The Thai economy began to show seeds of recovery in the fourth quarter of 2021 with the easing of government measures and re-opening of borders to visitors without quarantine. The country’s vaccine rollout has also picked up pace in recent months which has led to a decline in the number of cases and facilitated the reopening of borders to vaccinated travelers from more than 60 "low-risk" countries, those of which can forego hotel quarantine following a negative test on arrival. However, the new coronavirus Omicron variant has spread to a number of nations, putting these signs of recovery at risk with varying levels of concern amongst businesses and tourists. As a result, whilst there are some positive signs, it remains likely we will not see tourists and the Thai economy return to full strength for some time yet.

In addition to government and Bank of Thailand (BoT) support measures, the central bank is also resisting pressure to raise interest rates due to increased government spending, fuel prices and inflation with the BoT still keeping an accommodative monetary policy. The BoT lowered their GDP forecast again from 1.8% to 0.7% in 2021, but maintained GDP growth at 3.9% in 2022 with a stable policy rate at 0.5%. Whilst the Thai economy is projected to see some growth in the fourth quarter of 2021, increasing fuel prices and inflation along with the Omicron variant will impact sentiment into 2022.

Financial support measures continue to be provided to assist businesses still impacted from the economic downturn. As of 15 November 2021, total soft loan facilities of THB126.9 billion to 39,722 debtors were approved by BoT, an increase of 8,560 debtors in the last three months with an average approval limit of THB3.2 million per debtor. The asset warehousing program has also seen increased uptake, with a total of 178 debtors and debt value of THB25.2 billion now under the scheme, an increase from THB11.1 billion in August 2021. These increases indicate that measures are still required, and being used effectively by debtors and banks where required.

