You don't need a crystal ball to predict that the world is moving towards open banking. Some markets, led by the EU and the UK, have already taken the lead by creating and passing their own open banking regulation. Other markets, such as Australia, Canada, New Zealand, Mexico, Argentina, Nigeria, Hong Kong, Japan and Taiwan, for example, are also moving in that direction.

At the same time, there are a growing number of markets where – even absent of regulation – open banking is taking hold. In the US, for example, the complexity of the federal financial regulatory system means there is little potential for federal-level open banking regulation any time soon. Yet some of the greatest activity in open banking is happening in that market as players vie to find new ways to deliver new and compelling customer experiences.

What is Open Banking? While, in practice, open banking can take many forms (including standards and directives such as PSD2 in Europe and Open Banking in the UK), it generally refers to the ability for banking customers to authorize third parties to access their bank account data to either collect account information or to initiate payments (or, in some markets, both).

Open banking goes global

Over the coming few years, we expect to see a rapid uptake of open banking approaches and models as people become more aware of the benefits it could bring consumers and small to medium enterprises (SMEs) – the ability to quickly understand their financial position, explore alternatives and make better financial decisions.

Catalyzed by regulation, banks in Europe, the UK and Australia are already hard at work testing and prototyping new use cases and operating models that leverage application program interfaces (APIs) and open banking principles, such as comparison services, know-your-customer, auto savings and credit scoring to name a few. As these use cases are commercialized into functional solutions, the lure of open banking will grow (both for banks and for consumers).

At the same time, we expect to see customer demand and shifting expectations drive increased adoption of open banking models, even where regulation doesn't explicitly require it. Customers are looking for easier, more seamless and intuitive value-added banking experiences and there are a growing number of fintechs and 'challenger banks' seeking to capitalize on these developments.

As these new offerings start to influence customer expectations – and as customers start to understand and assess the value of their data – many banks will have little choice but to shift towards more open models (if only to reduce the friction between ecosystem partners) as they strive to offer better customer experiences.

Balancing the risks

Of course, there will also be the continued stick of regulation. As Scott Farrell - the author of Australia's Review into Open Banking report1 notes, “There is a strong desire to move relatively quickly – and we should expect to see a number of new jurisdictions implement open banking within the next 2 years.”

Indeed, the trend now emerging in some markets, particularly the UK and Australia, is to extend customer right to data across multiple sectors including insurance, utilities and pension data. While consumer 'ownership' of data will be a central component, each jurisdiction will take its own distinct approach to open data regulation in each sector.

The challenge facing policy makers and regulators is how to structure an open banking regime that balances the need for innovation, information security and privacy, and does not inadvertently create an uneven playing field for both traditional and non-traditional players.

In the EU, the balance seems to be in favor of the non-traditional players: with the proper consents, banks are required to open up their customer data to retailers, for example, but banks are not able to access retailer's customer data. This not only creates an imbalance of information, it also dampens the desire for innovation in the banking sector.

Grabbing the low-hanging fruit

While this has made open banking a compliance headache for many, we still expect to see banks start to get serious about finding the value in open banking in the near-term.

Many will be rolling out new capabilities and applications designed to make consumers' lives easier (and their digital assets 'stickier'). Expect to see a plethora of new tools emerge – solutions like personal financial management platforms that aggregate spend data across users' various banks, loyalty programs and payment platforms in order to provide insightful investment and financial advice.

Also expect banks to become savvier in the way they source and analyze data in order to gain better insight into customer activity and interactions. The reality is that the key to profitability (in the banking sector, at least) still rests in the bank's ability to fulfil a greater number of their customer's needs (whether through the bank itself or other third parties). Open banking has the potential to help banks know much more about their customers' patterns of behavior, financial health, investment plans and goals; the challenge for banks will be in convincing their customers of the value in sharing their data.

Where is this all going?

Over the longer-term, we expect open banking to bring fundamental change to the industry. Indeed, if you play out the current trends and direction of travel, our view suggests that most market players will start to coalesce around three potential business models.

- Front-end providers: These players will be focused on delivering a superior customer experience and access to a range of bank-owned and third-party services – often to a targeted segment of potential customers – through aggregation and product targeting. They will be the 'ecosystem orchestrators', delivered through super apps (more on this in a future article) and embedded into customer's lives.

- Product specialists: Expect to see some players focus on becoming increasingly agile at designing and tweaking products to meet the needs of individuals. Product design will be complemented by a deep understanding of how the front-end platform algorithms work to ensure products remain highly recommended.

- Infrastructure giants: Leveraging economies of scale and potential operating efficiencies, some players will choose to become back-end infrastructure providers to the banking industry – essentially providing the balance sheet and payments infrastructure that keeps the system operating.

Interestingly, as the fundamentals of open data start to flow across industry areas and customer expectations and needs evolve, our view suggests that banks could start to uncover entirely new areas of opportunity for future growth and value.

Open banking could allow banks to build trust with customers as a safe and secure data holder. Over time, the shift towards open data across industries might, for example, create the need for centralized repositories of personal data – a personal 'data bank', if you will - that can be accessed by approved service providers (beyond banking) through open data agreements.

Open banking will almost certainly allow banks to find niche areas of expertise and develop unique products and services. Consider, for example, how the spread of open data might create demand for easy and efficient payment platforms that aggregate users' spend and payments in one central app.

Open banking should also allow banks (particularly smaller organizations) to partner with accredited open banking partners and third parties to create better economies of scale. As banks start to expand their ecosystem in order to better serve customers, the ability to quickly and effectively connect to partners, data and systems will be key to organizational agility.

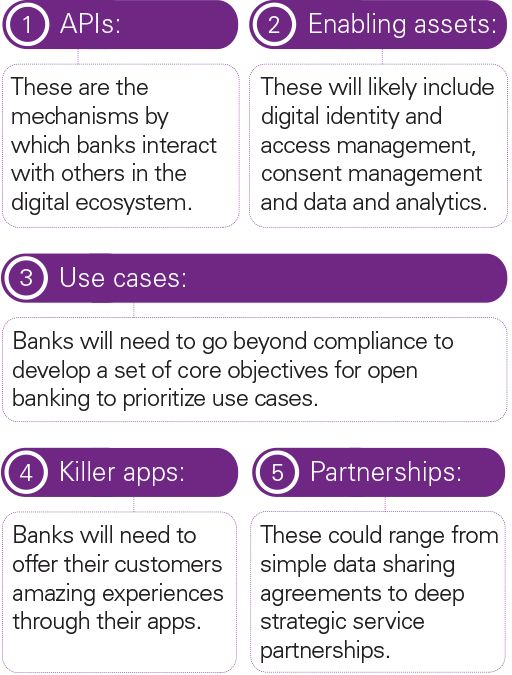

5 ecosystem requirements for successful open banking

Making the most of it

Given the inevitability and opportunity of open banking, the big question facing most banking executives is what to do in order to prepare.

Rather than view open banking as simply another compliance exercise, many bank leaders are now asking how they can make the most of the benefits of open banking. Even leaders in markets without existing regulation are keen to turn this shift into an advantage in their local jurisdictions.

Our experience working with banks and fintechs in the UK, EU and Australia suggests that today's banks should focus on six key areas:

- Understand the current direction of travel. Assess what regulators and competitors around the world are doing with open banking. Leverage the experience and capabilities being developed in key markets.

- Educate and engage customers. Elevate the conversation above the technicalities of open banking to talk to customers about their data and how they can safely leverage it to achieve their goals and aspirations, gain access to better services and improved pricing from banking and other third-party providers.

- Prioritize open data. Focus investments on driving more open data across the enterprise and ecosystem. Look for opportunities to encourage greater data sharing. We will start to see this being applied beyond banking to energy/utility data, telecommunications or even grocery data, with the ambition to provide a better customer experience.

- Improve technical and operational capabilities. Enhance your existing capabilities – particularly around APIs and analytics – to take advantage of new opportunities as they arise. Build on your reputation of trust by keeping a strong focus on data and cyber security.

- Embed data security into the design. In opening access to data, it is critical that banks also consider how they secure customer data. This is not only about remaining compliant with privacy regulations such as the EU's General Data Protection Regulation (GDPR), it's also about ensuring consumers feel confident and secure sharing their data with you and your partners.

- Develop your partnership strategy and capability. Identify and source capability from partners that can help enable compliance and operational readiness. Identify and form strategic partnerships (e.g. data sharing) with third parties that can help you create new products, services and experiences.

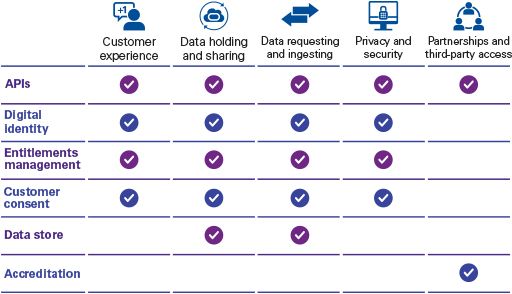

Given the wide-reaching implications of open banking, most banks will want to prioritize the development of a very clear framework for leveraging and managing the impacts and opportunities. As the graphic below suggests, the considerations for open banking will touch a range of enabling capabilities, such as consent management and data ingesting which will be new activities for banks to develop or procure from third parties, including fintech companies.

To be sure, there has been a lot of hype around open banking. But we believe that – over the coming few years – we will finally start to see traction around use cases in the lead markets and that, in turn, will drive greater competition and more rapid adoption in other markets.

It is not a question of whether or not you will need to deal with the implications of open banking. You will. The question should be whether you are ready to make the most of it.

Alex Azzopardi

Partner, Advisory Services

KPMG in Malta

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia