On 11 August 2021, the Revenue Department issued Departmental Instruction No. Taw.Paw. 336/2564 to extend withholding tax reductions on certain types of income for payments made via the e-withholding tax system. The reduction period was due to run from 1 October 2020 to 31 December 2021 and will now be extended to run until 31 December 2022.

The reduced 2% withholding tax remains applicable for income types subject to a statutory withholding tax rate of 3%. In addition, the Departmental Instruction has expanded the scope of reductions to include several income types that are normally subject to a 5% statutory withholding tax rate.

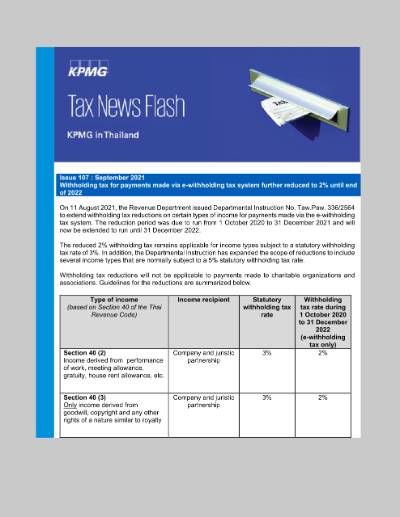

Withholding tax reductions will not be applicable to payments made to charitable organizations and associations. Guidelines for the reductions are summarized below.

Type of income (based on Section 40 of the Thai Revenue Code) |

Income recipient | Statutory withholding tax rate | Withholding tax rate during 1 October 2020 to 31 December 2022 (e-withholding tax only) |

Section 40 (2) Income derived from performance of work, meeting allowance, gratuity, house rent allowance, etc. |

Company and juristic partnership | 3% | 2% |

Section 40 (3) Only income derived from goodwill, copyright and any other rights of a nature similar to royalty |

Company and juristic partnership | 3% | 2% |

Section 40 (5)(a) Income derived from rental of property, except for certain types of leasing |

Company and juristic partnership/individual | 5% | 2% |

Section 40 (6) Income derived from liberal professions, i.e., law, medical services, engineering, architecture, accounting and fine arts |

Company and juristic partnership/individual | 3% | 2% |

Section 40 (7) Income derived from a contract of work where the contractor has to provide essential materials besides tools, e.g., turn-key contracts |

Company and juristic partnership/individual/ registered branch of a foreign company | 3% | 2% |

Section 40(8) Income derived from a hire of work contract |

Company and juristic partnership/individual/ registered branch of a foreign company | 3% | 2% |

Section 40(8) Income derived from prizes received from competitions, lucky draws or others of a similar nature |

Company and juristic partnership/individual | 5% | 2% |

Section 40(8) Income paid to public an actor or actress who is a resident of Thailand |

Individual | 5% | 2% |

Section 40(8) Income derived from provision of services excluding service fees paid to hotels, restaurants and life insurance |

Company and juristic partnership/individual | 3% | 2% |

Section 40(8) Income derived from sale discounts, rebates, or any benefits in connection with sale promotions |

Company and juristic partnership/individual |

3% | 2% |

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia