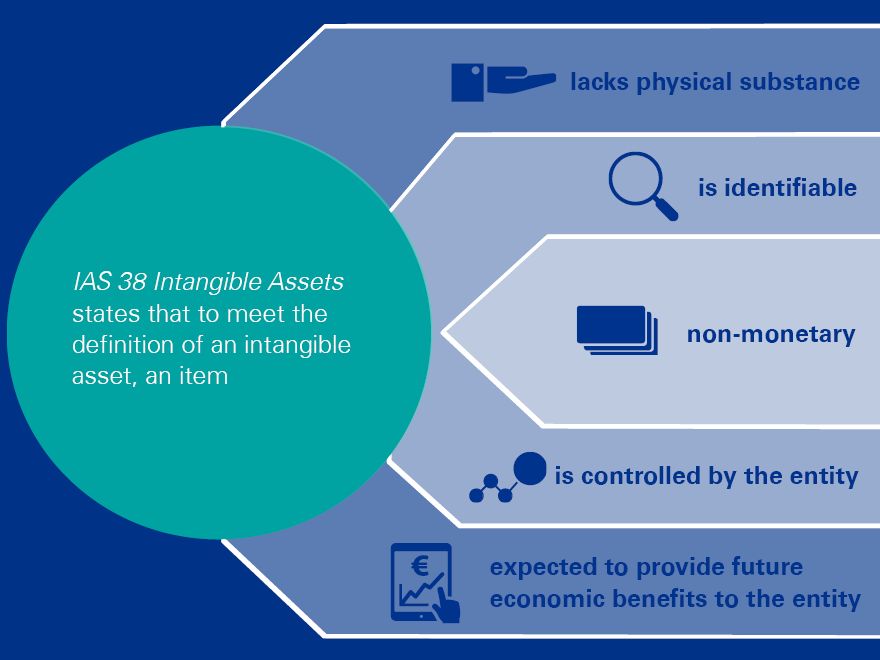

Most companies operating within the gaming industry have intangible assets on their balance sheet. Although intangible assets do not have a physical substance, they can be a significant element for companies to be able to operate successfully. Examples of such assets include platforms, games and other software specific to the business’ operations.

These criteria apply to all intangible assets, whether acquired separately, acquired in a business combination or generated internally.

Jonathan Dingli

Partner, Corporate Accounting Advisory Services

KPMG in Malta

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

It may be challenging to assess whether an internally generated intangible asset qualifies for recognition, due to issues in:

- Identifying whether and when the identifiable asset will generate expected future economic benefits; and

- Determining the costs of the asset reliably. In some cases, the cost of generating an intangible asset internally cannot be distinguished from the cost of maintaining or enhancing the entity’s internally generated goodwill or from the running of the day to day operations.

In this respect, in addition to complying with the criteria to qualify as an intangible asset and the recognition criteria mentioned above, to assess whether internally generated intangible assets meet the recognition criteria, an entity is required to classify the generation of the assets into 2 phases:

Distinction between Research and Development

IAS 38 defines Research and Development as follows:

‘Research’ is original and planned investigation undertaken with the prospect of gaining new scientific or technical knowledge and understanding. Research costs are expensed as they are incurred.

Examples of research activities include:

- Activities aimed at obtaining new knowledge;

- The search for, evaluation and final selection of, applications of research findings or other knowledge;

- The search for alternatives for materials, devices, products, processes, systems or services; and

- The formulation, design, evaluation and final selection of possible alternatives for new or improved materials, devices, products, processes, systems or services.

‘Development’ is the application of research findings or other knowledge to a plan or design for the production of new or substantially improved materials, devices, products, processes, systems or services, before the start of commercial production or use. Development does not include the maintenance or enhancement of ongoing operations.

Examples of development activities are: -

- The design, construction and testing of pre-production or pre-use prototypes and models; and

- The application and infrastructure development, graphical design and content development (content falls under development, to the extent that it is developed for purposes other than to advertise and promote an entity’s own products and services).

In view of the above, a company needs to be able to make a distinction between the 2 phases of its projects. The costs attributable to activities that fall under the research phase (as defined above), need to be accounted for as an expense. On the other hand, anything that qualifies as development could be capitalised, if they satisfy the recognition criteria that will be discussed in more detail below.

Should the company not be in a position to distinguish between the 2 phases of its internal project to create the intangible asset, all the expenditure incurred on the project needs to be treated as if it was incurred in the research phase and hence expensed when incurred.

It is also important to note that when the standard refers to development, it does not necessarily need to be in relation to an entirely new innovation; but rather it needs to be new to the specific entity.

