M&A advisors across the globe have seen an overnight shift in their day job; from a pleasant mix of execution and origination to maintain a confident 12-18 month forward deal book –to an unsettling period of waiting to see what deals they would be fortunate enough to re-do, re-negotiate or re-structure (as opposed to lose permanently).

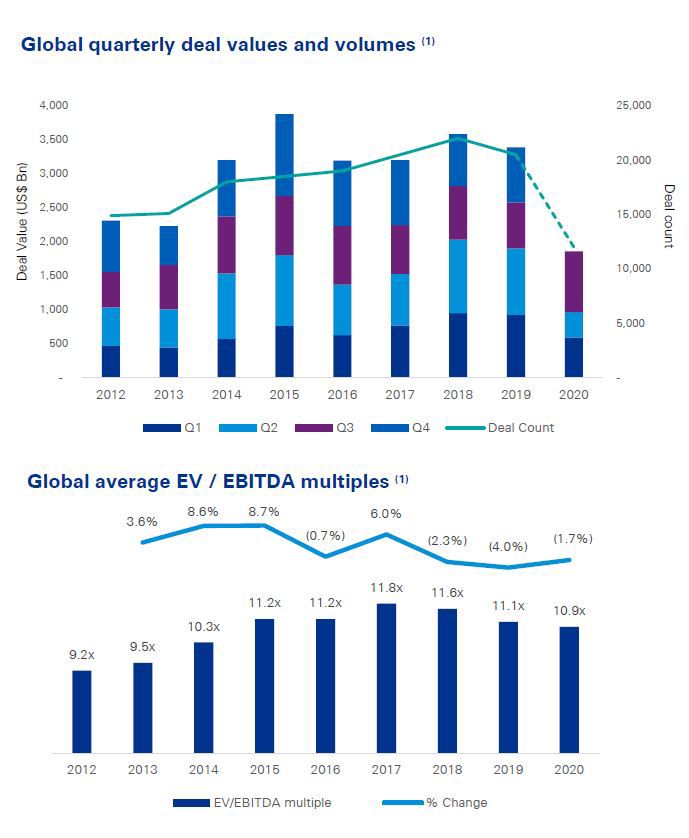

From a global perspective, whilst M&A activity for 1H 2020 was around half the level of what we’ve seen over the past several years, there has been a catch up in Q3 –with activity in line with what’s typically been observed. Pricing has broadly held up for 1H 2020, with the average EV / EBITDA multiple of 10.9x broadly flat on 2019 at 11.1x. This will be partially influenced by Covid not hitting until early-mid March and the average EBITDA multiple for Q2 2020 is a bit softer at 10.4x1.

Looking at KPMG’s own statistics, our current position is pleasing and certainly exceeds how we thought the year would play out when forecasting during the first lockdown in March.

In fact, 80% of our department’s 25 transactions (across M&A and due diligence) have now completed or are close to completion. However, close to half (40%) have completed following the deal structure taking a change of course to shift more risk to the vendor (through earn-outs, reduced investment stakes and other mechanisms) in order for the purchaser and vendor to reach an equilibrium.

Despite GDP being down 12.2% for Q2 –the largest decline on record, and Treasury forecasting it will be through to September 2022 until real GDP recovers to pre-Covid levels, our expectations for New Zealand mid-market M&A volumes for 2021 and into 2022 are a little more upbeat.

Our view is a softer start for the year (Q1, and possibly Q2) will be followed by robust volumes and a return to pre-Covid levels for mid-market M&A (below $250m) by the middle of 2021.

A few factors underpin this view:

- The focus for M&A advisors this year has largely been dealing with their pre-Covid portfolio as mentioned. Investment bankers have also been focused almost purely on executing equity capital market raisings. M&A deal origination has therefore has taken a bit of a backseat for much of the year but is now returning to normal.

- Some pre-Covid deals are likely to stay in the pie-warmer for a while yet (and for us around 20%) as in these situations it makes good sense to see another six months or so go by and therefore be 2H 2021 deals. For example:

- assets dependent on discretionary spend (and therefore need to see how the economy reacts to the run-off of the wage subsidy)

- assets that would benefit from certainty on the next New Zealand government and new policy implementation (e.g. education sector reliant on continuity of international students)

- competitive processes with a buyer field reliant on Australian participants –and not necessarily suiting a digital only environment to evaluate and execute

- We’re expecting to see more distressed or involuntary M&A deals come through during Q1 / Q2 2021 as the wage subsidy rolls off, and banks come to an end with covenant waivers (in our discussions it has been common for waivers to have been granted until 31 December 2020 or 31 March 2021). There are plenty of cashed up high net worth investors, private equity firms and alternative financiers providing flexible capital solutions throughout the capital structure looking to invest –so we expect many distressed situations will see a solution before going down the VA or liquidation route.

- We’re also being approached by local corporates on non-core disposal possibilities (those where Covid has had a meaningful impact on their strategy) as well as disposals of the New Zealand division of global corporates as they look for ways to build cash reserves and re-focus on core markets.

- On the public markets side, our listed companies are fairly well capitalised with strong support for the numerous capital raisings executed so far this year. Therefore we expect to see continued M&A activity by listed corporates during 2021.

- Australians are common participants in New Zealand M&A, and our expectation of strong mid-market M&A activity returning for the second half of 2021 and beyond will certainly be reliant on a quarantine free travel arrangement with Australia at a minimum

- Many credible market commentators expecting a Covid vaccine(s) to be available for distribution by Q1 2021.

- Regarding the IPO market, whilst there has been high volatility in the market this year, our understanding (speaking with local bankers and our Australian ECM colleagues) is the expectation for both New Zealand and Australia is solid activity for 2021. Primarily driven by low interest rates and record NZX/ASX pricing/valuation levels. Further, if there is still no visibility on the timing of borders re-opening by Q1/Q2, we expect those M&A sale candidates at the bigger end of town reliant on international buyers flipping into an IPO.