Optimizing Procurement: Investing in talent and technology

Investing in talent and technology

Key findings from KPMG’s Procurement Advisory 2015 – Investing in talent and technology

The shortage of talented procurement professionals is expected to continue to worsen over the next 2 years. Some of the skills in particularly short supply are legal, relationship brokering, technical and market intelligence, as organizations strive to cope with increasingly complex global supply chains, where commodities and components are purchased from all over the world.

Paul Jones, Director, Management Consulting, KPMG in the UK, feels that the development of younger procurement talent has been too often neglected – as has the need to “manage out” poor performers:

“Investment in processes has not been matched with parallel investment in people. The current shortages will only get worse, so we need to focus on talent management, and view procurement as an essential competence for all senior managers. By raising the profile of the function, companies can attract bright people from other parts of the business, either permanently or on job rotation, giving team members a wider, more strategic outlook on the business. This in turn should place Procurement alongside the likes of Finance, Operations and Sales & Marketing as an essential route to the c-suite.”

As a true partner to the Board, Procurement should operate across functions and incorporate a range of disciplines, with a wider vision over the entire supply chain. This would enable its leaders to drive the agenda for key tasks such as category management and managing strategic suppliers, working with other parts of the business.

Competition for scarce procurement experts is particularly intense in fast-growing markets such as India. Consequently the best people will inevitably be attracted by offers of higher salaries and faster progression, putting even greater pressure on companies to build exciting Procurement careers. However, worryingly, the survey shows that organizations’ capabilities to attract, develop and retain talent are considered to be “below average,” indicating considerable room for improvement.

Can technology close the skills gap?

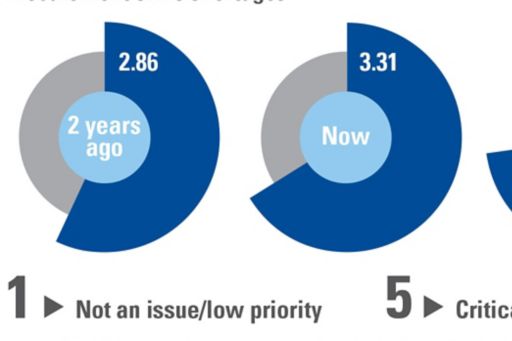

The survey respondents feel that investing in technology and automation is the most important means to address skills and talent shortages, followed by optimizing processes and increasing use of shared services. These three elements can be complementary, with process standardization and automation enabling a smaller, core procurement team that would be freed up to spend more time on strategic activities.

The findings also suggest that many Procurement functions lack in-depth capabilities to make the most of technology. When asked about the level of technological skills in areas such as invoicing, purchase-to-pay, sourcing, supplier collaboration, spend analytics, and contract management, respondents rate organizations as “average-to-weak”; an issue that concerns S.V. Sukumar, Head of Manufacturing Sector for KPMG in India:

“Procurement now has a global remit, and volatile commodity prices and fluctuating supply and demand affect both the price and availability of critical components and materials. Relatively few procurement professionals have the experience to manage such unpredictability – or the advanced tools to help them predict and hedge against price movements and other changes. It’s not surprising that respondents feel that market intelligence will be one of the most important skills for tomorrow’s procurement professionals. They need to know what data is available, where to access it, and, critically, how to use it.”

KPMG’s Paul Jones believes that technology alone will not be enough: “Businesses need people that understand technology and processes and possess strong technical procurement skills such as supplier relationship management, business partnering and category management. These kinds of competencies can be developed through more structured, blended learning and knowledge sharing across the organization.”

However, “developing more interesting procurement career paths” is ranked as the least important means to address skill shortages, implying that many organizations are not sufficiently committed to career development.

“Investing in technology and automation is considered the most important means to address procurement skills and talent shortages.”

