Companies are increasingly looking to buy carbon credits to offset their greenhouse gas emissions and potentially reduce their carbon tax liabilities. Large emitters in Singapore are exploring this with new vigour given that the country’s carbon tax will be raised in coming years. In turn, the local carbon credit market is gearing up to meet demand, with new trading platforms being established.

Those trading carbon credits must ensure that they understand the tax consequences of their transactions in terms of both goods and services tax (GST) and direct tax.

Addendum

Following KPMG in Singapore’s Whitepaper in October 2022 noting the taxable goods and services tax (GST) treatment of voluntary carbon trading, it was reported in the media that the Inland Revenue Authority of Singapore (IRAS) has moved to waive the tax from such activities.

The IRAS has said that from 23 November 2022, the issuance, transfer and sale of carbon credits including the digitised form transfer and sale of carbon credits including the digitised form is to be treated as “neither a supply of goods nor a supply of services, i.e. an excluded transaction” for GST purposes. The IRAS also confirmed that such transactions conducted prior to that date would be subject to GST. This clarifies the GST treatment of carbon trading, cuts costs for businesses and may help to foster Singapore’s carbon credit market.

Download the addendum for full implications of new GST treatment of carbon trading in Singapore

Singapore's carbon tax outlook

Demand for carbon credits will increase among emissions-intensive enterprises, such as petrochemical companies, when Singapore hikes its carbon tax from 2024.

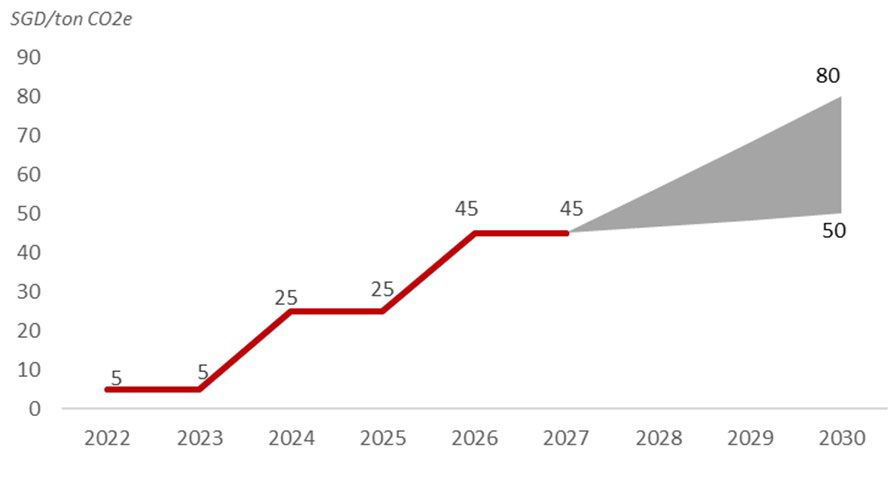

While Singapore set its initial carbon tax rate at $5 per tonne of CO2 equivalent (tCO2e) generated — a significantly lower rate than envisioned — when it was introduced in 2019, the tax will soon increase over three phases. It will rise to $25 in 2024 and to $45 in 2026, before increasing to between $50 and $80 per tC02e by 2030.

Singapore carbon tax rate

GST implications

Check out our full report, as well as the addendum Q&A to address implications of the new GST treatment of carbon trading in Singapore following clarifications from IRAS.

Direct tax implications of carbon trading

The application of direct tax to carbon trading in Singapore is clearer cut than GST, with the basic concepts of corporate taxation in Singapore applying to the trading of carbon credits.

For a company trading carbon credits, related income and gains would simply be regarded as revenue and would be taxable. Accordingly, associated expenses incurred would generally be regarded as tax-deductible business expenses.

The Inland Revenue Authority of Singapore has provided clarifications which are helpful for taxpayers and signals the Government's commitment to enhance Singapore's position as a carbon trading hub.

Carbon credits are also included as qualifying products under Singapore’s Global Trader Programme incentive, which provides for reduced tax rates on trading income. This is good news for commodity traders who are considering Singapore as a potential location for their carbon trading desks.

How we can help

With the increasing urgency to reduce emissions and reach national net-zero targets by 2050, Singapore’s carbon trading market will continue to grow.

Our tax teams at KPMG in Singapore are well-positioned to partner with you in your journey towards environmental sustainability. We help to increase your awareness of the carbon trading tax landscape, identify opportunities for tax optimisation and ensure that you comply with the relevant laws and regulations.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia