Venture Pulse: Q2’17 Global analysis of venture funding

Venture Pulse: Q2’17

Quarterly global report on VC trends published by KPMG Enterprise

KPMG Enterprise’s Global Network for Innovative Startups launched the Q2’17 edition of the Venture Pulse Report. The report analyses the latest global trends in venture capital investment data and provides insights from both a global and regional perspective. This edition of the quarterly series provides in-depth analysis on venture capital investments across North America, EMA and ASPAC and will cover a range of issues such as financing and deal sizes, unicorns, industry highlights and corporate investment.

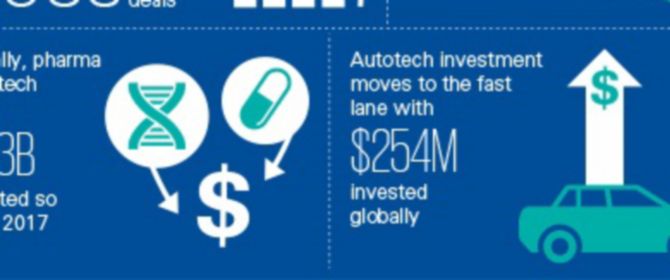

Worldwide VC investment volume slid again by just over 7% between Q1 and Q2 2017. However, thanks to a surge of mega-rounds, the quarter-over-quarter increase in total venture capital invested was a staggering 55.3%. US Initial Public Offering (IPO) activity continued to make a turnaround during the quarter, with a number of technology companies achieving successful exits. In tandem with solid merger and acquisition (M&A) activity, this renewal is a positive sign for the market.

This edition of the report seeks to answer a number of key questions, including:

- The pickup in megadeals activity across the globe

- The ongoing decline in deals activity, specifically at the seed and early stage deal levels

- The drivers behind advancements in autotech

- The growing focus on business to business (B2B) opportunities.

© 2024 KPMG, a New Zealand partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved.

KPMG International Cooperative (“KPMG International”) is a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.