In-house versus third party skills

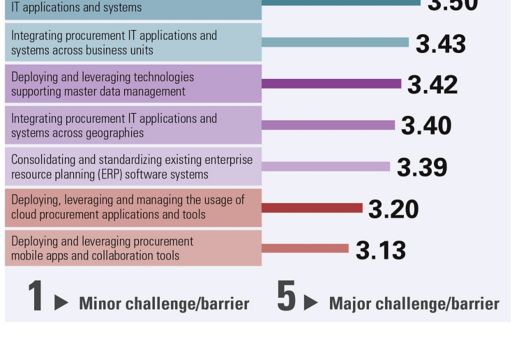

Respondents see the number one technology challenge as the deployment of analytics to harness big data. Such skills are especially in demand, and KPMG’s S.V. Sukumar believes that businesses may not be able to build sufficient resources internally: “Even if you do manage to train your own people in this area, they are likely to be quickly snapped up by competitors. In addition, most procurement teams are limited in scale, which opens the door to dedicated, independent advisory firms that can specialize in specific sectors.”

Lack of integration of disparate procurement systems and applications is rated as a highly significant obstacle, along with master data management. Many organizations also struggle to achieve widespread adoption of technologies, often due to cultural resistance. By linking performance management with behavioral change, it should be possible to leverage technology more effectively.

When asked where technology could have the biggest impact upon procurement, the most popular response was financial analysis and optimization. These two activities can demonstrate how procurement contributes to the bottom line, and help to enhance the function’s reputation, which in turn could open the door for investment in enabling technologies.

Case study: rising influence, aided by technology

The client, an oil and gas company, wanted to improve the way it purchased materials and services, and in doing so, serve customers better and help the business grow. In addition to lacking influence, the Procurement function lacked some key technical and technology skills, which restricted its ability to adopt new ways of working.

KPMG’s approach

The member firm helped create a centralized, global supply chain operation, with standardized processes for procuring goods and services. Various procurement and sourcing software tools were introduced, to help minimize manual work, provide more control over spending, reduce stock levels, and better manage supplier contracts.

By assessing what skills were needed for this new organization, gaps were identified & recruitment, training and developments programs were recommended. A ‘technical competency’ was introduced framework that matched specific skills to jobs, so that people could use the new technology effectively and get the most out of its undoubted power.

As a result, the Procurement process is fully automated, and operated by a single, global team, with a common culture, and the flexibility to adapt to local market needs. The group managed to achieve cost savings 20 percent above forecast. The enhanced standing of the Procurement team enables it to become more involved in strategic decisions, which should ultimately bring down costs further and build stronger supplier and customer relationships.

Lessons learned

- Technology may not enhance procurement without effective processes in place, and staff skilled in utilizing the software

- Companies need a detailed understanding of the skills required of their teams.

Conclusion: next steps

- Integrate procurement into general management development and training programs, to raise the profile of the function, improve its skill set, and help ensure that big decisions on new products, new customers, or new organizational structures, can all maximize procurement efficiency

- Carry out an audit of the skills required to get the most out of your investment in Procurement technology. Then, develop recruitment and training programs to fill any gaps in areas such as purchase-to-pay, sourcing, supplier collaboration, and contract managements

- Leverage alternative service delivery models such as shared services and outsourcing to gain economies of scale and augment in-house skills

- Consider whether you can realistically acquire data analytics skills in-house, or whether external providers are needed.

About the survey and KPMG Procurement Advisory

In this latest Pulse survey, 298 KPMG member firm consultants globally gave their views on the latest procurement trends. All those polled are professionals working in different areas of procurement consulting, and serving both global and national clients in energy and natural resources, industrial, manufacturing, financial services, technology, telecommunications, life sciences and consumer products.

Forty-three percent of the respondents are based in the Asia-Pacific region, thirty-nine percent in the Americas, and twenty-three percent in Europe. Eighty-five percent are manager level or higher.

KPMG International is one of the world’s leading advisors in strategic sourcing, procurement and supply chain management. Supported by our Center of Excellence, our member firm professionals work with clients to not just drive cost savings, but to improve business value, mitigate risks and create transparency in supply management.

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.