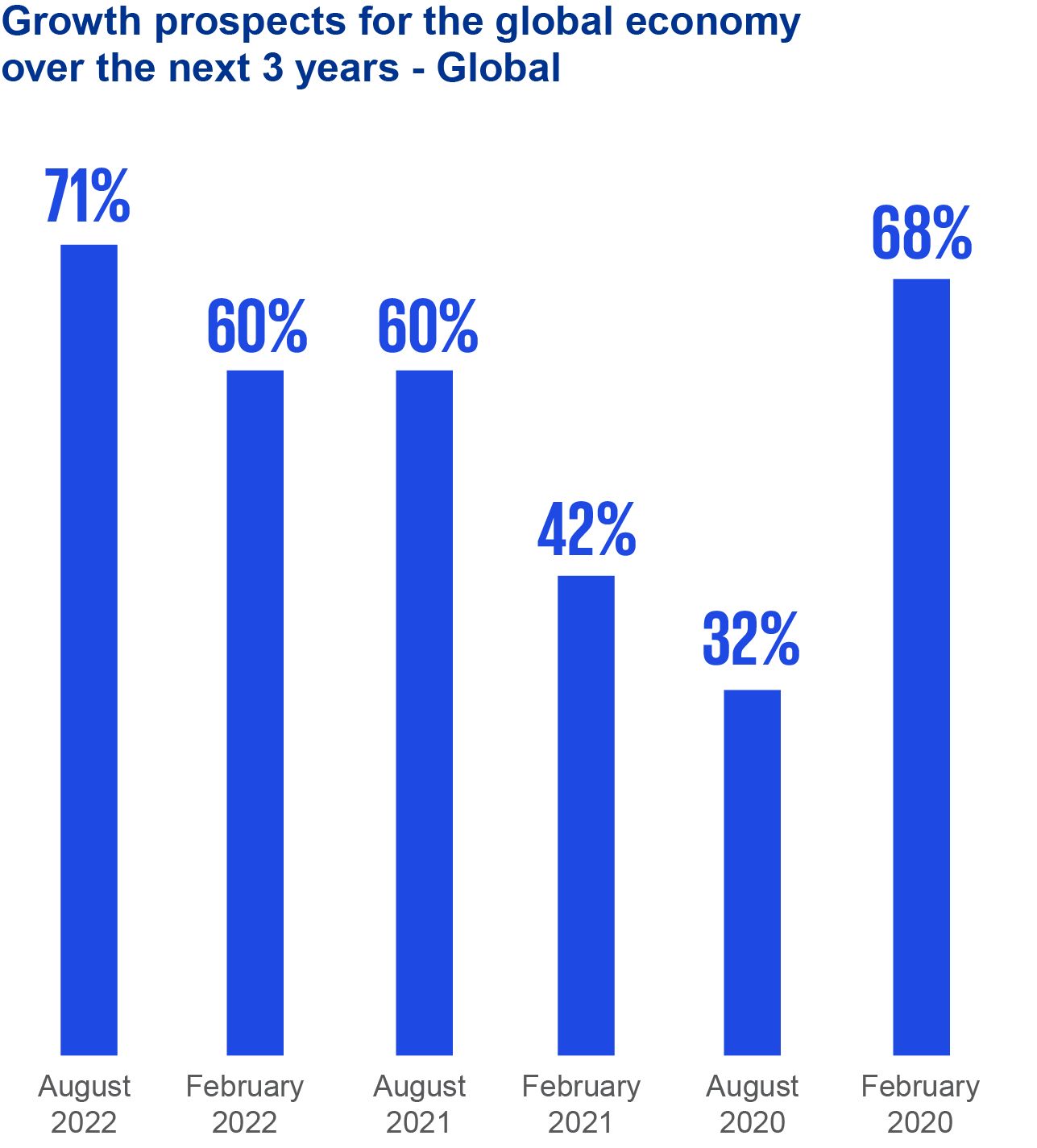

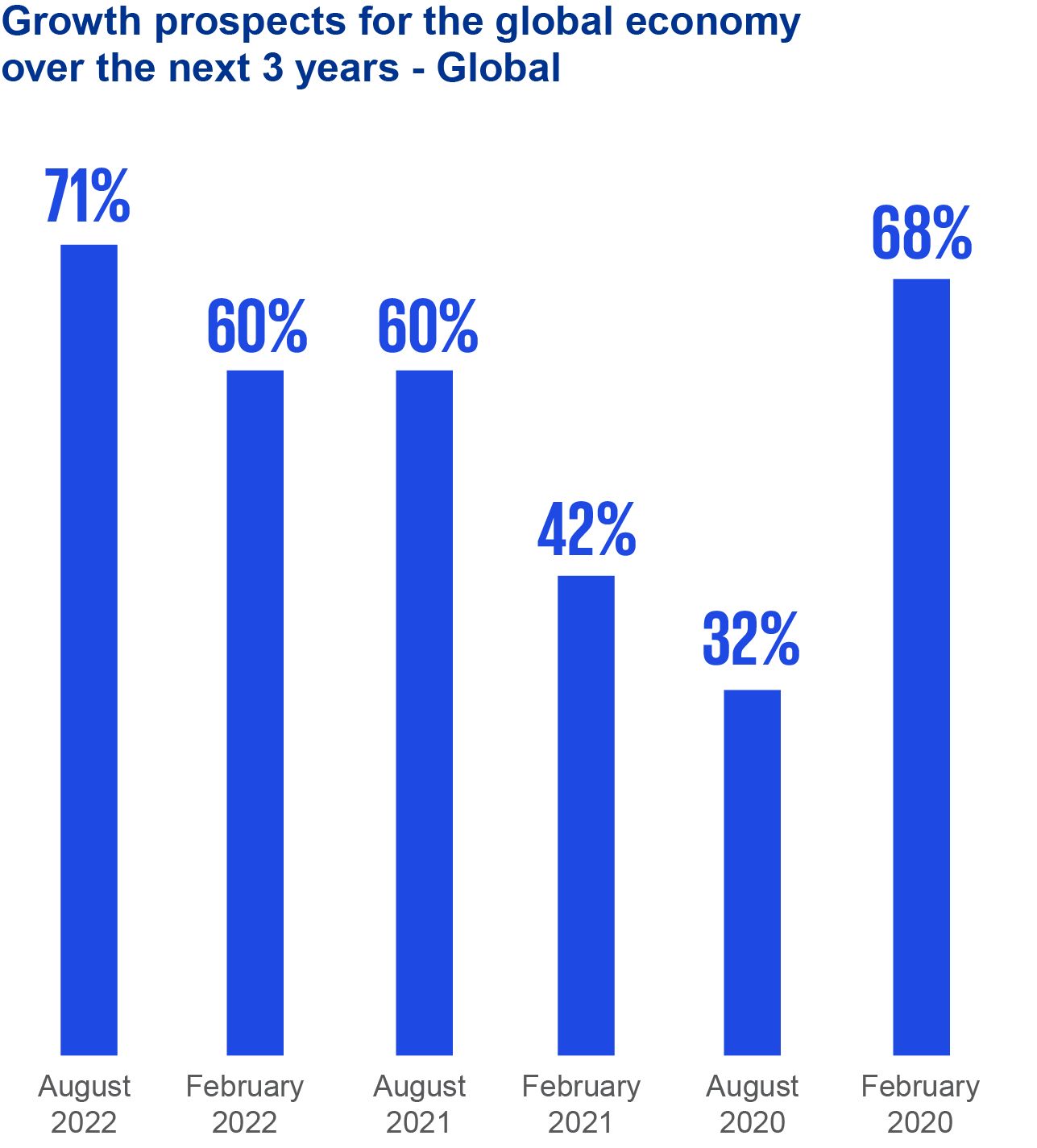

Optimism in long-term growth remains

The KPMG 2022 CEO Outlook surveyed global CEOs for their three-year outlook on the business and economic landscape. Despite ongoing geopolitical and economic challenges, global economic confidence in the next three years has rebounded from early 2022 — rising to 71%.

In Singapore, CEOs are slightly more optimistic than their global peers at 72%.

As companies continue to navigate a changing landscape shaped by the COVID-19 pandemic, 85% of global CEOs report positive growth expectations in 2022. Singapore’s executives are more muted in their expectations, with 76% remaining positive about their company’s growth prospects in 2022.

Source: KPMG 2022 CEO Outlook

Increasing M&A appetite

The three-year outlook for appetite in mergers and acquisitions (M&A) remains high despite economic concerns. In our survey, 47% of CEOs report a high appetite for M&A while 38% reflect a moderate keenness — a significant shift from the 23% who had a high appetite for M&A in early 2022.

In Singapore, 44% of CEOs demonstrate a high M&A appetite and 40% are moderate. With higher interest rates and borrowing costs, rapid innovation will be key to staying competitive.

Amid higher interest rates and borrowing costs, rapid innovation will be crucial to staying competitive. Deal makers may be taking a sharper pencil to the numbers and focusing on value creation to unlock and track deal value, every step of the way.

CEOs anticipate a recession, but they’re prepared

Four out of five (80%) Singapore CEOs predict a recession will impact company earnings by up to 10% over the next 12 months. However, they are far more optimistic than their global peers on the longer-term outlook with less than half expecting a recession to upend anticipated growth over the next three years.

Singapore CEOs expect to see growth in company earnings over the next three years, but they have reined in their expectations with a majority (60%) suggesting an earnings outlook of between 2.5% and 4.99% per annum.

To limit recession-driven disruption, 88% of Singapore CEOs have embarked on a hiring freeze or are planning to do so in the next 6 months. This is also high on the list for 74% of CEOs globally. Diversifying supply chains is another precautionary step that CEOs in Singapore have taken or considered.

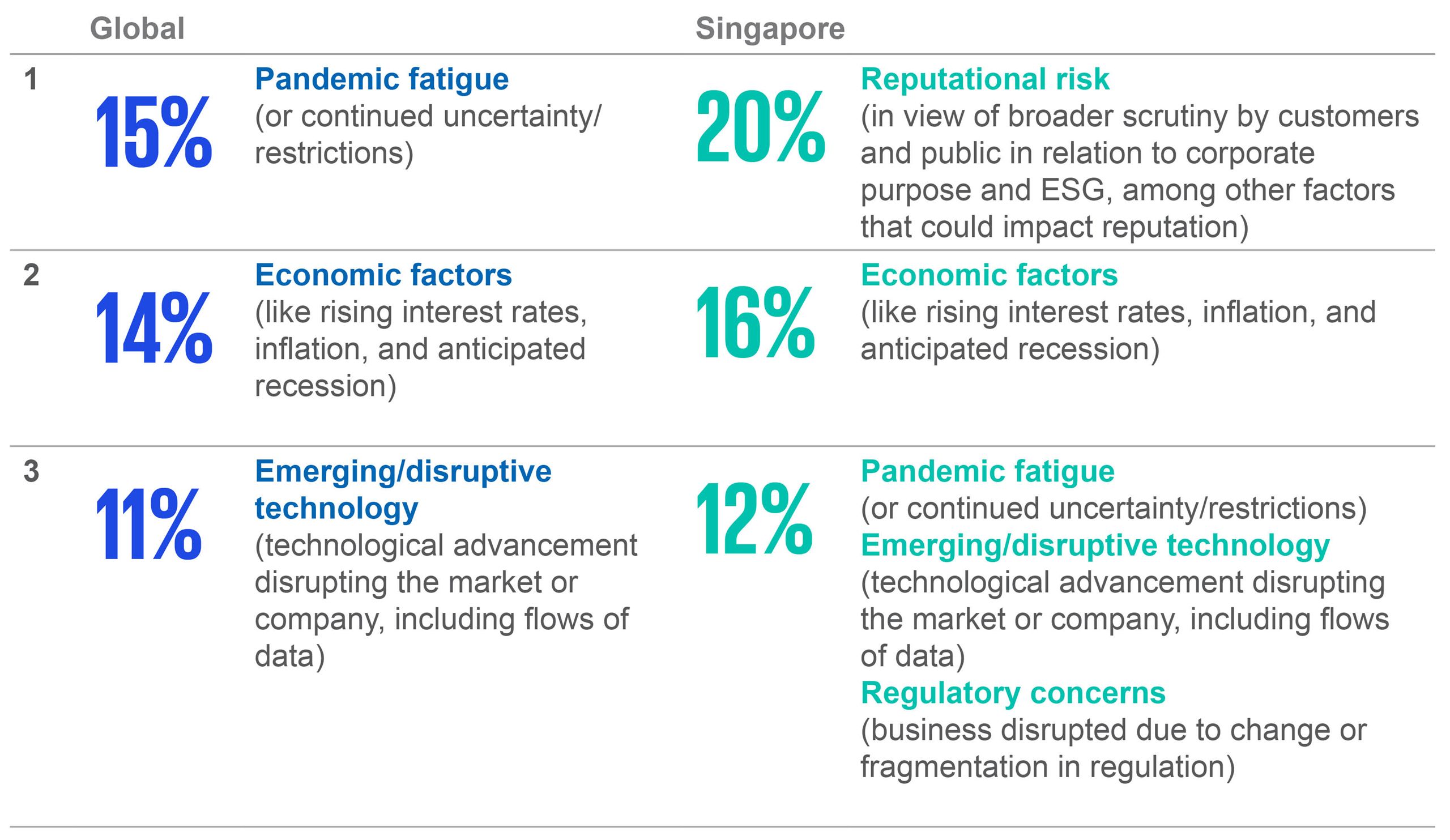

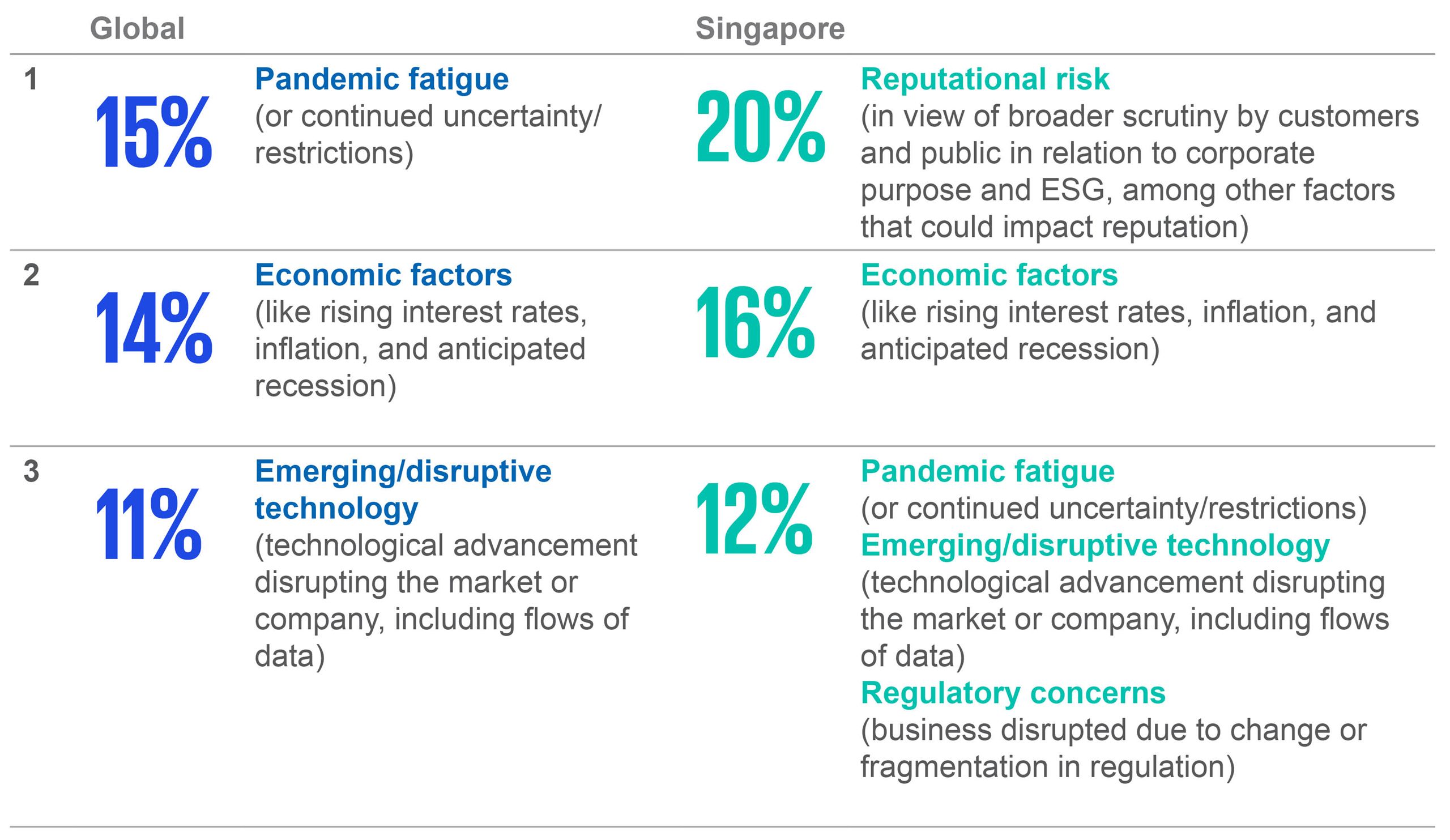

Top risks looking towards 2025

Pandemic fatigue and economic factors, including the threat of rising interest rates and inflation, top the list of most pressing concerns for CEOs today at 15% and 14%, respectively. Even as they take steps to insulate their businesses from the upcoming recession, CEOs in Singapore are increasingly aware of the broader public scrutiny of their corporate purpose and ESG accountability, reflected by their top concern: reputational risk.

Managing geopolitical risk

CEOs indicate that geopolitical uncertainties will continue to impact their strategies and supply chains during this period. In Singapore, 72% of CEOs have adjusted or plan to adjust their risk management procedures considering geopolitical uncertainties. In addition, 28% say they will be increasing measures to adapt to geopolitical issues to achieve their growth objectives — slightly higher than the global figure (21%).

Source: KPMG 2022 CEO Outlook

Increasing M&A appetite

The three-year outlook for appetite in mergers and acquisitions (M&A) remains high despite economic concerns. In our survey, 47% of CEOs report a high appetite for M&A while 38% reflect a moderate keenness — a significant shift from the 23% who had a high appetite for M&A in early 2022.

In Singapore, 44% of CEOs demonstrate a high M&A appetite and 40% are moderate. With higher interest rates and borrowing costs, rapid innovation will be key to staying competitive.

Amid higher interest rates and borrowing costs, rapid innovation will be crucial to staying competitive. Deal makers may be taking a sharper pencil to the numbers and focusing on value creation to unlock and track deal value, every step of the way.

For more insights on report data and methodologies, visit our global page.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

- Request for proposal