerings.

"Both oil and gas majors and suppliers are de-risking their portfolio to get into new market segments. This is driven by their financial partners asking for more assurance on investments. This requires companies to continuously reinvent themselves and take tough strategic and operational decisions."

– Ramanathan V, Manager in Oil & Gas, KPMG the Netherlands

Asian Investment: Taking a far-sighted view

OPEC upgraded its expectation for global oil demand in 2016, contributing to a growth spurt in this month’s international crude benchmarks. Against this environmental backdrop, whispers of divestments by large oil companies have spread. Nonetheless, the products market remains not only oversupplied but on-edge over the growth trajectory of the Chinese and Indian industrial markets. In light of the contrasting dynamics in the crude and products markets, the bulk of market participants are adopting a ‘wait and see’ approach, with traders thriving upon the short-term volatility.

"Within the last two years, Asian investors have had a strong interest in Canadian oil and gas assets; some looking to enter, others aiming to extending their footprint in the country with the third largest oil reserves in the world. Furthermore, with news permeating that large oil companies are on the cusp of shedding assets, Asian traders who have not over-leveraged their books and are relatively cash-liquid, are now eyeing strategic investments with even greater interest. This activity is likely a reaction to the anticipation that, over the medium-term, crude prices will rise on the back of flattening production, upstream investment cuts and the eventual curtailment of the refined product surplus."

– Oliver Hsieh, Director, Commodity & Energy Risk Management for ASEAN, KPMG in Singapore

Africa: Considerable Developments and Traction

Earlier this month, production licenses for Total E&P and Tullow Oil in Uganda for oilfields in the Albertine Graben were approved by Cabinet. The actual issuance of the licenses is likely to be completed in the next few months. This is a significant development in moving along resource development in Uganda. Though CNOOC was issued its production license in 2013, activities in its licensed areas were not able to proceed until joint venture partners, Total and Tullow Oil, had secured their licenses.

The development of the 60,000 barrels per day (bpd) refinery project, which includes construction of a 205 km product pipeline, is also forging ahead with the Government of Uganda beginning negotiations with the alternate bidder to the project, South Korea’s SK Engineering & Construction. The Government in the earlier part of this quarter halted negotiations with the previously preferred bidder RT Global Resources consortium after reported delays with closing certain key agreements.

"We can also expect considerable traction in the development of the pipeline from Hoima to Tanga in Tanzania in the latter half of this year. Negotiations are underway to conclude preliminary plans with focus on completing agreements between the Government of Uganda and the Government of Tanzania. At the same time the JV partners are discussing the particulars of participation and investment in the pipeline."

– Ben Ndung’u, Head of Energy and Natural Resources, KPMG East Africa

An Executive Director for the newly created Petroleum Authority, Petroleum Authority of Uganda (PAU), was also appointed last week and will assume office in September. This newly formed authority has the mandate to monitor and regulate upstream petroleum development in the country. The formation and operationalization of key institutions is in line with the recent ramp up in preparations for development of crude finds in Uganda.

In Kenya, the Cabinet approved plans for early crude oil export and related projects to upgrade infrastructure that will facilitate the logistics of early oil. Tullow Oil will begin a pilot project to move crude oil by truck to the Mombasa refinery for a period of one month. The trial run is expected to provide insight into how the products behave in transit and work out other logistical matters. The Ministry of Energy and Petroleum is keen to meet the commitment to export crude to market by August 2017. At the same time, Tullow Oil, Africa Oil and Maersk Oil, partners in the Lokichar Basin oilfields, are progressing plans with GoK on how to develop the export crude pipeline from Lokichar to the Coast of Kenya.

Meanwhile, in Tanzania, LNG projects partners BG Group (acquired by Shell), Exxon Mobil, Statoil and Ophir Energy in partnership with the state-run Tanzania Petroleum Development Corporation (TPDC) are progressing plans for the USD 30B plant at Lindi on the South East Coast of Tanzania.

"The Government of Tanzania will likely comment an Environmental Impact assessment for the planned LNG plant site at the end of August. We understand that the GoT is yet to finalise agreements on certain terms with the partner IOCs for the plant. The IOCs are also yet to reach the FID; competition from neighbouring Mozambique and available incentives in Tanzania are expected to play a major role in reaching the FID."

– Alex Njombe, Director, KPMG East Africa

Analyst estimates: oil

| 2016 | 2017 | 2018 | 2019 | |

| June Avg | 42.6 | 57.1 | 72.0 | 76.1 |

| July Avg | 44.9 | 57.9 | 71.0 | 73.5 |

| June Median | 42.5 | 56.3 | 70.0 | 75.0 |

| July Median | 44.9 | 56.3 | 70.0 | 72.0 |

Analyst estimates: gas

| 2016 | 2017 | 2018 | 2019 | |

| Min | 2.2 | 2.8 | 2.9 | 3.2 |

| Average | 2.4 | 3.1 | 3.4 | 3.5 |

| Median | 2.4 | 3.2 | 3.3 | 3.5 |

| Max | 2.5 | 3.5 | 4.0 | 4.0 |

| 2016 | 2017 | 2018 | 2019 | |

| June Avg | 2.3 | 3.0 | 3.4 | 3.5 |

| July Avg | 2.4 | 3.1 | 3.4 | 3.5 |

| June Median | 2.3 | 3.0 | 3.2 | 3.5 |

| July Median | 2.4 | 3.2 | 3.3 | 3.5 |

Note: The forecasts/analyst estimates identified are an indication based on third party sources and information. They do not represent the views of KPMG.