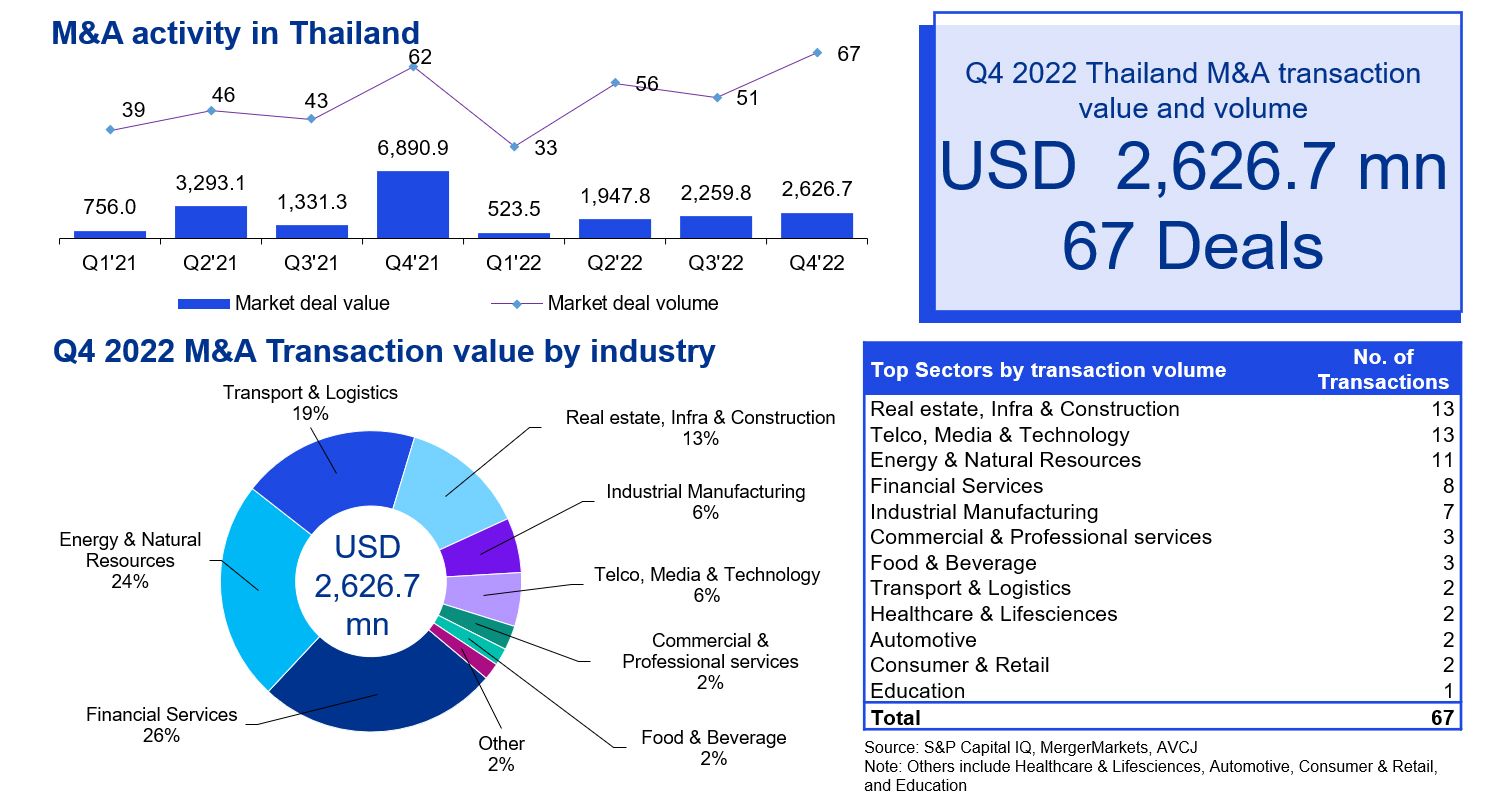

M&A activity in 2022 grew at a relatively stable level compared to 2021 in terms of deal volume; however, deal value was significantly less as fewer mega-deals occurred. Q4 2022 M&A activity was higher than the previous quarter, with 67 deals valued at USD 2.6 billion. Investments in Thai companies accounted for 55% of deal value in Q4 2022, while outbound deals represented 45%.

