Banking: Realizing the need for speed

Banking: Realizing the need for speed

Results of our 2016 Banking Industry Outlook Survey indicate banks have made progress in recent years. In many respects, they are in good shape and are optimistic about the future. New models are evolving and innovative approaches emerging. Yet, the strides are small. Banks need to fast track digital integration throughout their organization. Digitization has to become the foundation for their business. And the need for speed is more important than ever before, as a new banking landscape unfolds, bringing with it a continuous wave of new competitors. The big and strong are no longer guaranteed to win. Speed and agility count just as much…if not more. And the time to accelerate is now.

- Gaining on growth – 87% of bank executives foresee revenue growth in the year ahead

- Driving digital - 74% of executives rate their bank’s digital banking capability as above average or excellent

- Leading innovation – 57% of executives say their bank has a chief innovation officer

- Leveraging fintechs – 51% of executives say their bank has aligned with consumer lending fintechs

Banks today are in relatively good shape and are optimistic about the future. In fact, 87 percent of the executives surveyed in our 2016 Banking Industry Outlook Survey foresee revenue growth over the next year. Approximately two-thirds of executives believe their organizations are embracing change and more than half rate their digital capabilities in the above average to excellent range.

These and other results in the survey point to the progress that banks have made in recent years and how they continue to move in the right direction. But the strides are small. The challenges are many. And the competition is increasingly fierce.

Time is of the essence. Newer tech savvy entrants have speed and agility on their side and continue to successfully nip away at different facets of a bank’s business. Meanwhile, consumer expectations of highly personalized experiences continue to evolve daily.

A key to future success will rely on banks’ ability to fully integrate digital into their business. This means going beyond front-end capabilities and instilling a core focus on the customer that permeates every aspect of the organization. It requires reengineering business models around the customer, implementing core technology that is flexible and agile and accepting change and embracing innovation in all areas of the business.

There is much to do. And quickly.

The predictability, reliability and trustworthiness of banking institutions have stood the test of time. However, seismic shifts in demographics, rapidly advancing technological change, and increasing competition in all areas of a bank’s business is creating an entirely new banking landscape. And to effectively compete, banks need to do better and act faster.

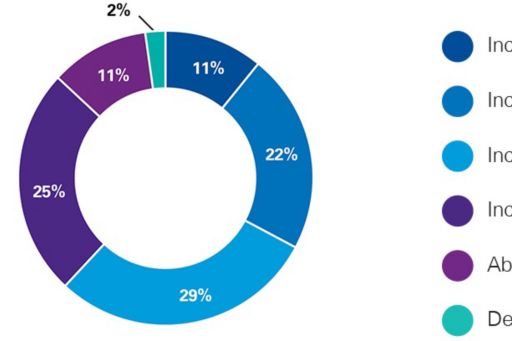

Survey Methodology: Survey data is based on the responses of 100 US senior banking executives conducted in the first quarter of 2016. Of respondents, 21% held CEO/President titles, 22% held C-suite titles (CFO, COO, CTO), 32% held Executive Vice President (VP)/Managing Director titles, and 25% held senior VP or Director titles. Banks represented included 42% with assets greater than $250 billion, 34% with assets between $50 and $250 billion, and 24% with assets between $20 billion and $50 billion.