New Program of Direct Aid to Business due to Covid-19 in Serbia

New Program of Direct Aid to Business due to Covid-19

The Program has entered into force on 13 February 2021.

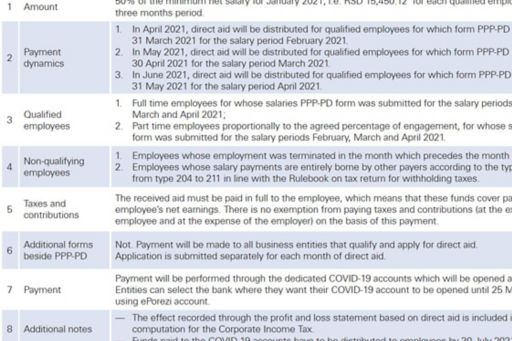

In the Official Gazette of the Republic of Serbia No. 11 of 12 February 2021, the Government of Serbia (Government)

has issued the Decree establishing Program of direct aid from the budget of the Republic of Serbia, to business entities in private sector aimed at reducing economic consequences due to disease COVID 19 caused by virus SARS-CoV-2 (Program).

The Program has entered into force on 13 February 2021.

Who is eligible for the new Program of direct aid?

The right to direct aid in accordance with the Program, regardless of the size of the business entity, have:

1) Resident business entities in private sector including branch and representative offices of foreign legal entities,

2) Which are not on the list of public funds users,

3) Which are founded/registered no later than 13 February 2021 or which became VAT payers by this date,

4) Whose Tax Identification Number is not temporally revoked by the last day of month which precedes the direct aid payment month,

5) Which have submitted statement of acceptance of direct aid on the ePorezi platform for each monthly payment,

Who is not eligible for the new Program of direct aid?

The right to direct aid in accordance with the Program do not have entities from financial sectors:

1) Banks,

2) Insurance and reinsurance companies,

3) Voluntary pension fund management companies,

4) Providers of financial leasing,

5) Payment institutions and electronic money institutions.

Loss of the right on direct aid

1) If the number of qualifying employees is reduced by more than 10% (excluding temporary employees with whom contract is concluded before 13 February 2021, and expires during this period), in the period from 13 February 2021 until the expiry of the period of three months from the last payment of direct aid (30 September 2021 latest),

2) If user of state aid distributes dividends from 13 February 2021 until 31 December 2021.

Tax Authorities will check eligibility on the last date of each month until the end of September 2021.

Consequences of the loss of the right for direct aid include repayment of received direct aid including interest for within five days from the day of the loss of rights.

If you have any questions or you need assistance of our professionals, please contact us at tax@kpmg.rs

For previous editions of KPMG Tax Alerts please visit the following web page:

KPMG Tax & Legal Department

KPMG d.o.o. Beograd

Milutina Milankovića 1J

11 000 Belgrade, Serbia

T: +381 11 20 50 500

F: +381 11 20 50 550

tax@kpmg.rs

home.kpmg/rs

© 2024 KPMG d.o.o. Beograd, a Serbian limited liability company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.