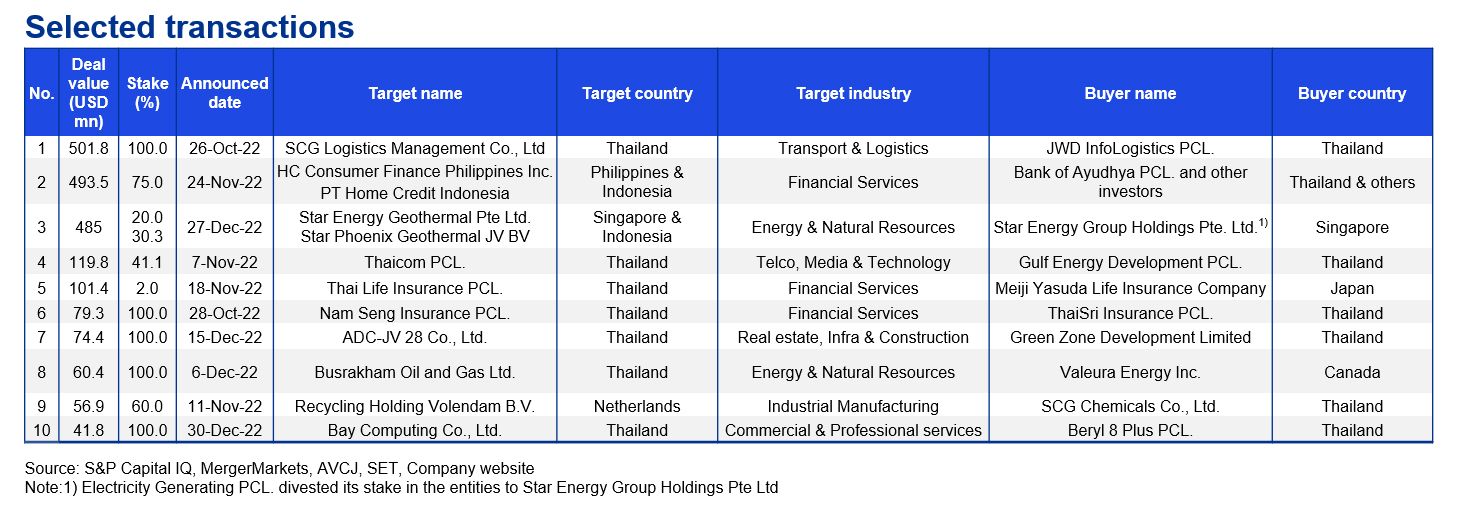

The Financial Services, Energy & Natural Resources, and Transport & Logistics sectors contributed 69% of the total Q4 2022 deal value. The largest deal in Q4 was JWD InfoLogistics’ and SCG Logistics Management’s planned merger to become an integrated logistics and supply chain solutions provider in ASEAN. Notable deals included Electricity Generating PCL’s divestment of 3 geothermal plants in Indonesia for USD 485 mn and Gulf Energy Development’s acquisition of Thaicom to develop its existing telecommunications portfolio by adding satellite capabilities.

Economic growth in Q4 2022 was primarily driven by rising consumer confidence, stronger private consumption and the recovery of tourism; key catalysts supporting these factors were the relaxation of lockdown regulations and travel restrictions. Continued expansionary polices by the Thai government, improving economic data, growth in inbound tourism, and China’s reopening shall contribute to growth going forward. However, the long-term competitiveness of Thai goods and services will be challenged by the upcoming 20% rise in fuel tariff, a main component of electricity prices, and the 5% increase in minimum wages that came into effect in October 2022.

Looking ahead, a potentially low-growth environment globally in 2023 may boost the Thai M&A landscape as firms are expected to seek inorganic growth through acquisitions. Ongoing supply chain relocation into Southeast Asia also presents an opportunity for the economy. Amidst global macroeconomic uncertainties, Thai businesses are expected to seek capital whether from equity, debt or refinancing during 2023, as covid-related government and banking support comes to an end. This potential pressure on business owners may lead to a narrowing in the 'valuation gap' which investors have cited as an obstacle to deal-making during 2021 to 2022. In addition, the divestment of non-core assets to streamline portfolios as well as consolidation within industry segments to strengthen market positions are expected to be M&A themes in Thailand going forward.

Data criteria

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia