Seven months on from the declaration of COVID-19 as a pandemic, there remains continued uncertainty in the global and Thai economy. With many countries experiencing second waves of outbreaks and no clear timeline on the availability of a vaccine, export demand remains dampened and the borders remain closed to mass tourism. As a result, many companies remain at high risk of default on their debts.

The government and financial institutions have continued to support via stimulus measures and many banks extending a debt moratorium until the end of 2020. The Bank of Thailand (BoT) and Thai Bankers’ Association also implemented new financial measures such as the DR BIZ program for SMEs from 1 September 2020 to alleviate the impact of the expiry of the BoT’s debt moratorium program which, despite some calls for an extension, ended in October 2020.

The BoT has announced an intention to shift its focus to targeted assistance for SMEs, which involves financial institutions supporting their clients to restructure debts based on their specific situation and needs. The aim of this shift is to ensure that support measures are targeted at those most in need, whilst those corporates which can repay continue to do so. The BoT encourages both debtors and banks to stay connected and engage in discussion regarding the restructuring of debt, which is sound advice for both corporates and SMEs.

Whilst debt restructuring is often seen as a negative step, it is a commonly used solution to help companies solve short-term liquidity problems or provide time to adjust their business model based on external or unforeseen factors. It can take several forms, but may typically involve extension of repayment periods, reduction of repayment amounts, interest rate reduction, or the waiver of interest or some amounts. The objective of debt restructuring is to ensure the longer-term survival and growth of the business, allowing it to generate cash flow and therefore enable debts to be repaid.

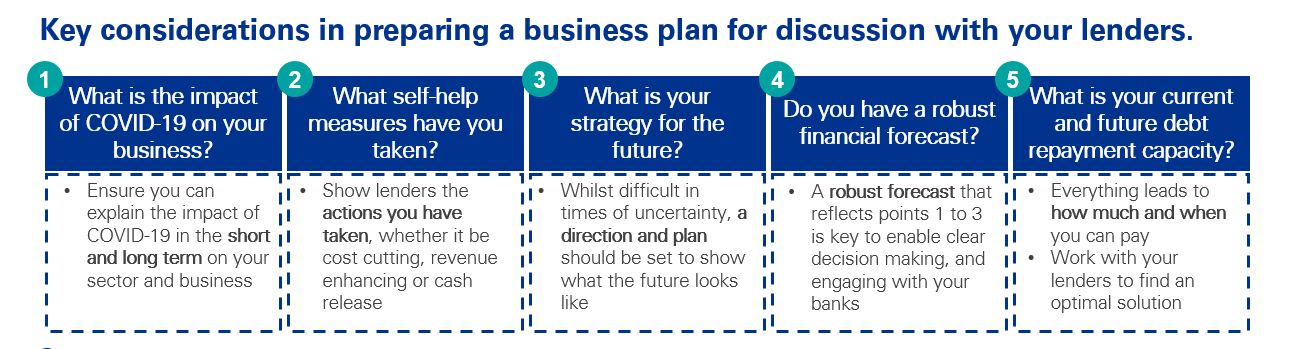

In order to do this successfully, companies should proactively engage with their lenders and prepare a solid business plan with robust financial forecasts to facilitate a productive conversation with their banks regarding their current situation, plans to weather the storm, and improve their business and repayment capacity.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia