Global Metals and Mining Outlook 2016: Working together to improve visibility and predict demand

Working together to predict demand

"If metals and mining organizations could better share demand signals, inventory levels and growth plans, both sectors would be in a stronger position to negotiate prices and invest in future capacity. Complete visibility may not ever be entirely possible, but greater coordination and collaboration is certainly a worthy goal." – Richard Sharman, Global Head of Commodities Trading, KPMG International

With both metals and mining organizations suffering significant pricing pressures and intense competition, it is clear that the fortunes of both sectors relies on future economic growth. In the meantime, however, mining organizations and their metals customers could be doing more to improve visibility and share demand signals across the supply chain.

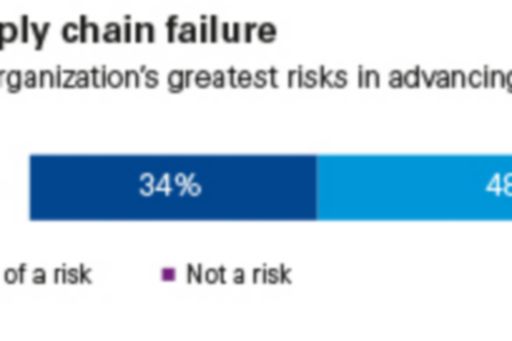

Given the high levels of overcapacity in almost every mining sector, it is perhaps not surprising that almost a quarter of mining executives participating in our survey believe that their supply chain is ‘very’ ready for growth. However, our survey suggests that metals executives are concerned that supply chain failures could impact their growth objectives. In fact, 82 percent of metals executives in our survey say that supply chain failure is a risk and more than a third say it is a significant risk.

"Metals organizations are still focused on reducing costs and improving performance, but they want to know that – when growth does return – they can move quickly and with agility to capitalize on the opportunities as they appear," notes Eric Damotte, Global Head of Metals at KPMG International. And according to Richard Sharman, Global Head of Commodities Trading at KPMG International, mining organizations are doing everything they can to keep capacity online, waiting for growth to return and for prices to start to rise once again. But he also notes that continued low margins should lead to lower production levels which will eventually create the type of structural deficit that will be required to drive up prices. "The low price environment will not remain forever," he says.

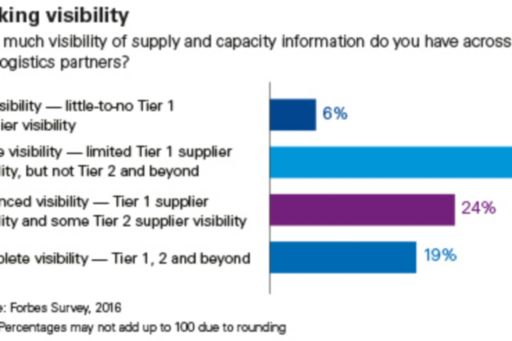

One of the greatest challenges facing both metals and mining organizations is a lack of confidence in future demand. However, our survey illustrates that there is little coordination of demand signals and visibility between metals organizations and their suppliers. Just one-in-five metals executives report complete visibility across their Tier 1 suppliers, Tier 2 suppliers and beyond. The majority (51 percent) say they have only limited visibility into their supply chain.

"If metals and mining organizations could better share demand signals, inventory levels and growth plans, both sectors would be in a stronger position to negotiate prices and invest in future capacity," notes Richard Sharman, Global Head of Commodities Trading at KPMG International. "Complete visibility may not ever be entirely possible, but greater coordination and collaboration is certainly a worthy goal."

How are leading metals organizations responding?

- Exploring opportunities to improve transparency across their supply chain, both upstream and downstream

- Implementing new technologies and applying Data and Analytics to identify opportunities to improve supply chain efficiency and flexibility

- Improving the sharing of data between metals customer, suppliers and operations through new IT platforms and tools.

How are leading mining organizations responding?

- Assessing the sustainability of price increases and demand rises to adjust production accordingly

- Learning how to improve supply chain efficiency and visibility from other manufacturing sectors such as automotive

- Shifting the supply chain focus from development to operations.

> Read full report (PDF 2.6 MB)