Boris Johnson has said farewell as Prime Minister of Great Britain, leaving behind a fiercely debated Brexit legacy. The UK left the European Union on 31 January 2020, with an eleven-month transition period. On 1 January 2021, it was no longer possible to provide regulated financial services from UK institutions to customers in other countries in the European Economic Area (EEA) on a cross-border basis (passport).

Fintechs that previously passported their financial services from the UK to other European countries now had to find another gateway to the European market. A debate ignited on which countries and cities would benefit most from a ‘Brexodus’. Frankfurt, Dublin, Paris and Amsterdam were often mentioned as likely candidates. When the dust settled, we examined the registrations of licensed payment and e-money institutions from the European Banking Authority (EBA) and Financial Conduct Authority (FCA) registers, to determine which country benefited most from Brexit Fintech relocation.

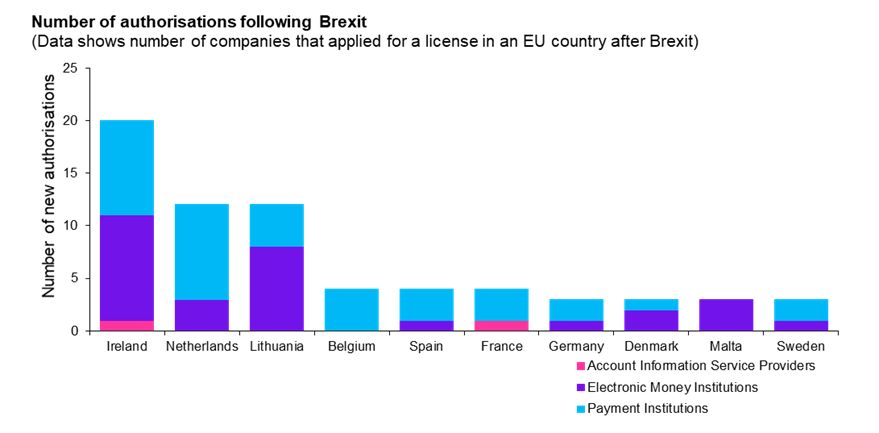

Following the Brexit referendum in 2016, over 77 fintechs[1] with a license in the UK obtained an additional license in the EEA[2]. We examined in which countries these fintechs obtained their authorization for the provision of payment and e-money services. Results reveal that Ireland, the Netherlands, and Lithuania attracted the most payment and e-money institution applications following Brexit (graph 1). Notably, Germany (Frankfurt) and France (Paris) have been mentioned frequently as possible locations for UK financial services firms, but they take a 6th and 7th place when it comes to payments and e-money related fintechs.

During 2018, two years after the Brexit referendum, the KPMG Pulse of Fintech already showed an increasing interest in Ireland and Lithuania from fintechs looking to establish a European presence[3]. In this research we found that the Netherlands attracted relatively more payment institutions, while Ireland and Lithuania attracted relatively more electronic money institutions. This is in line with the results of a broader KPMG research on fintech market entry in Europe[4].

The top three is followed by a long tail of other EEA countries with a significantly lower number of new UK entrants. Notable examples of companies that obtained a license in the beforementioned top three countries are payment service provider Stripe in Ireland, Payments-as-a-Service fintech Modulr in the Netherlands, and the short-stay platform Airbnb in Luxembourg.

The reasons why these countries attracted so many UK-based firms following Brexit are diverse. In separate research[5] about the registrations of licensed payment and e-money institutions in Europe, we found that fintechs generally base their decision in which country to domicile on five key factors: (i) access to knowledge and talent, (ii) digital savviness, (iii) access to funds and tax implications, (iv) market adoption of digital payments, and (v) ease of the application process. Likely reasons for Ireland’s number one position include geographical and cultural proximity, including a common mother tongue.

Selecting the most suitable country to domicile, depends to a significant degree on certain firm-specific characteristics in relation to these five key factors. KPMG’s multidisciplinary, holistic approach helps clients deal with choices related to market entry strategy and licensing, enabling them to reap the benefits of country-specific advantages in relation to their company’s goals.

For more information on how KPMG can help your organization in relation to payment or e-money services, please reach out to Martijn Berghuijs (Partner KPMG, Digital Strategy), or Roderik Jongbloed (Senior Manager KPMG, Digital Strategy).

Footnotes

[1] Specifically firms authorized as Payment Institution (PI), Electronic Money Institution (EMI) or Account Information Service Provider (AISP).

[2] Data was obtained from both the FCA and EBA register. Fintechs included in the study obtained their license in the FCA register before they obtained the license in the EBA register, following the Brexit referendum. Data was gathered in January 2022.

[3] KPMG | Pulse of Fintech: https://assets.kpmg/content/dam/kpmg/xx/pdf/2019/02/the-pulse-of-fintech-2018.pdf

[4] KPMG | The Netherlands: Europe's number one fintech hub? : https://home.kpmg/nl/en/home/insights/2022/04/the-netherlands-europes-number-one-fintech-hub.html

[5] KPMG: “The Netherlands: Europe’s number one payments and e-money fintech hub?”

Discover more

Contacts

Partner Digital Strategy | Fintech

Senior Manager Digital Strategy | Fintech

We will keep you informed by email.

Enter your preferences here.