Retail banks build innovation systems to win the fight for home loan customers

Can banks win the fight for home loan customers?

Banks must reimagine home loan customer experience to fend off low-cost competition.

Intense competition for home loan customers has created a price war that is affecting profitability. Retail banks are seeking innovative ways to differentiate their offers by providing a better experience for their customers. They need a system to understand customer needs and expectations; the ability to bring innovative, value-added solutions to market swiftly; and also comply with changing regulatory requirements.

Compete with innovation rather than reduce loan profitability

With demand for residential properties outstripping supply in many cities around the world, and memories of the financial crash fresh in their minds, governments are trying to ease conditions for first-time buyers and cool the investment property segment, while encouraging responsible lending. Examples of steps being taken are stricter limits on loan-to-value ratios for residential lenders coupled with more stringent checking of a buyer’s financial situation to reduce the likelihood of a borrower defaulting.

Competition amongst retail banks in home lending has become particularly fierce. To maintain market share, home loan providers are heavily discounting their front books below the standard variable rate. To escape this race to the bottom in home loan profitability, retail banks are increasingly trying to differentiate themselves on service by delivering a superior customer experience.

Invest wisely in home loan customer experience

Globally, we estimate retail banks will spend as much as US$5 billion in each of the next 2 years on improving the customer home loan experience. But to get the most from this investment, they need to understand what customers really want, and how this may vary by age group, gender and relationship status.

Research conducted by KPMG early in 2016 identified six ‘pillars’-personalization, integrity, time and effort, expectations, resolution and empathy-that underpin excellent customer experience and the kind of long-term customer relationships needed to drive growth and shareholder value.

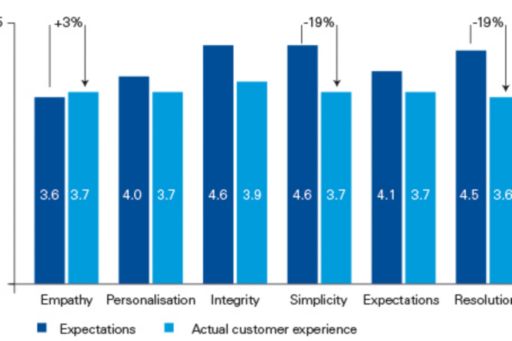

A more recent KPMG study of mass affluent home loan customers, sought answers to a range of questions about their home lending experience. The responses indicate that:

- Not all pillars are viewed as equally important in delivering a great home loan experience. Respondents to our home loan survey feel that Integrity, Simplicity and Resolution were the most important.

- The biggest gap between customer expectations and actual experience are against the customer experience pillars that matter most to this segment.

- Integrity, Simplicity (time and effort) and Resolution all failed to meet home loan customers’ expectations.

- The quality of home loan experience varies by acquisition channel. Of the three channels (applying through one’s existing bank relationship, applying directly with a new financial institution, or applying through a broker), brokers had the lowest score across all six pillars.

Banks must reimagine the home loan customer journey

Banks must reimagine the customer home loan journey. Instead of being a series of steps beginning with a loan request and ending with the drawdown of the loan, they should view it as a value chain centered around an individual or family moving home. Internally, cross-functional customer experience teams should begin by understanding what triggers the thought processes of prospective customers, and how they can ensure that the bank is front of mind from the earliest stage.

The next step is to articulate the customer’s various needs at each stage of the extended value chain. The team can then generate ideas on how the bank (or its strategic partners) can best fulfil these needs and satisfy all six customer experience pillars.

While it may be easy to generate innovative ideas for delivering greater value to customers, the bank also needs a systematic process for narrowing this list down, along with the capabilities to rapidly develop and test ideas.

The ultimate goal is a repeatable system for identifying unmet customer needs, producing exciting, distinctive ways to better satisfy these needs, and creating an agile environment that encourages experimentation and quickly brings feasible solutions to market. Banks that master this discipline are the ones that should ultimately win the battle for home loan customers. But the demand for responsible lending means that any efforts to deliver an outstanding customer experience must conform to ever-changing regulatory requirements.

Authors:

Geoff Rush, KPMG in Australia

David Bolton, KPMG in Canada

Chris Monaghan, KPMG in the UK