Background

On 27 October 2021, the European Commission put forward a proposal for amendments to EU banking rules which aim to ensure that EU banks become more resilient to potential future economic shocks, while contributing to Europe´s recovery from the COVID-19 pandemic and the transition to climate neutrality.

The main objectives of this Banking Package are to:

- Strengthen the risk-based capital framework;

- Enhance focus on ESG risks in prudential framework;

- Further harmonise supervisory powers and tools; and

- Reduce administrative costs of disclosures and improve access to prudential data.

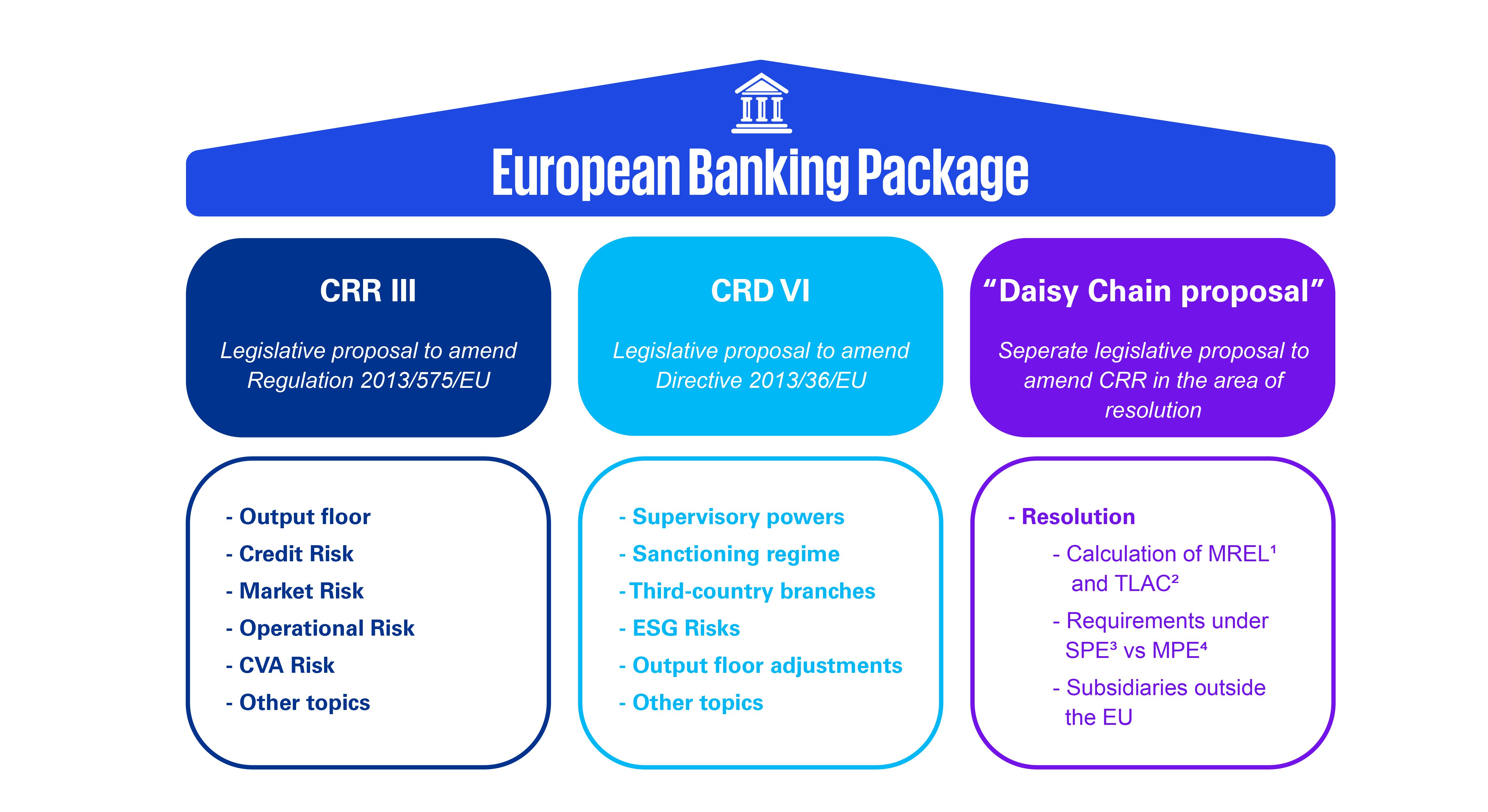

The EU Banking Package is based on three legislative proposals, as showing in the diagram below.

