Increased tax relief for R&D

Increased tax relief for R&D

Tax relief for research and development has entitles enterprises to a reduction of their tax base based on their research and development activities; as a result, a company can save PLN 190 on every PLN 1,000 it spends on R&D (or as much as PLN 285 if it has a Research and Development Centre status). Here, research and development activity is defined as creative work involving scientific research or experimental development work undertaken on a systematic basis in order to increase knowledge resources and use of that knowledge to develop new applications.

In practice, any enterprise which improves its products, technologies (including production technologies) or services, or which creates those from the inside out conceivably fulfils the R&D work related tax relief eligibility conditions. What is crucial is that the taxpayer engages in research and development work; also worth noting is the fact that the tax relief eligibility requirements do not impose any minimum level of innovation: outcomes that are just company-scale innovations are acceptable. Research and development areas can be identified in any industry, e.g. in: the construction industry, among others, the development of prefabrication systems, including research into the use of new materials; ICT, among others, the development of specialised software related tools and techniques (image processing, presentation of geographical data, handwriting recognition); the food industry, among others, the development of technologies and devices for harvesting and storing agricultural products; the raw materials recycling industry, among others, improved waste treatment technologies (e.g. mechanical, thermal, biological); the financial sector, among others, the development of systems that increase the efficiency of transaction data processing; the medical industry, among others, research into new formulations and dosage forms of multi-component medications.

What are the advantages?

Since the beginning of 2018, the eligible cost deduction limit has been raised significantly and currently stands at 100 per cent for all companies, with the exception of enterprises with the status of Research and Development Centre (formal status which a company can obtain after meeting certain requirements); in their case, the deduction limit can reach 150 per cent. In effect, entrepreneurs may recognise up to 200 or 250 per cent of their tax deductible R&D related eligible costs. What this means in practical terms is that for every PLN 1,000 they spend on research and development, the taxpayer can deduct from their tax base an additional PLN 1,000 to PLN 1,500, which translates into a direct tax reduction of between PLN 190 and PLN 285.

A sample tax relief calculation:

| Item | Value without R&D tax relief [PLN]

|

Value with R&D tax relief [PLN] |

Value with tax relief for R&D Centres [PLN] |

| R&D costs | (10,000,000) | (10,000,000) | |

| Tax base | 20,000,000 | 20,000,000 | 20,000,000 |

| Deduction of eligible R&D costs (100%) |

None | (10,000,000) | (15,000,000) |

| Tax base after deduction of R&D tax relief | 20,000,000 | 10,000,000 | |

| Tax rate | 19% | 19% | 19% |

| Tax due | (3,800,000) | (1,900,000) | (950,000) |

| Difference in taxation/benefit: | 1,900,000 | 2,850,000 |

Which costs are eligible?

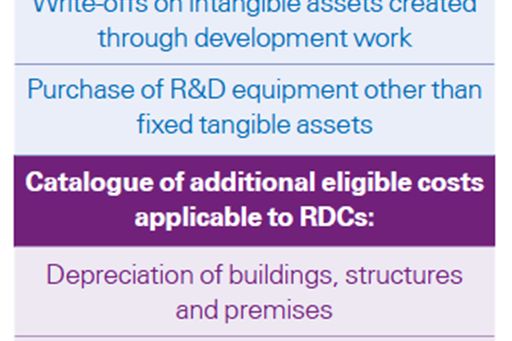

The research and development tax relief is granted toward the costs of R&D activities incurred in a given tax year (it is important to bear the cost, not the end of the project) consistent with the closed catalogue(s) of eligible costs (presented below).

Important steps in obtaining the tax relief

To be able to take advantage of the tax relief for research and development, the taxpayer needs to prepare appropriately. In addition to correctly mapping R&D activities (the fine line between those and other works considered routine and hence not qualified as R&D is often hard to identify), the taxpayer is required to comply with several conditions set out by legislators.

The eligible cost deductions are made on a cumulative basis in the annual tax return with respect to the tax year in which they are incurred (which does not exclude the possibility of using tax reliefs for costs incurred in previous periods as far back as the year 2016). At the same time, the taxpayer is required to maintain separate accounting records for R&D related expenses. Expenses deducted under R&D tax relief can not be refunded to the taxpayer in any way whatsoever; such refund should be understood as originating from public funds.

Taking into account all of the above, the taxpayer is required to report eligible costs in the CIT-BR form appended to the annual tax return. Moreover, it is good practice to document and substantiate the compliance of the company’s activities with the definition of R&D, and to document incurred R&D expenses in the form of an annual report on R&D activities, a document prepared for tax relief purposes.

R&D tax relief as a gateway to further benefits

Work is currently underway on a new tax relief instrument, referred to as the Innovation Box. This instrument will introduce preferential taxation for income obtained primarily through research and development works; one of the conditions of its use, now under consideration, is the previous use of R&D tax relief.

Marcin Mańkowski, Manager in the Grants & Incentives Team

Jakub Tomżyński, Senior Consultant in the Grants & Incentives Team

© 2024 KPMG Sp. z o.o., a Polish limited liability company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit Governance page.