We understand the unique challenges and opportunities that come with running a family business. Our team of experts is here to provide tailored guidance throughout every stage of your family business journey.

From starting and growing your business to preserving your family's legacy, we offer comprehensive support and advice. We understand the importance of family dynamics in shaping business decisions and strive to mitigate conflicts while promoting success.

Our focus is on aligning our advice with your family values and goals, ensuring long-term sustainability and personal fulfilment. As your family and business evolve, we will be your trusted partner, providing the guidance needed to navigate the complexities of running a successful family business.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

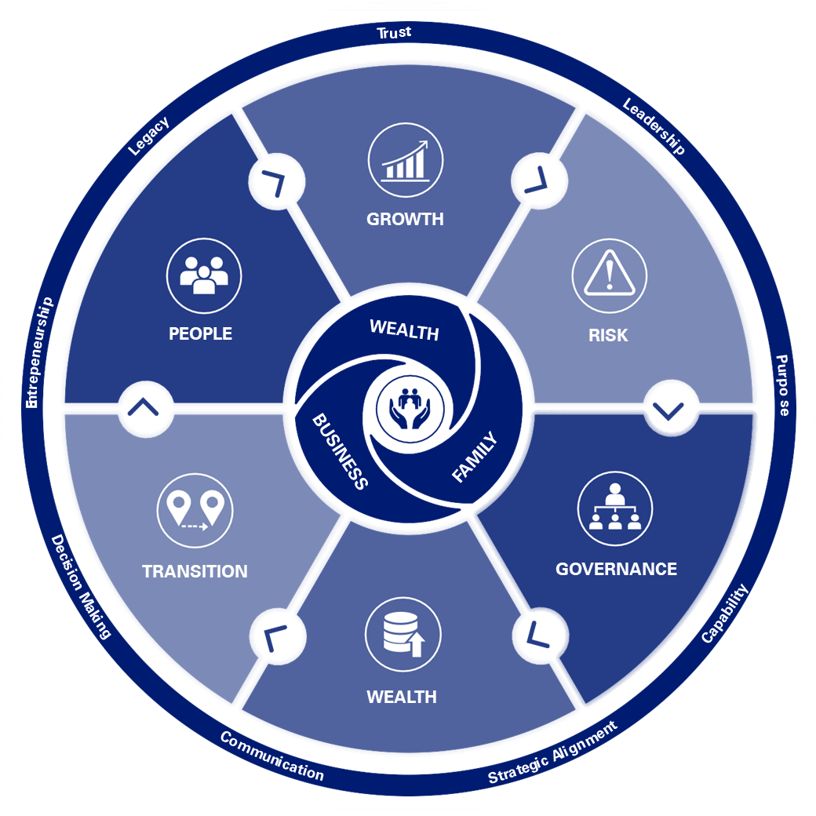

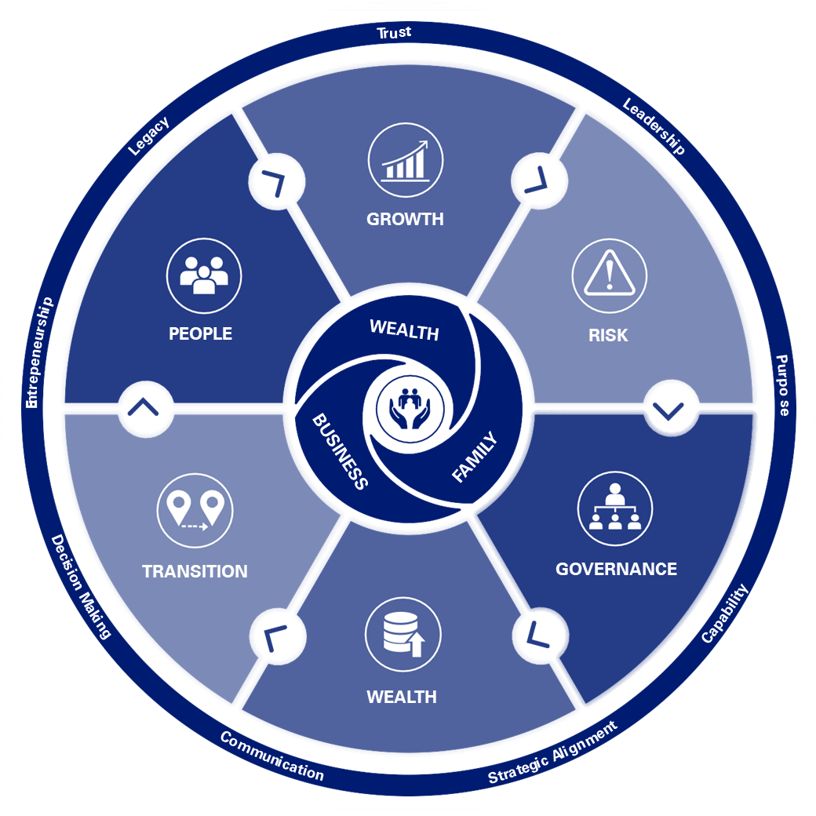

The evolution of your family business

As with your family, your business doesn’t stand still — it evolves. We have the expertise to assist you at each stage of growth, whether you are looking to expand, go international, strengthen your operations, or plan for an exit strategy. Our services are designed to help you navigate the unique challenges and opportunities of your family business so that you can achieve long-term success.

We can help you with:

When it comes to running a business, the toughest decisions can be around succession. As an owner-manager, you want to make the right choices, for your business – and your family. Starting early is critical for a smooth transition. By making decisions and developing transition timelines, you can avoid conflict and build the support and buy-in your successor will need.

KPMG Enterprise family business advisors can help you manage the sensitivities that come with succession and provide confidential advice on the implications of any decisions your family might make. When the time comes, we can also help your successor take on his or her new role.

Starting a family business is easy, relatively speaking; sustaining it beyond a couple of generations is the hardest part. It’s often said that the typical family business goes from rags to riches and back to rags in three generations. Better governance of a family business can help improve performance and satisfy the expectations of all family members. Establishing a governance framework that includes a family constitution and code of conduct for family members can help your family deal with changes in the business constructively. It requires your family to think through important scenarios before critical decisions have to be made and find agreement on important family and business goals.

