Arm's length interest rates for 2021

Arm's length interest rates for 2021

Ministry of Finance (“MF”) has adopted the Rulebook on arm’s length interest rates for 2021.

Ministry of Finance (“MF”) has adopted the Rulebook on arm’s length interest rates for 2021 (“the Rulebook”). The Rulebook was published in the Official Gazette of Serbia No. 24 dated 19 March 2021 and is effective as of 27 March 2021.

Impact of the Rulebook to transfer pricing documentation for 2021

According to the provisions of Article 61 of the Corporate Income Tax Law (“the CIT Law”), in determining arm’s length interest expense/revenue, taxpayers can:

1. use interest rates as prescribed by the MF Rulebook or

2. apply general OECD based methods for assessment of arm’s length interest as prescribed by the CIT Law.

Taxpayers may opt only for one of the above options. Selected option needs to be consistently applied to all intercompany loans.

Prescribed interest rates should be applied to interest income/expense recognized during 2021 regardless of the period from which loan(s) originate.

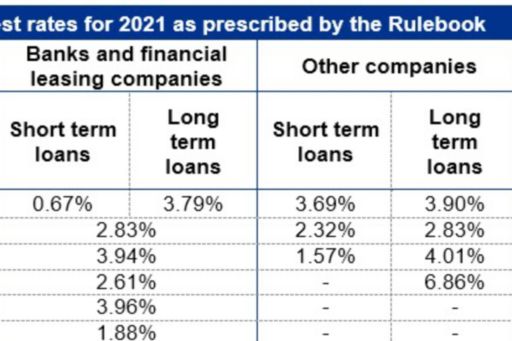

The Rulebook prescribes separate interest rates for long-term and for short-term borrowings for all non-finance entities and a single interest rate for banks and finance leasing companies (except for RSD denominated loans where interest rate is prescribed separately for short term and long term loans).

Arm’s length interest rates for 2021 as prescribed by the MF

What impact may this have on your business?

Compared to 2020, a general decline in interest rates for other companies can be observed. In the case of banks and financial leasing companies, a decrease in interest rates was recorded in case of short-term loans in RSD, loans in EUR and RUB, while in case of interest rates on loans in GBP no change was recorded in comparison to the previous year.

It is necessary to review if new interest rates for 2021 are aligned with interest rates currently applied in your related party financial instruments. In addition, companies exposed to significant / long-term related party financing should consider applying general OECD based methods for assessment of arm’s length interest as prescribed by the CIT Law, as such approach may be more beneficial and provide increased level of certainty in relation to future tax treatment.

If you have any questions or you need assistance of our tax professionals, please contact us at tax@kpmg.rs.

KPMG will continue to monitor all relevant developments in this complex area and inform you about possible impact of these events on business operations.

For previous editions of KPMG Tax Alerts please visit the following web page:

KPMG Tax & Legal Department

KPMG d.o.o. Beograd

Kraljice Natalije 11

Belgrade, Serbia

Office: +381 11 20 50 500

© 2024 KPMG d.o.o. Beograd, a Serbian limited liability company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.