The Tax-Induced Debt Bias in Malta: Part 2

The Tax-Induced Debt Bias in Malta: Part 2

Another debt bias was identified from a personal tax perspective towards the Investment Income Provisions (IIP).

Article co-authored by: Ann Xuereb (Senior lecturer of Accounting at Junior College & visiting lecturer at University of Malta) and Faye Marie Gauci Grech (Corporate Tax Assistant Advisor - Incentive Legislation)

The first part of this article presented the analysis of the tax-induced debt biases that the Income Tax Act (ITA) may create. From a corporate tax perspective, the deductibility of interest versus the non-deductibility nature of dividends creates the first bias towards debt. Nonetheless, when the implications of corporate and personal tax were analysed simultaneously, the findings show that the full imputation system is effectively removing the debt bias. However, due to the recent reduction in income tax rates, this mechanism is no longer ensuring a tax neutral treatment for debt and equity in all scenarios.

Another debt bias was identified from a personal tax perspective towards the Investment Income Provisions (IIP). For instance, income derived from listed bonds is taxed at a favourable 15% withholding tax, while any dividend income is taxed with the marginal rates.

Subsequent to this analysis, the study proceeded to discuss the potential consequences, risks or benefits resulting from such biases.

What could the consequences of a debt-bias be for Malta? Is it beneficial or does it create risks?

In a report regarding an in-depth review for Malta, the European Commission (EC) highlighted that:

“… the debt-to-equity ratio exceeds the euro-area average, reflecting an underdeveloped domestic equity market and the tendency for the smaller family-owned Maltese enterprises (which make up the overwhelming majority of firms) to refinance themselves internally or take bank loans rather than to look for equity financing. The elevated ratio is also encouraged by the high bias towards debt-financing in corporate taxation”(EC, 2013a, pp.19-20)

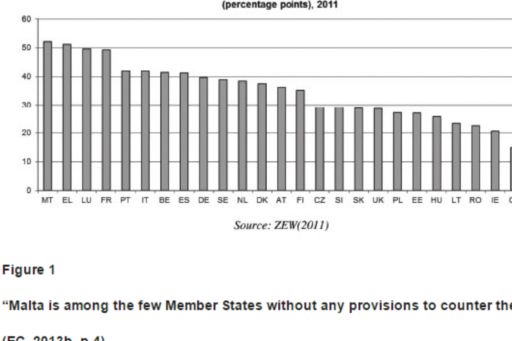

One way of measuring the debt bias is by using the Effective Marginal Tax Rate (EMTR). Fatica et al (2012) cited one particular study which used the EMTR to show that one of the highest debt biases within the EU in 2011 was found in Malta, as illustrated in Figure 1.

Moreover, in a council recommendation report by the EC on Malta’s 2013 National Reform Programme (NRP), the EC commented that:

“Tax incentives for companies to take on debt are still very high. In 2012, Malta stood out as the country with the second highest gap between the tax treatment of debt and equity financing of new investment. This debt bias may lead to excessively high corporate leverage and inefficient allocation of capital.”(EC, 2013b, p.4)

Grima and Vella (2014) reveal that Malta does in fact have high corporate leverage since companies are primarily financed with debt. Furthermore, with respect to the role of the debt bias in excessive corporate leverage, our study illustrated that while the tax bias is not a major driver of the over-indebtedness of Maltese companies, the tax benefit of debt is still one of the primary considerations of Chief Financial Officers (CFOs) in the debt-equity choice. Therefore, this could have contributed, to a certain extent, to the excessive use of debt.

Within an economic perspective, the bias towards debt is perceived as a problem due to the potential distortions that it may create in the economy (Zangari, 2014). The financial crisis serves as an example of the undesirable social effects of overly-geared companies. This, together with the fact that Malta is dependent on debt finance, may have triggered comments concerning the need to address the high leverage in Malta. Bankruptcy, high levels of unemployment, and huge losses of money by creditors and investors have forced many EU countries to address the debt bias. Therefore, to a certain extent, it is the social impact of having over-leveraged companies that has triggered the notion that the debt bias is a problem that should be addressed. In this context, it is imperative to mention that, even though the excessive use of debt is not necessarily driven by the tax bias, any tax incentives given to finance with debt are being addressed by countries like Belgium and Italy (Zangari, 2014). In Malta over-gearing is also perceived as a problem and that is why the Ministry of Finance, in Malta’s NRP under the Europe 2020 strategy (2014), has committed to introduce policies to reduce corporate leverage.

Is there a need to modify the Debt Tax Bias?

This may not be necessarily true as Malta operates a full imputation system which should effectively remove the debt bias. In fact, the Ministry for Finance in the NRP report (2014) utilised this basis to conclude that Malta does not need to address the excessive corporate leverage issue from a taxation perspective.

However, findings of the study illustrated the importance of the interest deductibility in financing decisions. Moreover, not only is the ITA creating a bias towards the IIP, but the full imputation system is no longer effectively fully eliminating the debt bias in all cases. Furthermore, such mechanism has been criticized by Shaviro (2011) as it targets the problem from a personal tax perspective and not from its corporate roots. In this context, and within the implications of research that show the high use of debt in Malta and its negative repercussions, the argument to modify any debt bias from a taxation perspective, is still a valid debatable issue. Such debate is built on the potential implications that the bias may have on Foreign Direct Investment (FDI), and other social and economic impacts.

The current taxation system is a major macro-economic tool that Malta uses to attract FDI which is supported by local research such as Coleiro (2011), Borg (2012) and Azzopardi (2014). The present system is very flexible because it can fit in well with other taxation systems around the world and is one of the EU’s most attractive tax jurisdictions. As a result, any change to the current system could threaten this flexibility which in turn may reduce Malta’s attractiveness as a tax-friendly jurisdiction.

A deeper analysis of the attractiveness of the Maltese tax system shows that the refund system, and the double tax treaties are the key factors used to attract FDI to Malta (Borg, 2012). Many foreign-owned companies are primarily equity-financed in order to benefit from the refund system. Therefore, any action to correct the debt bias without changing any aspect of the refund system should not in theory influence Malta’s ability to attract FDI. Furthermore, with respect to the possible biases found in the ITA, it could be argued that such biases are applicable only for Maltese investors, in which case the refund system may not always be beneficial. Thus, the modification of the debt bias should not influence FDI, but it should target the problem of over-leverage in Maltese companies which could be incentivised by the interest deducibility, the bias towards the IIP and the newly created bias where an imputation credit under the full imputation system is not being granted for dividend income exceeding the relevant thresholds.

With reference to social and economic impacts of the debt bias, the director from the Economic Policy Department (EPD) explains that a substantial part of over-leverage in Malta is due to the high concentration of SMEs, which means that many small firms are not growing. Maltese firms do not want to dilute ownership. However, for Malta to be able to grow economically, given the limitations of the Maltese market, companies must seek other foreign markets to invest in. This could be done by establishing foreign partners to share in the ownership of their company. Therefore, the notion of no dilution of ownership, although it provides Malta with stability during times of financial crises, is hindering long-term economic growth. In order to change this mentality, any incentives that promote the use of equity instead of debt are considered to be effective by the EPD.

The main reason for the introduction of corrective measures in other countries was the negative effects of the financial crisis. However, locally, the introduction of such measures for the same reason is deemed unfounded due to the lack of severe effects of the financial crisis in Malta. This is explained by the stability that SMEs provide to the economy when they seek finance from banks rather than foreign parties.

“Bank lending in Malta has acted as an important buffer to the severe external shocks and has been an important source of stability in the Maltese economy during the international crisis.” (Grima and Vella, 2014, p.2)

Nonetheless, the EPD believes that the benefits of long-term economic growth outweigh the benefits of having stability, thus the argument to introduce corrective measures still prevails in order to reduce the reliance on debt finance. A difference from other countries is that such an argument emerges from the need to enhance long-term economic growth for Malta and not from the need to counteract the negative repercussions of financial crises.

Concluding Remarks: Should Malta address the debt tax bias?

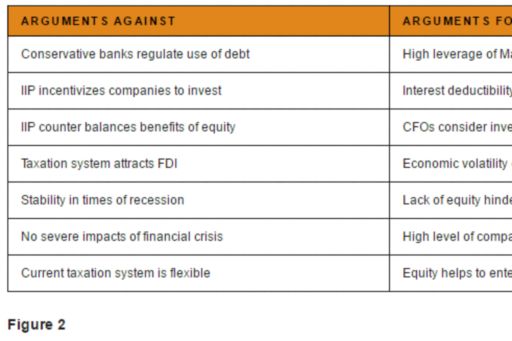

In order to formulate a valid argument for modification of the debt bias, the study presented several arguments for and against addressing the bias which are summarised in figure 2.

Primarily, Malta has one of the highest debt to GDP ratio in the euro area, and the International Monetary Fund (2015), points out that there is a high number of company failures in Malta. Therefore, although the financial crisis may not have harmed the local economy, Malta still experiences high levels of bankruptcy costs. Moreover, discussions with the EPD revealed the need to drive companies into utilising equity in a bid to trigger economic growth. Although retaining ownership is providing Malta with stability, it may limit Malta’s potential to grow economically.

The Ministry of Finance acknowledged the need to tackle corporate leverage through other means and not taxation, because leverage in Malta is driven more by the high concentration of family- owned firms than by taxation. Nonetheless, tax measures may still help in targeting the problem of over-indebtedness because the study revealed that interest deductibility does play a role in local financing decisions. Additionally, the IIP is to some extent influencing companies to match their supply of financial instruments with the demand by Maltese investors. This is evident in the fact that Malta is described by local stockbrokers as a bond market where the trading of equity is being somewhat hindered by the favourable tax rate on bonds.

Tax has also been found to influence the cost of capital of Maltese companies. From a corporate tax perspective, the interest deductibility is reducing the cost of debt. In contrast, the higher personal tax on dividends is increasing the cost of equity of some firms. The research finds that companies that have issued equity were forced to promise a return to the shareholders higher than the trending return on bonds. The difference pertains to the different personal tax treatment of interest income falling under the IIP and dividend income taxed at higher marginal rates.

Conclusion

In the light of the arguments set forth, the premise that Malta should address the bias becomes valid. The subsequent question would therefore be, to what extent should it be addressed and how? Such discussion is presented in part 3 of this article.

Article as published on The Accountant Winter 2017 issue.

© 2024 KPMG, a Maltese civil partnership and a member firm of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.