Growth is an essential ingredient to continued business success. While most businesses can achieve growth organically, this can require considerable time and effort. In order to grow sustainably, entrepreneurial businesses must consider all of their market opportunities including seeking out complementary businesses for acquisition, potentially divesting non-core businesses, outsourcing functions to increase cost efficiencies and potentially expanding into the emerging markets.

The need for effective risk management and controls is crucial in an environment of increased scrutiny. It is important to minimise these risks in an entrepreneurial business, not only for the business itself, but also for the family, property holdings and capital. Implementing controls, securing new financing, efficient tax management and optimisation can all have a positive impact on the bottom line of your business.

Sometimes, an exit strategy rather than a succession plan is needed as there isn’t a next generation of family members who are ready, willing or able to continue the business. The sale of your business is often a once-in-a-lifetime transaction, with just one opportunity to get it right. There are many options when considering an exit for the family business – KPMG Enterprise family business advisors can work with you to examine the options available to you and assist with the transaction itself.

You’ve worked hard to build your business and make it a success. Now, as you look to the future, you want it to remain in good hands. At the same time, you want to maintain your personal wealth and pass it on to future generations.

KPMG Enterprise family business advisors can help you develop an estate plan for transferring wealth to your heirs and a succession plan for your business in a manner sensitive to your needs. By thinking about the future today, you can mitigate many of the risks associated with unplanned transactions, including family conflict and high probate and other fees.

As a successful entrepreneur or owner-manager of a business, you recognise the importance of giving back to your community – whether through your time, wisdom, money or assets. But giving to others can also be an effective part of your tax and wealth management programme.

KPMG Enterprise family business advisors can work with you to maximise the impact of your philanthropic endeavours, both for the organisations and causes that you support and as part of your personal tax plans. We’ll help you find the best ways to structure your support so you can give generously while also being tax-efficient.

A holistic approach to grow and protect your legacy

Our approach is to take a holistic view of your needs and integrate all aspects that matter to you and your family members. With access to the breadth of experience across our New Zealand firm and global network, we can provide comprehensive support tailored to your unique circumstances. Our aim is to assist you in growing and protecting your legacy while ensuring the long-term success of your family business.

Insights

Contact an advisor

Brent Love

Partner - On Farm Agribusiness

KPMG in New Zealand