E-Commerce has attracted more attention in recent years with many companies seeking new business opportunities in e-Commerce.

In principle, the Foreign Business Act prohibits foreign companies from operating e-Commerce in Thailand. However, it would still be legally possible for foreign companies to carry out e-Commerce in Thailand. Normally, there are two potential options for a foreign company to operate e-Commerce business in Thailand. The first, and more common option is applying for the Foreign Business License (FBL) with the Department of Business Development (DBD). Key requirements of the FBL include that the company:

- retains a minimum capital of THB 3 million per business applied for the FBL

- ensures loans against capital for doing company business do not exceed 7:1

- has at least one authorized director with an address in Thailand

The DBD will also consider potential competition against any existing Thai business operators, and the know-how/technology of the business on a case by case basis, at the sole discretion of the DBD.

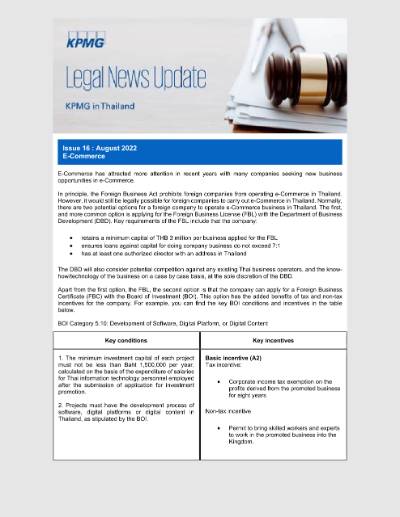

Apart from the first option, the FBL, the second option is that the company can apply for a Foreign Business Certificate (FBC) with the Board of Investment (BOI). This option has the added benefits of tax and non-tax incentives for the company. For example, you can find the key BOI conditions and incentives in the table below.

BOI Category 5.10: Development of Software, Digital Platform, or Digital Content

| Key conditions | Key incentives |

1. The minimum investment capital of each project must not be less than Baht 1,500,000 per year, calculated on the basis of the expenditure of salaries for Thai information technology personnel employed after the submission of application for investment promotion. 2. Projects must have the development process of software, digital platforms or digital content in Thailand, as stipulated by the BOI. |

Basic incentive (A2) Tax incentive:

Non-tax incentive:

|

Considering both options, while companies can obtain both the FBC and FBL if all conditions are met, the FBL is obtained at the discretion of the DBD on a case by case basis. We recommend that you take time to carefully consider whether the BOI or FBL application meets your needs best.

Please note that companies operating e-Commerce businesses with either the FBL or FBC are still subject to registering the e-Commerce business with the DBD and obtaining a direct marketing license.

How can KPMG Law assist you?

With our immense experience assisting various clients with both BOI and FBL applications, KPMG can provide legal advice and assist with the required approval requesting process. For more information, please feel free to contact us.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia