The price is not right, is it?

The price is not right, is it?

by Rommel T Casipe

Time and again, the government has been devising ways to deter the public from smoking cigarettes. To date, it has released television and radio advertisements, and public health advisories on the packs of cigarettes and other tobacco products, with graphic images of lung cancer-stricken patients emblazoned thereon. In fact, it has even resorted to using one of its inherent powers - the power of taxation - perhaps as a last ditch effort to stop at least 10 Filipinos from dying every hour due to smoking-related diseases.

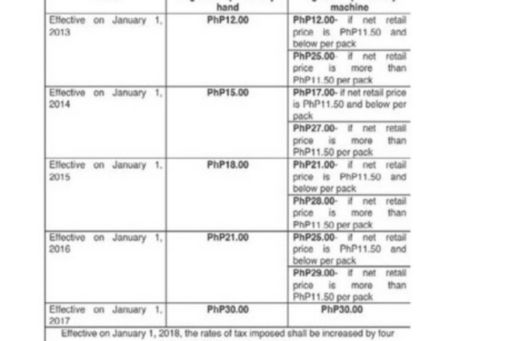

In 2012, Republic Act No. 10351 (RA 10351), an act restructuring the excise tax on alcohol and tobacco products, was signed into law. One of the main goals of RA 10351, aside from improving the financial sustainability of the country, is to promote better health by discouraging the public to smoke. The law introduced an annual increase in the tax rates of cigarettes packed by hand and machined, as follows:

Then, on May 16, 2017, President Duterte signed Executive Order No.26, which prohibits smoking in public.

A few months later, on December 19, 2017, President Duterted signed into law Republic Act No. 10963, otherwise known as the TRAIN Law, the first package of the Comprehensive Tax Reform Program. One of hte highlights of the TRAIN Law is the amendment on the imposition of a higher excise tax on cigars and cigarettes under Section 145 of the National Internal Revenue Code (NIRC), as amended.

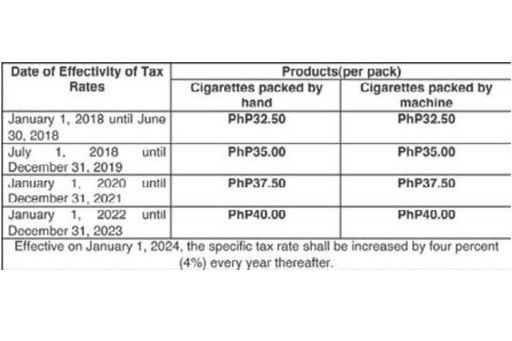

The table below shows the revised tax rates introduced by the TRAIN Law:

The new excise tax rate under the TRAIN Law will directly affect manufacturers, since they are the statutory taxpayers liable to file the return and pay the taxes. This increased rate in the excise tax on tobacco products, however, will be passed on by manufacturers to purchasers. This means tobacco companies will shift the impact of the increased rate of the excise tax on their consumers.

There is a P28.00 increase on the price of cigarettes from 2013 to 2023, subject to the four percent of cigarettes beginning in 2024. By imposing an increased specific tax rate, it is clear the government, aside from boosting revenues, intends to discourage people to purchase tobacco products. However, questions remain whether such increase would have significant impact on consumers and whether the new imposition would result in the decline of smoking prevalence in the country.

The cigarette price in the Philippines is still low as compared to its Asian counterparts. According to the Third Edition of the Association of Southeast Asian Nation (ASEAN) Tobacco Atlas, in 2015, the most popular cigarette brand in the Philippines costs $1.52, while $9.62 in Singapore, $5.11 in Brunei, $4.17 in Malaysia, and $1.94 in Thailand. Further, the said study explained that, the average monthly expenditure of an individual for cigarettes in the Philippines is $14.96 (P678.40). The study would suggest that, based on the price of the cigarettes in relation to the average monthly spending of an individual for cigarettes in the Philippines, smokers can still afford to purchase cigarettes, regardless of an imposition of a higher excise tax on cigarette. Also, some smokers may just shift to a cheaper cigarette brands or try other alternative such as vaporizer (e-cigarettes).

If the government is really serious in its smoking ban campaign and in discouraging the public to stop smoking, it can always invoke the power of taxation, which is inherent in the state and an attribute of sovereignty. However, one would ask, Will the government achieve its goal in promoting better health to justify the imposition of the increased excise tax on tobacco?

Rommel T. Casipe is a supervisor from the tax group of KPMG R.G. Manabat & Co. (KPMG RGM&Co.), the Philippine member firm of KPMG International. KPMG RGM&Co. has been recognized as a Tier 1 tax practice, Tier 1 transfer pricing practice, Tier 1 leading tax transactional firm and the 2016 National Transfer Pricing Firm of the Year in the Philippines by the International Tax Review.

This article is for general information purposes only and should not be considered as professional advice to a specific issue or entity.

The views and opinions expressed herein are those of the author and do not necessarily represent the views and opnions of KPMG International or KPMG RGM&Co. For comments or inquiries, please email ph-inquiry@kpmg.com or rgmanabat@kpmg.com.

© 2024 R.G. Manabat & Co., a Philippine partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.