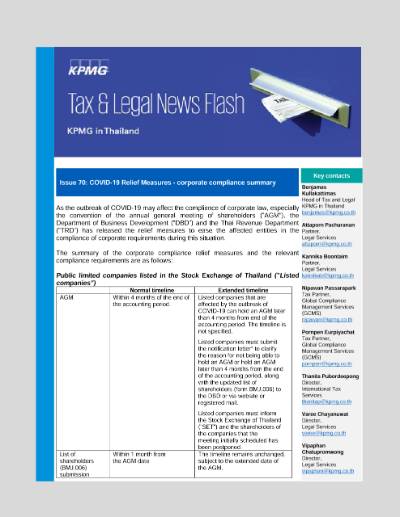

COVID-19 Relief Measures - corporate compliance summary

Tax & Legal News Flash Issue 70

As the outbreak of COVID-19 may affect the compliance of corporate law, especially the convention of the annual general meeting of shareholders (“AGM”), the Department of Business Development (“DBD”) and the Thai Revenue Department (“TRD”) has released the relief measures to ease the affected entities in the compliance of corporate requirements during this situation.

The summary of the corporate compliance relief measures and the relevant compliance requirements are as follows:

Public limited companies listed in the Stock Exchange of Thailand (“Listed companies”)

| Normal timeline | Extended timeline | |

| AGM | Within 4 months of the end of the accounting period. | Listed companies that are affected by the outbreak of COVID-19 can hold an AGM later than 4 months from end of the accounting period. The timeline is not specified. Listed companies must submit the notification letter* to clarify the reason for not being able to hold an AGM or hold an AGM later than 4 months from the end of the accounting period, along with the updated list of shareholders (form BMJ.006) to the DBD or via website or registered mail. Listed companies must inform the Stock Exchange of Thailand (“SET”) and the shareholders of the companies that the meeting initially scheduled has been postponed. |

| List of shareholders (BMJ.006) submission | Within 1 month from the AGM date | The timeline remains unchanged, subject to the extended date of the AGM. |

| Submission of audited financial statements to DBD | Within 1 month from the AGM date | The timeline remains unchanged, subject to the extended date of the AGM. |

| Submission of financial statements to SET (listed companies) |

|

The timeline remains unchanged. Note: Due to the postponement of AGM, listed companies can appoint the SEC authorized auditor to review financial statements for the first quarter of 2020 in order to disclose information and submit financial statements to SET under the specified timeline. However, the appointment of the auditor should be resolved in the next AGM. |

| Application for the Board of Investment’s corporate income tax incentive utilization Submission | Within 120 days from the end of accounting period. | The timeline remains unchanged. |

| Annual corporate income tax return (PND.50) submission | Within 150 days from the end of the accounting period. Audited financial statements are required to be submitted with PND.50. | The timeline remains unchanged. |

| Transfer Pricing (“TP”) Disclosure form submission | Within 150 days from the end of accounting period. | The timeline remains unchanged. |

| Mid-year corporate income tax return (PND.51) submission | Within 2 months from the half of the accounting period. | The timeline remains unchanged. |

Limited companies and public limited companies

| Normal timeline | Extended timeline | |

| AGM | Within 4 months of the end of the accounting period. | Limited companies and public limited companies that are affected by the outbreak of COVID-19 can hold an AGM later than 4 months from end of the accounting period. The timeline is not specified. Limited companies and public limited companies must submit the notification letter* to clarify the reason for not being able to hold an AGM or hold an AGM later than 4 months from the end of the accounting period, along with the updated list of shareholders (form BOJ.5/ BMJ.006) to the DBD or via website or registered mail. |

| List of shareholders (BOJ.5/ BMJ.006) submission |

|

The timeline remains unchanged, subject to the extended date of the AGM |

| Submission of audited financial statements to DBD | Within 1 month from the AGM date | The timeline remains unchanged, subject to the extended date of the AGM. |

| Application for the Board of Investment’s corporate income tax incentive utilization submission | Within 120 days from the end of accounting period. | 31 July 2020 or at least 30 days before the PND.50 submission due date. Note: The business operator can submit the documents via e-submission system from 30 March 2020 onwards. |