Recognition criteria for internally generated intangible assets arising from the development phase

If an internally generated intangible asset arises from the development phase of a project, then

directly attributable expenditure is capitalised from the date on which the entity can demonstrate: -

- How the intangible asset will generate probable future economic benefits. Amongst other things, the entity can demonstrate the existence of a market for the output of the intangible asset or the intangible asset itself or, if it is used internally, the usefulness of the intangible asset;

- Its intention to complete the intangible asset so that it will be available for use or sale. It may be challenging to obtain this evidence since it relies on management’s intent;

- The availability of adequate technical, financial and other resources to complete the development and to use or sell the intangible asset. Financial and other resources needed to complete the development are not required to be secured at the start of the project. An entity may be able to demonstrate its ability to secure these resources through business plans and external financing plans in which potential customers, investors or lenders have expressed interest;

- Its ability to use or sell the intangible asset;

- The technical feasibility of completing the intangible asset so that it will be available for use or sale. The recognition criterion of technical feasibility is very subjective and relies also on management’s intent;

- Its ability to reliably measure the expenditure attributable to the intangible asset during its development. The Company would require an appropriately equipped costing system (including for example a time keeping system if the entity’s human resources are being used in the asset’s development) to reliably determine the cost of production.

Cost of internally generated intangible assets

On initial recognition, an intangible asset should be measured at cost if it is probable that future economic benefits that are attributable to the asset will flow to the entity and the cost of the asset can be measured reliably.

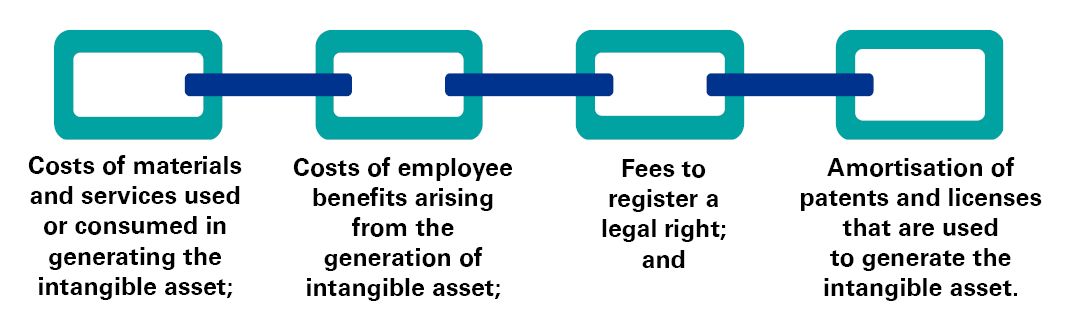

The cost of an internally generated intangible asset includes the directly attributable expenditure of preparing the asset for its intended use. Expenditure on training activities, identified inefficiencies and initial operating losses is expensed as it is incurred.

The cost to be recognised is the sum of expenditure incurred from the date when the intangible asset first meets the recognition criteria and prohibits reinstatement of expenditure previously recognised as an expense.

Directly attributable costs comprise all costs necessary to create, produce, and prepare the asset to be capable of operating in the manner intended by management. Examples of directly attributable costs are:

The below are not components of the cost of an internally generated intangible asset:

- Selling, administrative and other general overhead expenditure unless this expenditure can be directly attributable to preparing the asset for use;

- Identified inefficiencies and initial operating losses incurred before the asset achieves planned performance; and

- Expenditure on training staff to operate the asset.

The capitalisation cut off is determined by when the testing stage of the software has been completed and the software is ready to go live. Costs incurred after the final acceptance testing and launch have been successfully completed, should be expensed.

Beyond the ‘go-live’ date

There may be a period after the launch of the asset that would still be accounted for as part of the development phase, for example in the case of platform development, activities to improve its functionality to deal with higher volumes of players, could constitute development. However, this does not necessarily mean that the Company would be able to capitalise all the related expenditure. It needs to:

- Enhance the asset’s economic benefits potential. In view of the nature of the intangible assets, in many cases there are no additions to such an asset or replacement of part of it. Most of subsequent expenditures are likely to maintain the expected future economic benefits embodied in the existing intangible asset, rather than meet the definition of an intangible asset and the recognition criteria in the standard.

- Meet the 6 criteria listed above for the recognition of development costs as an asset.

Conclusion

Accounting for intangible assets, particularly those that are generated internally by an entity using its own in-house resources, can be challenging. Certain aspects of the recognition process can be subjective as they inherently depend on management’s intent. Other aspects of measurement can be judgmental and may need to rely on robust data capturing systems and sound controls. It is therefore imperative that all these aspects are adequately addressed in a timely manner before the ‘capitalise vs expense’ decision is taken by management.