In this fast-changing world, every business faces challenges. One step in the wrong direction can have a significant impact on business performance and corporate value. KPMG's integrated team of specialists will support you in challenging or difficult times.

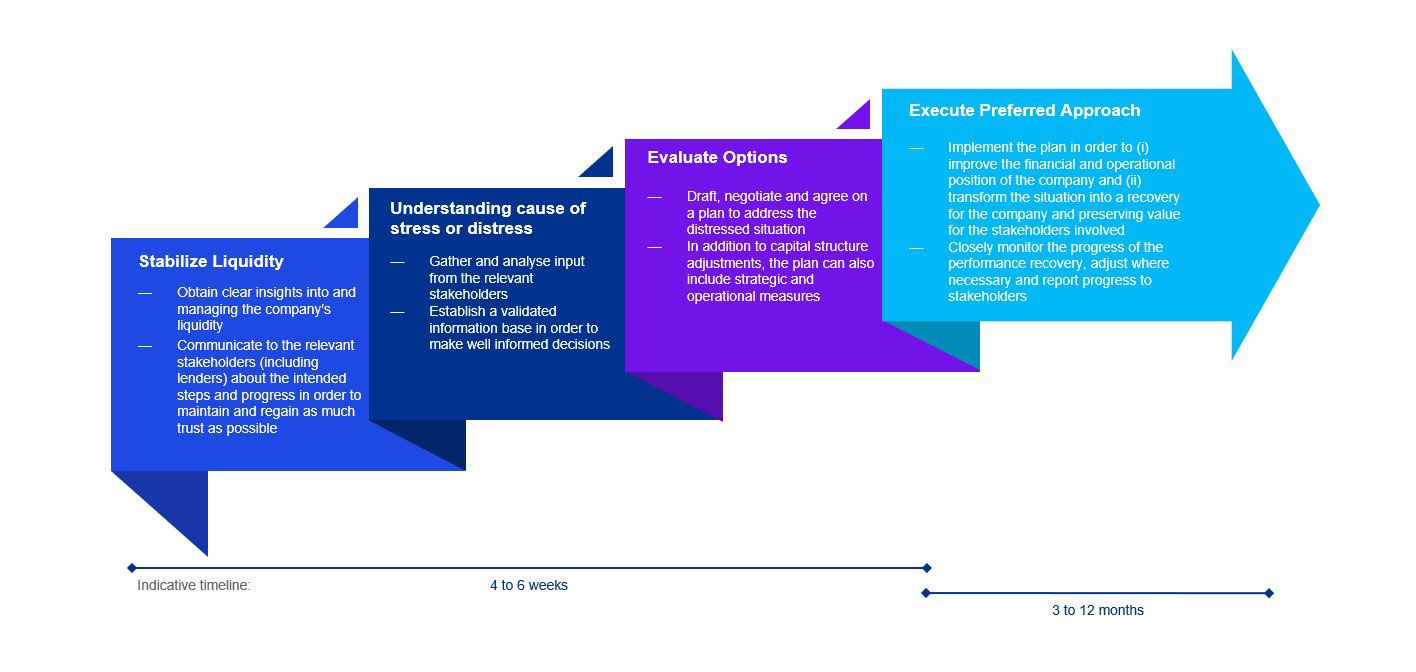

The road to value optimisation and recovery

To meet these challenges, it is important to quickly stabilize your liquidity position, to gain a realistic view of the options available for performance recovery and to implement the necessary changes in a timely manner. In addition, there must be proactive communication with stakeholders throughout the entire process in order to restore trust. Please read below how our integrated team of specialists can help you in operational turnaround and financial restructuring processes. KPMG can support you on the four stages of the road to value recovery.