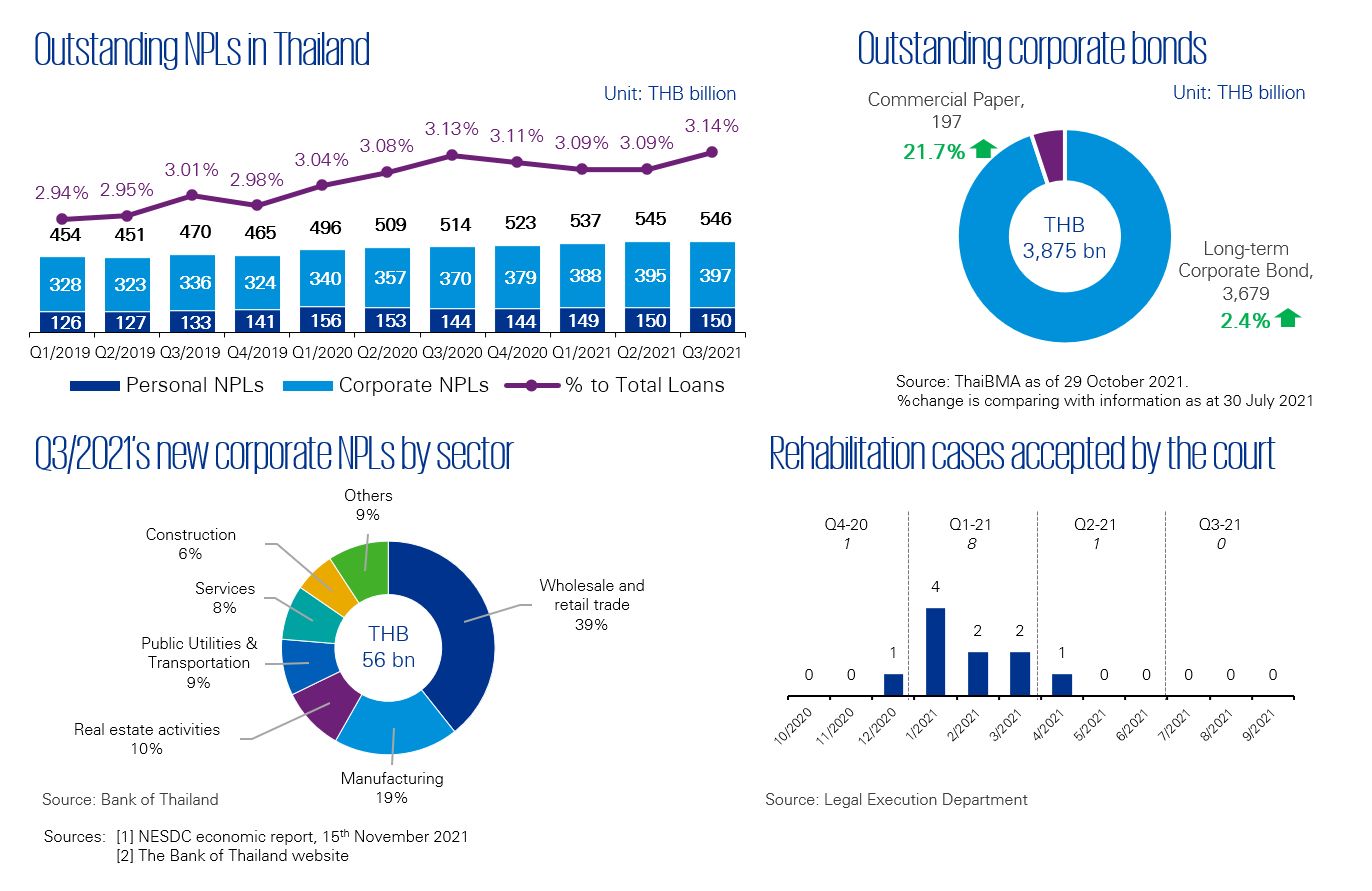

Outstanding Non-Performing Loans (NPLs) increased marginally to THB546 billion in the third quarter, with the percentage of NPLs to total loans also rising from 3.09% to 3.14%. Whilst we still expect to see a higher number of NPLs when the BoT and financial institutions start to slow down debt aid measures in 2022, it is unclear how quickly this will occur given the continued uncertainty. What is clear is that when the economic situation settles into the ‘new normal’, there will be many businesses that will be unable to repay the increased levels of debt, and will need to consider long-term debt restructuring. Alternatively, court ordered rehabilitation may also be an option for many businesses, although for now this remains a last resort for many with no new rehabilitation cases seen in the last two quarters.

Data criterion

- Value data provided in the ‘Outstanding NPLs in Thailand’ chart represent the value of the total outstanding non-performing loans (NPLs) of financial institutions for both corporate and personal consumer. The percentage to total loans represent the total outstanding NPLs to the outstanding loans.

- The pie chart ‘Q3/2021’s new corporate NPLs by sector’ represents the new and re-entered NPLs which occurred during the period. The number of personal consumer NPLs is excluded.

- The number of rehabilitation cases accepted by the Central Bankruptcy Court only refers to the applications that the Court has accepted for consideration. The court may reject the application for rehabilitation.

KPMG Deal Advisory

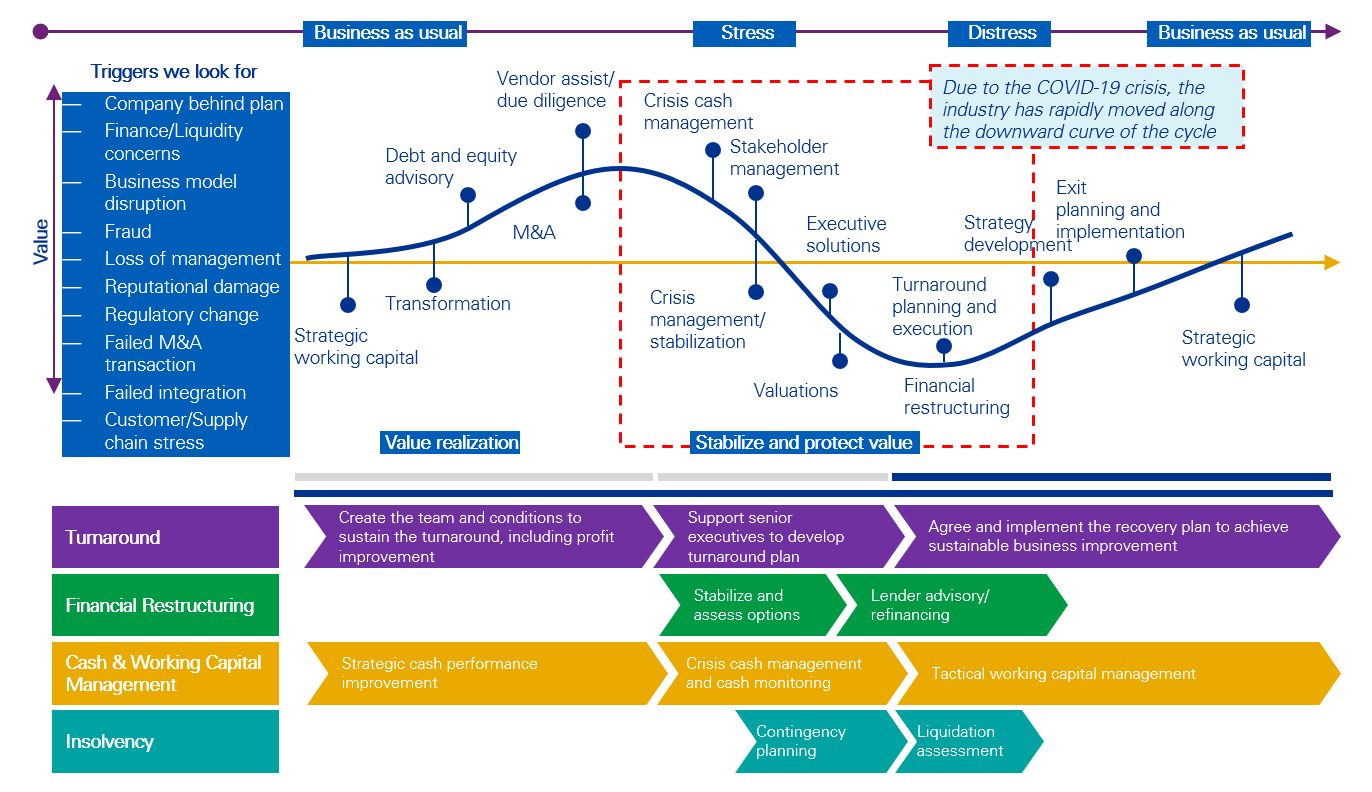

Our solutions address a number of different requirements from businesses and their stakeholders across an organization’s lifecycle. The global impact of COVID-19 has unavoidably pushed several businesses into the Stressed and Distressed part of the cycle. Our experienced approach bring valuable insights and guidance to help you to stabilize, protect value, and then ready the business to emerge.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia