Singapore CEOs more confident about growth

Optimism is the business sentiment of the moment. In Singapore, CEOs across sectors are more bullish about growth and their companies’ earning power over the next three years despite continued uncertainty and risk volatility.

Their levels of confidence are higher than those displayed by peers in Asia Pacific and globally, although broad-based rebound in optimism is observed across geographies.

These were key findings from the KPMG 2021 CEO Outlook, which draws on the perspectives for the future of 1,325 CEOs across 11 major markets, including Singapore. The survey, conducted from June 29, 2021 to August 6, 2021, provides an in-depth 3-year outlook into leadership strategies, priorities and insights as businesses chart their recovery from the pandemic.

About 92% of Singapore CEOs surveyed are confident in the country’s growth outlook, the industry they operate in, and their companies.

These levels of confidence are higher than those expressed by CEOs in ASPAC and globally.

72% of Singapore CEOs are more confident in global growth prospects than their ASPAC and global peers.

Across regions, expectations for global economic growth are more subdued with the impacts of new virus variants, vaccine inequality and concerns around evolving global tax rules adding to the sense of uncertainty. This points to widening fault lines in global economy recovery.

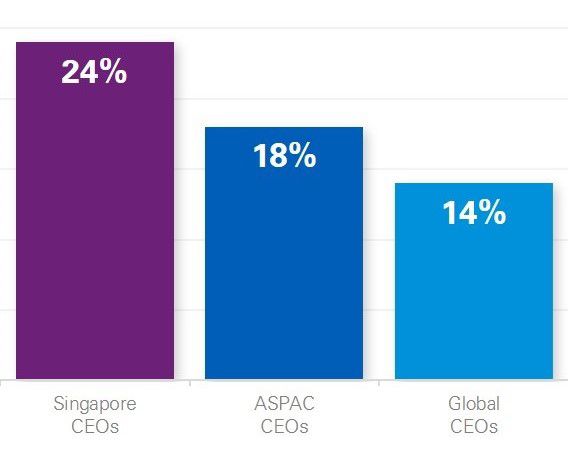

Some 24% of Singapore CEOs expect earnings growth of 5–20% per annum over the next 3 years, compared to 18% and 14% of ASPAC and global peers, respectively.

This is in sharp contrast to 2020’s findings, when none of the Singapore CEOs surveyed felt that their company’s earnings could exceed 5% per annum.

War for talent

As business grows, so too does demand for talent. Singapore CEOs are keen to attract and hire exceptional talent, while cultivating the right skill sets and capabilities in the new world of work. They are increasingly exploring hybrid and remote work models, as they seek to build capabilities and keep employees engaged.

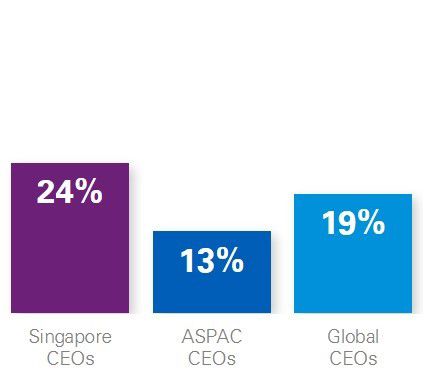

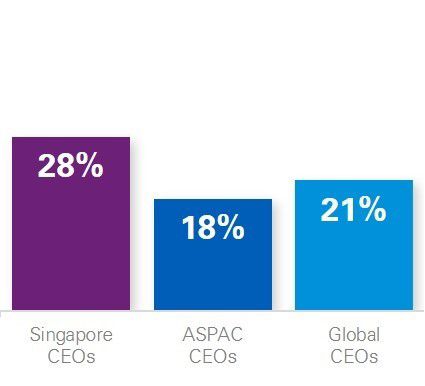

More business leaders are considering hybrid and omnichannel work models, with 28% of Singapore CEOs planning to downsize or having already reduced their physical footprint, compared with 18% in ASPAC and 21% globally.

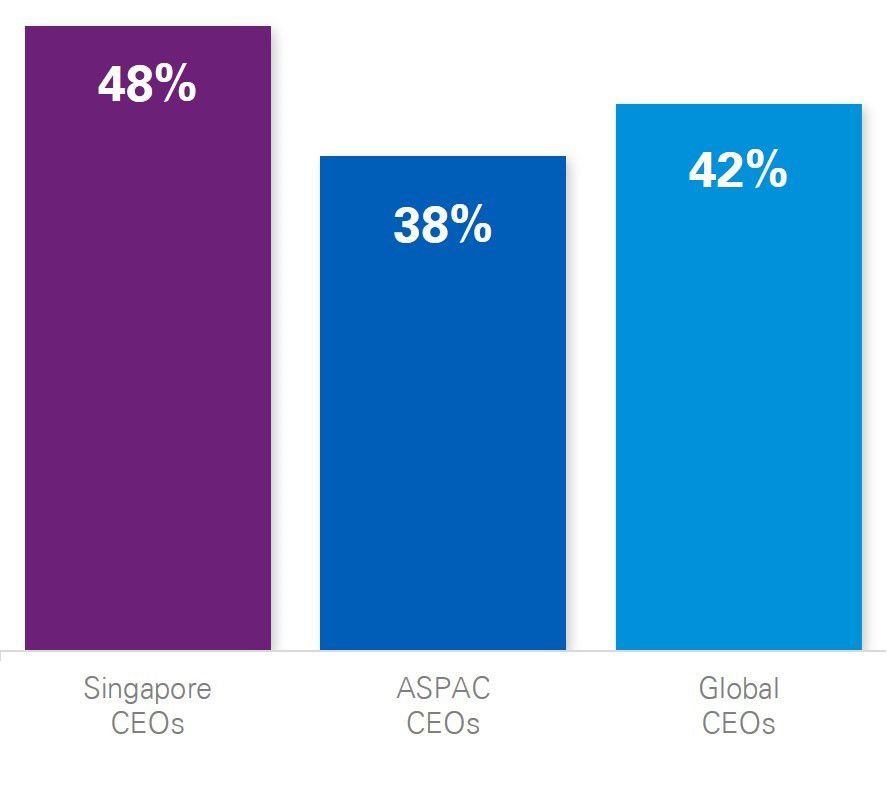

Around 48% of Singapore CEOs will be looking to predominantly hire talent that work remotely, higher than 38% in ASPAC and 42% globally.

Keeping tabs on global tax

Amid optimism about growth and expansion strategies, Singapore CEOs are keeping a close watch on evolving international tax rules. The proposed rules of the global tax deal, set to kick in from 2023, may require increased tax compliance and reporting demands, while pressure mounts on organisations to pay their taxes responsibly.

Around 4 in 5 Singapore CEOs say the proposed global minimum tax regime is of “significant concern” to their organisations’ growth goals, compared to 77% globally and 78% in ASPAC.

Tackling challenges of tomorrow, today

The aftermath of the turbulent pandemic has turned the heat up on climate change action.

In Singapore, there is increased stakeholder pressure to build business back better. A key challenge remains for CEOs locally and globally to convincingly narrate their companies’ environmental, social and corporate governance (ESG) stories and embed ESG into their business strategy.

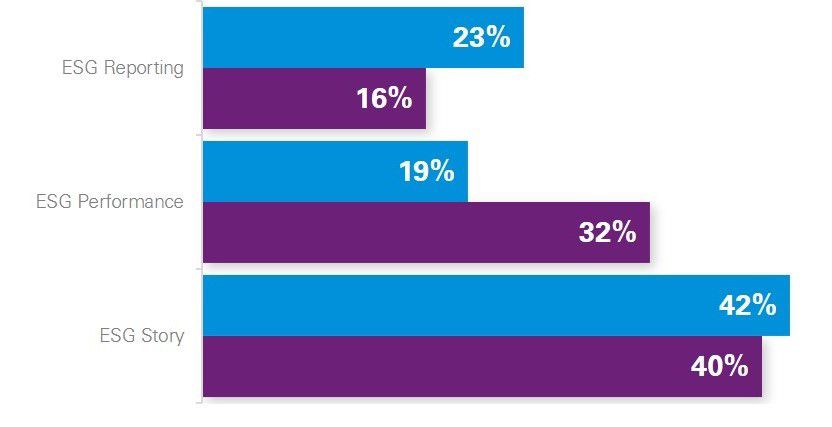

CEOs (42% globally, 40% locally) are struggling with articulating a compelling ESG story; increasing the rigour of ESG performance reporting quality (19% globally, 32% locally); and addressing the varying ESG reporting needs of different investors and stakeholders (23% globally, 16% locally).

Digital agility is also a key focus of business survival and sustainability, with leaders keen to be on the front foot when it comes to disruption and innovation.

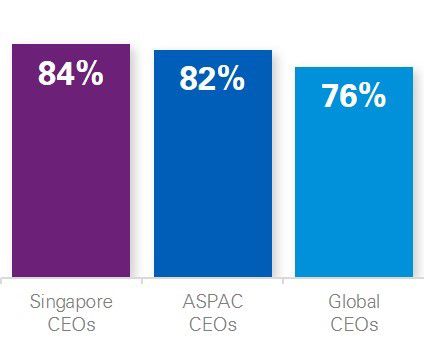

84% of Singapore CEOs surveyed view technological disruption as more of an opportunity than a threat, higher than 82% in ASPAC and 76% globally.

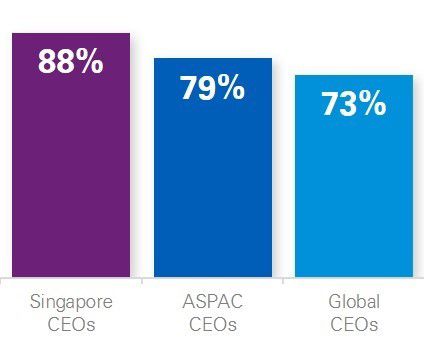

Rather than wait to be disrupted by competitors, a greater number of Singapore CEOs (88%) are looking to actively disrupt the sector they operate in — up from the 76% last year and the 68% in 2019. This is higher than the 79% in ASPAC and 73% globally who held the same view.

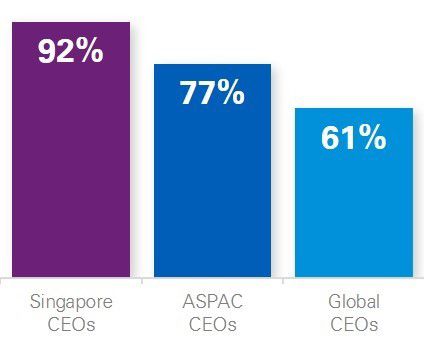

92% of Singapore CEOs feel new partnerships will be critical to continuing their pace of digital transformation, compared with 77% in ASPAC and 61% globally.

For more insights and information