| Annual corporate income tax return (PND.50) submission | Within 150 days from the end of the accounting period. Audited financial statements are required to be submitted with PND.50. | For limited companies and public limited companies that are required to submit and pay corporate income tax within April 2020, May 2020, June 2020, July 2020 and August 2020, the deadline is extended to 31 August 2020. For limited companies and public limited companies that the normal timeline for corporate income tax payment and return submission is from 24 August 2020 to 31 August 2020, the 8-day extension for e-fling is still applicable. |

| TP Disclosure form submission | Within 150 days from the end of accounting period. | For limited companies and public limited companies that are required to submit TP Disclosure form within April 2020, May 2020, June 2020, July 2020 and August 2020, the deadline is extended to 31 August 2020. |

| Mid-year corporate income tax return (PND.51) submission | Within 2 months from the half of the accounting period. | For limited companies and public limited companies that are required to submit and pay mid-year corporate income tax within April 2020, May 2020, June 2020, July 2020, August 2020 and September 2020, the deadline is extended to 30 September 2020. For limited companies and public limited companies that the normal timeline for mid-year corporate income tax payment and return submission is from 23 September 2020 to 30 September 2020, the 8-day extension for e-fling is still applicable. |

Registered partnerships, foreign companies operating business in Thailand and joint ventures

| Normal timeline | Extended timeline | |

| Submission of audited financial statements to DBD | Within 5 months of the end of the accounting period. | For entities that have the accounting period ending from 31 October 2019 to 31 March 2020, the deadline is extended to 31 August 2020. |

| Annual corporate income tax return (PND.50) submission | Within 150 days from the end of the accounting period. Audited financial statements are required to be submitted with PND.50. | For entities that are required to submit and pay corporate income tax within April 2020, May 2020, June 2020, July 2020 and August 2020, the deadline is extended to 31 August 2020. For entities that the normal timeline for corporate income tax payment and return submission is from 24 August 2020 to 31 August 2020, the 8-day extension for e-fling is still applicable. |

| Transfer Pricing (“TP”) Disclosure form submission | Within 150 days from the end of accounting period. | For entities that are required to submit TP Disclosure form within April 2020, May 2020, June 2020, July 2020 and August 2020, the deadline is extended to 31 August 2020. |

| Mid-year corporate income tax return (PND.51) submission | Within 2 months from the half of the accounting period. | For entities that are required to submit and pay mid-year corporate income tax within April 2020, May 2020, June 2020, July 2020, August 2020 and September 2020, the deadline is extended to 30 September 2020. For entities that the normal timeline for mid-year corporate income tax payment and return submission is from 23 September 2020 to 30 September 2020, the 8-day extension for e-fling is still applicable. |

Trade associations and chambers of commerce

| Normal timeline | Extended timeline | |

| AGM | Within 120 days of the fiscal year-end. | Trade associations and chambers of commerce that are affected by the outbreak of COVID-19 can hold an AGM later than 120 days from end of fiscal year. The timeline is not specified. Trade associations and chambers of commerce must submit the notification letter to clarify the reason for not being able to hold an AGM or hold an AGM later than 120 days from the end of the fiscal year to the DBD or via website or registered mail. |

| Submission of audited financial statements to DBD | Within 30 days from the AGM date. | The timeline remains unchanged, subject to the extended date of the AGM. |

| Annual corporate income tax return (PND.55) submission | Within 150 days from the end of the accounting period. Audited financial statements are required to be submitted with PND.50. | For entities that are required to submit and pay corporate income tax within April 2020, May 2020, June 2020, July 2020 and August 2020, the deadline is extended to 31 August 2020. For entities that the normal timeline for corporate income tax payment and return submission is from 24 August 2020 to 31 August 2020, the 8-day extension for e-fling is still applicable. |

Note:

*The DBD has published a standard format of letter clarifying the impact from COVID-19 pandemic in particular. The letter can be downloaded from: https://www.dbd.go.th/download/regis_file/covid19/dbdregist_exam_COVID19.pdf

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia