Insurtech: The innovation imperative continues

Insurtech: The innovation imperative continues

To grow and be competitive, insurers are leveraging and integrating insurtech solutions.

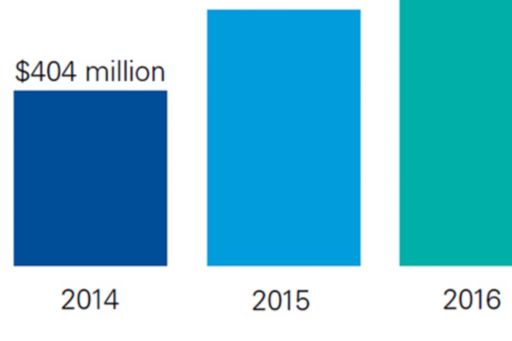

Investor interest in insurtech is exploding and poised for more growth. Between 2014 and 2016, the amount invested in insurtech by venture capital (VC) players rose from US$404 million to well over US$1 billion.

The importance of innovation in insurance

Having recognized the value and customization they receive from innovations in banking and other sectors, consumers now expect the same of their insurance providers. The response – insurtech – is causing dissolution of the insurance value chain by tech startups developing niche, tailored offerings.

But technology also lets traditional insurers open up new channels, speed up claims processes, and use data analytics to tailor products. By working with, rather than against, insurtech companies, the big insurance players can respond to competitive threats.

Getting the most out of insurtech investments: four key issues

Each traditional insurance company needs to determine how best to approach insurtech, by considering the following activities:

1. Define current problems

Before deciding which innovations to invest in, insurance companies should define the problems they want to resolve, like reducing claims wait times, decreasing operating costs, or providing more tailored insurance products.

2. Identify insurtech opportunities

Some insurers run innovation challenges to develop relevant insurtech solutions, while others opt for in-house insurance innovation labs that foster several insurtech companies. Examples include Met Life’s LumenLab, Allianz’s Data Lab and Aviva’s ‘digital garage’.

3. Address integration challenges

Insurers should examine their ability to integrate technologies obtained from insurtech companies. This might involve rethinking their innovation culture and addressing technology barriers.

4. Bring together the right partners

As they scale up, insurtech startups often partner with established insurers to access distribution networks, capital and regulatory expertise. Traditional insurance players need to seek out insurtech companies with the skills to address their own specific challenges.

Insurers should focus on a future based around insurtech

The pace of technological change requires insurers to keep abreast of evolving insurtech trends, namely:

Technology enablement: new innovations that integrate legacy systems can help incumbents embrace insurtech faster and with less hassle.

Cross-industry applicability: convergence with sectors like retail, banking and automotive generates threats and opportunities, and insurers may partner with companies from these industries to address challenges.

Proactive technologies: emerging technologies can help offer proactive services, like Helium, which provides environmental sensors, and Kinetic, whose wearable devices aim to reduce workplace injuries.

Improved customer experience: with vast amounts of information, insurers need to invest in data analytics to gather insights that help them tailor services to customers, or enable customers to manage risk.

Grasping the insurtech innovation opportunity

If they are to grow and be competitive, insurers need to leverage and integrate insurtech solutions, either through acquisitions, direct investments, innovation labs or services agreements. Having a clear insurtech strategy can help them achieve this goal.