1 Minimum Requirement for own funds and Eligible Liabilities; 2 Total loss absorbing capacity; 3 Single point of entry; 4 Multiple point of entry

Summary of main changes in CRR III:

Output Floor

- Setting of a lower limit to capital requirement calculated by internal models.

- Distinguishes between floored and un-floored total risk exposure amount (TREA).

Credit Risk

- Revision of the standardised approach (SA-CR), including, amongst others, unrated, low-PD corporates.

- Reduction of the scope of internal ratings-based approaches (IRB).

- Credit risks mitigation techniques.

Market Risk

- Introduction of FRTB approaches to calculate own funds requirements.

- Setting of alternative standardised approach (A-SA), alternative internal model approach (A-IMA) and simplified standardised approach (SSA).

Operational Risk

- Introduction of a new single, non-model-based, standardised approach.

- Business indicator component (BIC) as unique factor in calculation of own funds requirements.

- Entities with a business indicator ≥ EUR 750M to calculate and disclose annual operational risk losses.

- European Banking Authority to report on the threat of use of insurance for regulatory arbitrage.

CVA risk

- Definition captures both credit spread risk of counterparty and market risk of portfolio traded with that counterparty.

- Introduction of basic approach, standardised approach and simplified approach.

- New requirements for eligible hedges for own fund purposes.

Other Topics

- ESG Risks - Institutions are expected to identify systematically, disclose and manage ESG risks at individual level.

- Disclosures

- Small and non-complex institutions and other non-listed institutions should disclose performing, non-performing and forborne exposures for loans, debt securities and off-balance-sheet exposures, and information on past due exposures on an annual basis.

- New disclosure requirements for market risk (using SA approaches and the A-IMA) and for CVA risk.

- Revised disclosure requirements for operational risk.

- Leverage Ratio

- Amended treatment of client-cleared derivatives.

- Removal of minimum conservation factor of 10 % for certain off-balance-sheet items.

- Provisions relating to regular-way purchases and sales awaiting settlement apply to financial assets, rather than only to securities.

- Prudential Scope - Financial groups headed by Fintech companies or include entities engaged in financial activities are part of the prudential scope of consolidation.

- EUCLID - centralised integrated system to aggregate reporting information shared by supervisors on the largest institutions.

How can KPMG help?

High-level assessment of how the implementation of CRR III will impact your bank. We can highlight the main areas of impact and suggest recommendations of how the bank can prepare for these changes.

Regulatory impact analysis

High-level assessment of how the implementation of CRR III will impact your organisation. We can highlight the main areas of impact and suggest recommendations of how the bank can prepare for these changes.

Readiness gap analysis

Gap analysis between your organisation’s current processes and procedures and the new regulatory framework. We will highlight which areas require improvement to be compliant with the changes brought about by the new banking package.

Assistance with implementing Banking Package changes

Provision of advice and assistance on the most efficient and effective way to implement the regulatory changes within your organisation’s processes and procedures. We can, inter alia, develop an implementation roadmap, assistance in updating policies and procedures, draft reporting templates, and training to staff (refer to the next point).

Training

Provision of training on any of the impacted areas from the implementation of this banking package. This training can be tailor-made to your bank’s needs – both in terms of timing, frequency, and duration, as well as topics delivered, which can refer to bank-specific documentation and processes. Training can be developed and delivered to the Board of Directors, Senior Management and even first line functions depending on the needs of the bank.