KPMG & HSBC Emerging Giants Report Identifies 10 Potential Unicorns in Malaysia

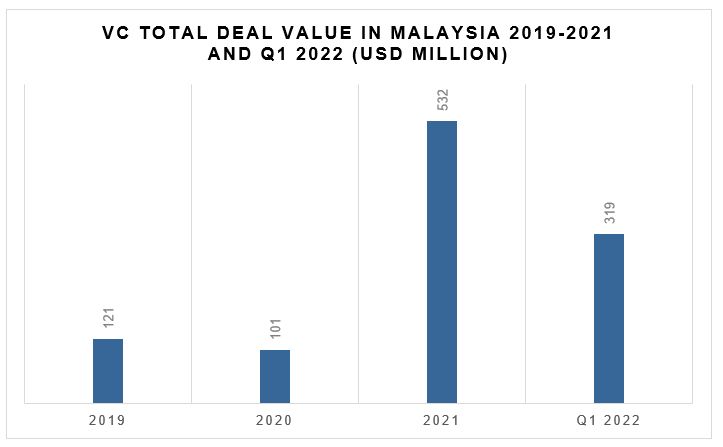

Q1 2022 sees USD 319 million venture capital deals, surpassing investments in 2019 and 2020 combined

PETALING JAYA, 25 July 2022 – As the Asia Pacific region becomes wealthier and more digitally connected, technology-focused ecosystems are maturing, generating billion-dollar companies at an unprecedented rate. The Emerging Giants in Asia Pacific report by HSBC and KPMG took an in-depth look at 6,472 technology-focused start-ups in 12 Asia Pacific markets[1] with valuations up to US$500 million[2].

The report identified 100 Leading Emerging Giants in Asia Pacific that are fast-growing, influential, and innovative with ambitions to achieve unicorn status and 10 Leading Emerging Giant companies in each market surveyed[3].

The list of 10 Emerging Giants in Malaysia who are poised to make a lasting impact on the global business landscape over the next decade are as follows:

Company |

Sector |

Boost Holdings |

Mobile Commerce |

Exabytes |

E-Commerce |

Jirnexu |

FinTech |

Presto Mall |

E-Commerce, Technology, Media, and Telecom |

Mindvalley |

Artificial Intelligence and Machine Learning, EdTech, Mobile, Technology Media and Telecom |

Neurogine |

FinTech, Mobile |

Eatcosys |

FinTech |

Says |

Mobile, Technology, Media and Telecom |

Lapasar |

Advanced Manufacturing, B2B Payments, E-Commerce, Mobile, SaaS |

PolicyStreet |

Fintech, InsurTech |

“Malaysia has developed a good understanding of technology and how innovation works, as evidenced by the many home-grown companies listed in the top 10 leading Emerging Giants for Malaysia. While start-ups are poised to continue playing a major role in the country’s development, some may struggle to gain the guidance and business support needed to grow. Beyond government support, nurturing the right ecosystem for our local startups requires adopting a regional outlook, and encouraging strong collaboration by stakeholders in the space,” says Guy Edwards, Head of Technology, Media and Telecommunications, KPMG in Malaysia.

“The list of Emerging Giants in Malaysia excites us because it is proof that our nation has all the right ingredients for start-ups to flourish and be leaders that shape their industry. As the world’s leading trade bank, we’re always looking for ways to help our customers innovate, develop the solutions of the future and add value. Financial institutions must be committed to offering start-ups the right support so they can scale beyond Malaysia to be an Emerging Giant or unicorn,” said Karel Doshi, Head of Commercial Banking, HSBC Malaysia.

Key characteristics of Emerging Giants

While there is no specific formula to be an “Emerging Giant”, the companies identified were standout players in a wide variety of disciplines, including superior technology and/or technical knowledge, “hyper localised” businesses, mastery of logistics channels and supply chain operations, successful adaptations of their business model(s) based on correct identification of market gaps and a winning culture that attracts and retains talent.

2022 Q1 VC already surpassing 2020 levels

According to Securities Commission Malaysia, funding is starting to reach a significant level – total committed venture capital (VC) funds hit US$1.2 billion in 2021, up 20 percent on 2020, and nearly five times more than Malaysian start-ups raised in 2019.[4]

There has also been an increase in venture capital deals in the region, with record-breaking numbers in 2021. Although 2022 looks unlikely to repeat the highs of 2021, Q1 2022 figures suggest that 2022 is on target to exceed both 2020 and 2019 funding levels for Asia Pacific as a whole. This is consistent with the investments in Malaysian startups. USD 319 million has been invested in Q1 2022 versus USD 121 million in 2019, USD 101 million in 2020 (totaling USD 222 million) and USD 532 million in 2021[5].

The report also features interviews with start-up founders and executives across the 12 Asia Pacific markets that offer insight on the challenges and opportunities that start-ups face.

Emerging Giants in Asia Pacific can be downloaded here or https://kpmg.com/emerginggiants or https://www.business.hsbc.com.sg/giants

[1] Mainland China; India; Japan; Australia; Singapore; South Korea; Hong Kong (SAR); Malaysia; Indonesia; Vietnam; Taiwan and Thailand.

[2] Valuations based on Pitchbook data current as of 30 April 2022

[3] Consideration for these lists was based on estimated valuations and venture capital received based on Pitchbook data figures; as well as KPMG and HSBC analysis on the future growth potential of these companies.

[4] https://www.sc.com.my/resources/publications-and-research/sc-annual-report-2021

[5] KPMG and HSBC analysis of Pitchbook data

Media queries?

For media-related queries, please email marcom@kpmg.com.my