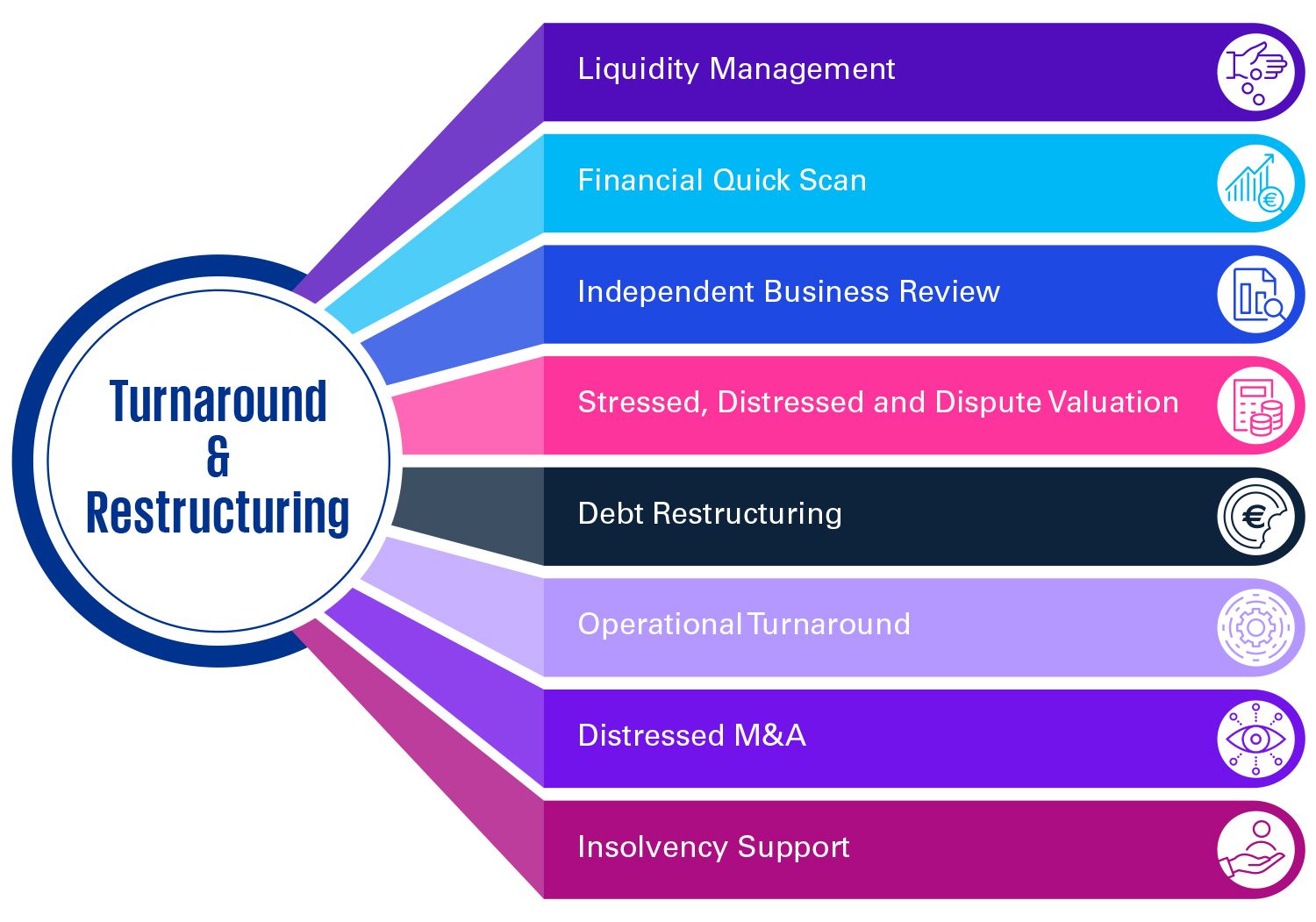

Helping your company with optimisation and restructuring

Whichever challenge your business is facing, our services are aimed at giving you the best possible support. Depending on your wishes, that support may consist of the following services (expand the items below for further details):

Providing insight into and gaining control of the company’s cash flows and liquidity position, by applying proven liquidity management tools such as a 13 week cashflow forecast in order to create stability and regain trust with stakeholders.

Headline assessment of the company’s financial position in terms of assets and liabilities, performance and/or cash flows in an outline and short time frame in order to determine key risks and vulnerabilities.

Financial due diligence and, if necessary, strategic assessment of the situation as well as setting out the available options for the company and its stakeholders to address the situation, which objectivised information basis serves as a starting point for negotiations between the parties involved.

