Interest in banks keeping up

Interest in banks keeping up

Banking in Malta

There were no fresh bank licences issued last year – unless you count Al Faisal’s acquisition of majority shareholding in BanifBank and MFC Bankcorp Ltd’s acquisition of Bawag PSK Bank – but there has been no shortage of interest, with what KPMG has described as a dramatic increase in potential interest in acquisitions.

In line with the trend being seen across Europe, Malta is still seeing an influx of enquiries from Asia and the Middle East, although ones from Europe are also picking up again after a “wait and see” period post-Brexit, associate director Mark Curmi said.

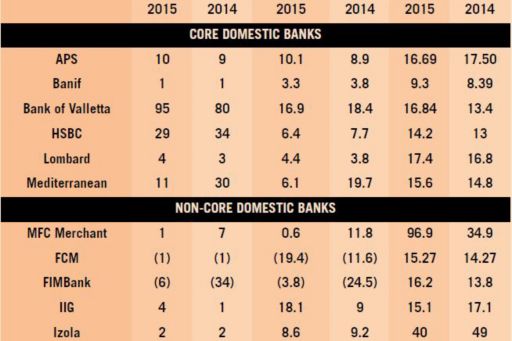

However, it is just as important for existing banks to do well as it is for new ones to come to Malta. KPMG’s annual publication analysing the local sector show that four banks made a loss in 2015 and five had either zero profit or just €1 million (see table). Is this a source of concern?

Mr Curmi said that rather than just profitability– for banks especially those which are still in their “start-up” phase, like Sata-Bank and Pilatus which only started operations in 2014 – the most important metrics were capital and liquidity.

“CET 1 ratios in the eurozone averaged 12 per cent, while Malta’s core domestic banks had an average above 13 per cent, which is excellent,” he said, with his colleague Noel Mizzi pointing out that the few eurozone banks with better ratios were often those whose capital had been boosted by government bail-outs.

Of course, profitability can become a concern in the long term as it would eat away at capital, and poor return on equity – it was negative for five Maltese banks – also deters investors. That said, eurozone Significant Banks’ average return on equity was 5.8 per cent in 2015 while for local core domestic banks this averaged at 9.9 per cent.

“A loss does not mean that the bank is not a going concern: some banks have bad years and you cannot draw conclusions from the performance on a single year, just as you cannot say that huge profits are going to be repeated every year as they might be due to one-offs. The issue is whether the banks have a sustainable business model. That is why regulators look at liquidity and capital, rather than profitability,”Mr Mizzi said.

Although a few banks have posted losses year on year, the core domestic banks remain very sustainable, and poorly-performing non-core domestic banks have seen a dramatic improvement. Even international banks which had posted losses have started to recover as their tweaked business models started to pay off.

Nemea, which is facing withdrawal of its licence, and which is protesting quite vociferously, had not published its results, and had not been included in the 2015/2016 KPMG analysis.

Referring to the improvements registered by a handful of banks, Mr Curmi said that in 2017, one of the main priorities of the European Central Bank was going to be banks’ business model – with the buzzword being “sustainability”.

This is one of the reasons that it takes almost a year for a licence to be approved. KPMG acknowledges that this time is necessary to ensure that the local regulator understands what the new acquirer or the new bank intends to do, and to get fina lECB approval.

Mr Mizzi acknowledged that the market has not been easy for Maltese banks.

“Although the economy has been doing very, very well, banks have excess liquidity and in a service industry, there is a problem transforming that excess liquidity into loans. There are limited opportunities to invest in huge projects – except government infrastructure, which poses other issues because of concentration risk.

“And for every deposit the bank accepts, it has to pay more to the deposit compensation reserves. So if you cannot transform deposits into positive yields, it costs the bank more and more,” Mr Mizzi said.

“What is definite is that banking has become a more difficult profession. The rules of the game have changed and will continue to change. I would say that for the foreseeable future, we will see more regulation and more competition – with IT increasingly the distinguishing factor between one provider and another.”

Of course, it is not only internal factors that affect banks here. Mr Curmi warned of other challenges, apart from Brexit, such as Trumponomics and other elections in EU member states.

“If you have someone outside of Europe deregulating, you have to see what impact that will have on banks in the EU,” Mr Curmi said.

KPMG partner Juanita Bencini is, however, optimistic that the drift in investor base to new regions will help to diversity the jurisdiction.

“New investors bring a new client base to Malta, for example, the Turkish banks which do not operate in the domestic market. And we will probably see a diversification of Banif’s customer base to clients from that region. There is also a very clear emphasis on wealth management going forward, not only for international banks and non-core domestic banks, but also core ones like BOV, according to the latest interviews given,” she said.

It remains to be seen whether Banif’s Qatari investors will attract clients seeking Islamic finance, but Ms Bencini remains to be convinced whether it would take off.

“Currently the demand is not that obvious, if there is any. However, to be fair we are not actually sourcing or encouraging it either. Our regulatory environment in that space is still unclear and, as typically happens, we need the regulator to push a set of regulations that encourages the setting up of such business. Hopefully, the fact that some of the shareholders come from jurisdictions where this is prevalent may be the push we need to look at seriously,” she said.

Islamic finance was one of 23 points in the Malta Stock Exchange’s strategic plan for the capital markets, which will require the MSE and the MFSA to pull on the same rope on various points.

“That is obviously important. The financial services sector is much more evolved than the capital markets one. Sufficient legwork needs to be done on capital markets before we can achieve the same level that we have in financial services. There could be potential, and certainly MSE chairman Joe Portelli believes there is.

“However, I will say that we cannot be everything to everybody. We have to decide what niches we want to go for, particularly since we have limited resources and cannot dissipate all our energy across too many things. Better to choose two or three, to make sure that they make sense for our country, that there is potential for growth, and go with them.”

© 2024 KPMG, a Maltese civil partnership and a member firm of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.