"Arm's length" interest rates adopted

"Arm's length" interest rates adopted

The Ministry of Finance of the Republic of Serbia (“MF”) has adopted the Rulebook on “arm’s length” interest rates (“the Rulebook”). The Rulebook contains the prescribed interest rates applicable to taxpayers who had or will have related party financing during 2015 and 2016.

Impact of the Rulebook to transfer pricing documentation for 2015 and 2016 and application of Double Tax Treaties

According to the provisions of Articles 59, 60 and 61 of the Corporate Income Tax Law (“the CIT Law”), in determining arm’s length interest expense/revenue, taxpayers can either use interest rates as prescribed by the MF Rulebook or opt to apply general OECD based methods for assessment of arm’s length interest as prescribed by the CIT Law. Selected option needs to be consistently applied to all loans to/from related parties.

Prescribed interest rates should be applied to interest income/expense recognized during 2015 and 2016 regardless of the period from which loan(s) originate.

The Rulebook prescribes a single interest rate for both short and long term borrowings/placements for banks and finance lease companies (except for Serbian Dinar).

The Rulebook prescribes separate interest for long term and for short term borrowings/placements for all non-finance entities, as well as for RSD denominated borrowings/placements for banks and financial leasing companies.

In determining the amount of interest which is subject to beneficiary rates prescribed by applicable Double Tax Treaty (“DTT“), taxpayers may also use prescribed rates or apply general OECD based methods. Unlike to the calculation of transfer pricing adjustments, taxpayers may apply prescribed rates and general methodology interchangeably in determining potential withholding tax exposure.

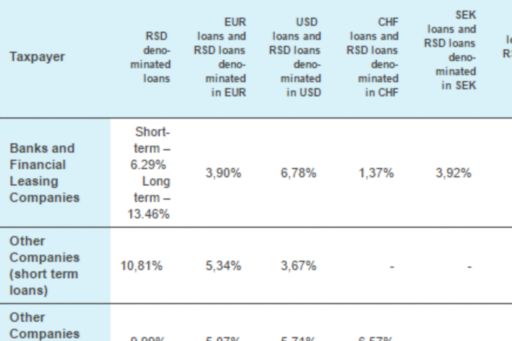

Overview of market interest rates as prescribed by the MF is presented below:

Arm’s length” interest rates as prescribed by the Rulebook

KPMG will continue to monitor all relevant developments in this complex area, and inform you about possible impact of these events on business operations.

For previous editions of KPMG Tax Alerts please visit the following web page: KPMG Tax Alerts

We remain at your disposal for any additional information you may require.

KPMG Tax & Legal Department

© 2024 KPMG d.o.o. Beograd, a Serbian limited liability company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.