Valuation of assets, liabilities (including claims) and/or companies as part of a financial restructuring process (including valuations under the Dutch Scheme of Arrangement (WHOA)) or dispute resolution procedures, in court or via mediation.

Provide support in preparing a plan that will be (sufficiently) accepted by the company and its creditors with respect to adjustments to the capital and (possibly) operational or organizational structure, both on a consensual basis as well as on the basis of a statutory creditors' agreement under the Dutch Scheme (WHOA).

Focus on improving the company’s productivity and asset base, by a structured and data driven cost approach, assessing and optimizing the company’s workforce, systems and processes and by setting up a clear dashboard for management to monitor progress and to further optimise the operations.

Provide support on the disposal of assets, shares or businesses where the seller or the company that is being acquired is in financial distress. The process is often run in order to raise liquidity and/or as strategic solution of the challenging situation. The process is characterized by short (DD) timelines, limited information and limited reps & warranties.

In case a corporate bankruptcy is inevitable, supporting bankruptcy trustees in a bankruptcy procedure by providing a wide range of services that can range from valuation and disposal of assets up to safeguarding data and IT systems with the aim to achieve value maximisation of assets and a prudent settlement of debts in the estate.

Three important factors for a successful restructuring process

Based on our experience, we distinct the following three factors that are important for a successful Restructuring process. however, each situation is different and requires a tailor-made approach. Our team is available to further discuss if you need support.

- Apply coordinated and proactive Stakeholder Management

Transparency and proactivity towards lenders suppliers and other stakeholders of the company is essential to restore trust.

Trust is needed to prevent the situation will get worse by stakeholders taking actions based on distrust or incomplete information.

Trust and confidence is also needed as basis for finding and implementing solutions in addressing the challenges of the situation. - Be willing to make decisions based on incomplete information

Considering the challenging and uncertain situation, time is of the essence but limited for gathering all relevant information.

The aim is to arrive at a solid set of financial, operational and strategic information in order for management to take the necessary decisions.

However, the urgency of the situation often dictates that decisions need to be taken prior to having access to a full set of information. - Restructuring dynamics require a specific expertise

Due to the stressed or distressed position of the company, management will experience that stakeholders will start acting differently.

Stakeholders will introduce Restructuring specialists on their side, being more demanding and with a strong focus on liquidity at first.

In order to adequately address these requests and regain control in time, management benefits from support by Restructuring experts

Experts on turnaround and restructuring challenges

The composition of the KPMG Turnaround & Restructuring Team brings a multi-disciplinary involvement with extensive experience in complex turnaround and restructuring processes to our clients. As evidenced by our testimonials, our clients appreciate our pragmatic and hands-on approach.

Demonstrated Turnaround & Restructuring skills

- Extensive experience and expertise within the Team to address complex Turnaround and Restructuring situations.

- Access to a broad network of Dutch KPMG specialists in the fields of a.o. Due Diligence, Strategy, and Technology services if required.

- Access to KPMG’s worldwide Turnaround & Restructuring network and transaction professionals if required.

Diverse Background & Expertise

- The Team members have a diverse background in roles in advisory, banking, valuation and legal industries, which supports our clients in finding the best possible solution in complex situations.

- Via our network of specialists, KPMG has access to in depth experience and knowledge of a broad variety of sectors, regions and type of clients.

- We have ample experience in working with lenders, lawyers and other relevant stakeholders in a Restructuring process.

Pragmatic Way of Working

- Clients describe our approach as hands-on, transparent and down to earth.

- The aim of our support is recovering and conserving as much value for our clients as possible, by working towards sustainable solutions.

- KPMG always commits itself in delivering its services within the timeframe as agreed with the client.

More information or do you have any questions, feel free to contact us directly.

What clients say about us

KPMG’s multi disciplinary services and clear communication throughout the insolvency process helped us, as bankruptcy trustees, in capturing a lot of value

KPMG’s report was clearly written, provided the assessment and views we were looking for on the debt capital structure and was timely delivered; well done

The hands on and pragmatic approach of the KPMG Team was very effective and a pleasure to work with, despite the financial and operational challenges we faced