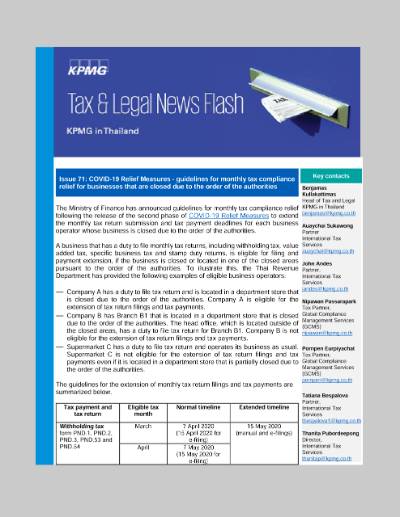

COVID-19 Relief Measures - guidelines for monthly tax compliance relief for businesses that are closed due to the order

Tax & Legal News Flash Issue 71

The Ministry of Finance has announced guidelines for monthly tax compliance relief following the release of the second phase of COVID-19 Relief Measures to extend the monthly tax return submission and tax payment deadlines for each business operator whose business is closed due to the order of the authorities.

A business that has a duty to file monthly tax returns, including withholding tax, value added tax, specific business tax and stamp duty returns, is eligible for filing and payment extension, if the business is closed or located in one of the closed areas pursuant to the order of the authorities. To illustrate this, the Thai Revenue Department has provided the following examples of eligible business operators:

- Company A has a duty to file tax return and is located in a department store that is closed due to the order of the authorities. Company A is eligible for the extension of tax return filings and tax payments.

- Company B has Branch B1 that is located in a department store that is closed due to the order of the authorities. The head office, which is located outside of the closed areas, has a duty to file tax return for Branch B1. Company B is not eligible for the extension of tax return filings and tax payments.

- Supermarket C has a duty to file tax return and operates its business as usual. Supermarket C is not eligible for the extension of tax return filings and tax payments even if it is located in a department store that is partially closed due to the order of the authorities.

The guidelines for the extension of monthly tax return filings and tax payments are summarized below.

| Tax payment and tax return | Eligible tax month | Normal timeline | Extended timeline |

Withholding tax form PND.1, PND.2, PND.3, PND.53 and PND.54 |

March | 7 April 2020 (15 April 2020 for e-filing) |

15 May 2020 (manual and e-filings) |

| April | 7 May 2020 (15 May 2020 for e-filing) |

||

Value added tax form PP.30 |

March | 15 April 2020 (23 April 2020 for e-filing) |

23 May 2020 (manual and e-filings) |

| April | 15 May 2020 (23 May 2020 for e-filing) |

||

Self-assessed value added tax form PP.36 |

March | 7 April 2020 (15 April 2020 for e-filing) |

15 May 2020 (manual and e-filings) |

| April | 7 May 2020 (15 May 2020 for e-filing) |

||

Specific business tax form PT.40 (excluding specific business tax on the sale of immovable property in a commercial or profitable manner according to Section 91/2 (6) of the Revenue Code) |

March | 15 April 2020 (23 April 2020 for e-filing) |

23 May 2020 (manual and e-filings) |

| April | 15 May 2020 (23 May 2020 for e-filing) |

||

Stamp duty form OS.4, OS.4 Gor and OS.4 Khor |

N/A | 1 April 2020 to 15 May 2020 |

15 May 2020 |

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia