The Tax-Induced Debt Bias in Malta: Part 1

The Tax-Induced Debt Bias in Malta: Part 1

In 2013, the European Commission (EC) issued a country-specific recommendation that required Malta to address the tax-induced debt bias

Article co-authored by: Ann Xuereb (Senior lecturer of Accounting at Junior College & visiting lecturer at University of Malta) and Faye Marie Gauci Grech (Corporate Tax Assistant Advisor - Incentive Legislation)

In 2013, the European Commission (EC) issued a country-specific recommendation that required Malta to address the tax-induced debt bias given that it was one of the few Member States without corrective measures to counter such bias. But to what extent is this relevant?

Does the Income Tax Act (ITA) create a bias towards debt?

Is there a need to distinguish between debt and equity when both are used for the functioning of the businesses’ operations (Flannigan, 2011)? Tax law justifies the distinction by treating debt costs as a production cost during production stage and dividends as profit distributions during distribution stage. This means that debt and equity are given their characteristics at different stages of the entity’s lifecycle; but as both are used in the production of income, should both be given the same tax treatment?

Most corporate tax systems do not treat equally debt and equity. Interest payments on debt are usually tax deductible, meaning that they are allowed to be deducted from the taxable income of a company thereby reducing the income tax liability. However, dividends are a disallowable deduction and hence do not contribute to a decrease in the tax due of an entity. This creates a corporate tax advantage for debt financing which may provide a reason for firms to prefer debt over equity. In fact, Modigliani and Miller (1963), whose theories are considered to be the cornerstone of modern theories on corporate finance, show that because of the debt tax benefit, a firm can fully maximise its value through debt financing.

Malta's corporate tax system is one that distinguishes between debt and equity. Article 14 (1) (a) of the Income Tax Act (ITA) allows ‘any sums payable by such person by way of interest upon money borrowed by him’ as a deduction, while under no circumstances in the ITA may dividends constitute an allowable deduction. This could have been interpreted as Malta having one of the highest biases towards debt in the European Union (EU) in 2011 (Fatica et al, 2012). However, this may be rendered true only if the implications of personal taxation are ignored, in which case it could be argued that the ITA does create a debt bias due to the non-deductibility nature of dividends.

Nonetheless, corporate taxation does not exist in a vacuum and personal taxation plays a major role in the analysis of the debt bias. However, in current literature there is not enough emphasis on the fact that the debt bias generally exists in a classical taxation system, like that prevailing in most EU Member States and the United States (U.S.). In such a system, equity income is disadvantaged at investor level. Dividends are taxed twice, first at corporate level and then at shareholder level, while interest income is taxed only once with personal tax rates (Lin & Flannery, 2012).

Malta operates a full imputation system rather than a classical taxation system. The full imputation system allows a company to distribute a dividend net of tax, the recipient to be taxed on the gross amount of dividends in accordance with the marginal rates, and an imputation credit of the tax paid at company level is then given to set off the individual’s tax liability. If a shareholder’s income falls in a tax bracket less than the corporate tax rate, he would be entitled to a refund of tax of the difference between the tax rate of the shareholder and the corporate tax rate (Attard, 2008). Effectively, the shareholder would be taxed at the marginal tax rates in accordance with Article 56 ITA.

Once the full imputation system comes into play, the debt bias at corporate level is eliminated. Tax saved at corporate level by the interest deductibility, is offset by the personal tax paid on interest income. Hence, even if the company may have a bias towards debt at corporate level, this is balanced off with taxation at personal level when the same tax rate applies.

However, when in local National Budgets the tax bands started to widen and tax rates reduced, dividends were not always being taxed in accordance with marginal rates. Recent National Budgets reduced tax rates from 35% to 25% for individuals earning up to €60,000 for year of assessment 2016. Such reduction created the new 25% tax band. This reduction in tax rates does not apply for dividend income that falls within the new 25% bracket, since it is exempt income under Article 12 (1) (c) (iii) ITA. Consequently, the shareholder cannot claim tax at source, and any dividend income that falls within the new 25% tax band and exceeds the thresholds laid down in Article 56, shall remain taxable at 35%.

The personal tax bias is illustrated when an investor has an incentive under the ITA to invest his funds in the form of a shareholder loan rather than equity. The study illustrated that the new 25% tax bracket creates a bias towards debt because up until the €60,000 band is maximised, any interest income received will be taxed at 25% as opposed to dividend income that remains taxable at 35% unless thresholds are exceeded.

However, such bias toward debt is limited. Once the investor exceeds €60,000 income annually, the applicable tax rate on interest income would be 35%, meaning that no further benefit is enjoyed if debt is utilised for financing. Moreover, corporate entities do not enjoy taxation at marginal rates.

The Investment Income Provisions (IIP)

Another debt bias in the ITA is observed when an investor invests money by either purchasing a bond that has been issued by a resident company, or invests in equity that has been made available to the public via a listing on the Malta Stock Exchange. Interest paid in respect of a public issue may be subject to the IIP under Article 41 of the ITA. Such provisions are applicable only for Maltese residents both for individuals and companies. The investor has the option to receive interest income net of 15% tax withheld at source.

Dividend income does not enjoy the same tax rate; it is taxed in accordance with marginal tax rates at a maximum of 35%. Thus, for individuals who fall within the 25% or 35% tax bands, it could be observed that the ITA may create a bias towards debt due to the IIP because while interest income is taxed at 15%, dividend income is taxed at 25% or 35%. Article 41 ITA is also applicable to corporate investors.

What are the implications of the debt bias on Maltese Corporate Entities?

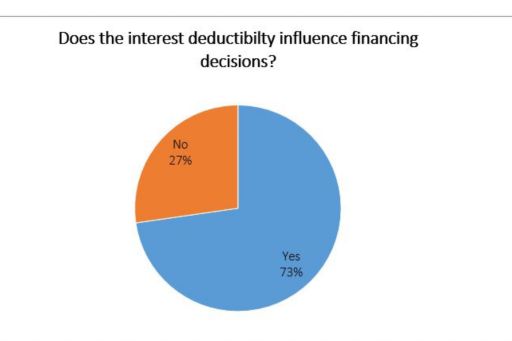

Out of a total of seventeen factors in the debt-equity choice, the deduction of interest is ranked at the third place. Figure 1 highlights the important role that the interest deductibility principle plays in financing strategies in local companies. A significant number of Chief Financial Officers (CFOs) interviewed claimed that the interest deduction is an important factor in choosing debt since it reduces the cost of debt.

The findings also divulge that most listed companies consider the preferences of the Maltese market. The majority of the listed companies claim that they issue bonds and not equity because they are certain that all bonds will be sold, while issuing equity does not give this certainty. This was also supported by a local stockbroker who stated that Maltese investors prefer bonds due to a fixed income stream and a favourable tax rate, which he believes influences heavily what companies issue to the market.

The benefit of debt as explained by Bontempi et al (2004) and Mackie-Mason (1990), reduces when the company is tax exhausted or has tax losses carried forward from previous years. In fact, one CFO emphasized that while the deductibility of interest was not considered in previous years because the company benefitted from the carry forwards of tax losses, it is now giving much more importance to interest deductions in a bid to reduce its tax liability. The same CFO also stated that the fact that interest deductions save tax for the company, and that bonds are favourable for investors, has pushed the company into the public issue of bonds.

Figure 2 illustrates that 73% of the CFOs interviewed admit that interest deductions influence their financing decisions due to the reduction in the cost of debt, the tax liability. Eight companies had a higher percentage for interest related deductions than for non-interest related deductions. Such finding implies that Maltese companies are more dependent on their interest deductions to reduce their tax expense, which outweigh the benefit of the other non-debt tax shields. This finding contradicts foreign studies such as those by DeAngelo and Masulis (1980) and Graham and Tucker (2005), which could be explained through the fact that Maltese companies have higher gearing ratios than those of the Euro Area (EA) (Grima & Vella, 2014) and would therefore have more interest expenses allowable for a deduction.

The study also illustrated that it is the non-listed companies that consider personal taxes, while listed companies admit that no consideration is given to the tax paid by their investor. Moreover, companies that have listed bonds responded differently to those that have listed equity. Listed equity companies give a greater importance to the return that the shareholder is receiving; in fact, one company even calculated the after-tax return to the shareholders. On the other hand, companies that have listed bonds give no consideration to the tax effect and this is because they believe that investors in bonds are aware of the 15% final withholding tax. A particular company gives so much importance to investor taxes that prior to promising a return to its shareholders, it calculated that such a return, net of tax, would be equal to the trending return on bonds. This implies that in order to make up for a higher tax rate on dividend income, this company had to compensate by promising a higher return to its shareholders than to its bondholders. Thus, while the debt bias is reducing the cost of debt for firms, it could be increasing the cost of equity.

In the context of non-listed companies, shareholder taxation is a major driving force of the financing decisions. These companies state that the shareholders are involved in financing decisions of the company and opt for the most tax efficient manner to raise finance. However, this is limited to when the shareholder is providing finance himself.

Other factors in Financing Strategies

The most important factor in the debt-equity choice is retaining control and ownership of the company, as shown in figure 1. This is significant in Malta given that most businesses are family run firms that do not want to dilute control. Most of the listed companies that participated in this study have listed bonds and not equities, and this could indicate that even such companies would want to retain ownership of their firm. In fact, Grima and Vella (2014) found that one of the drivers of leverage in Malta is the high concentration of small and medium enterprises (SMEs) that are family owned.

The tax-induced debt bias has also been proved to have promoted debt-shifting (Fatica et al, 2012). Companies engage in shifting their debt to their subsidiaries in countries that have high tax rates, so that larger tax savings are made from interest deductions. When debt shifting does not result in tax savings, it would be substituted by profit-shifting. Hence, when the benefits of the tax savings by the subsidiary are offset by the high tax imposed on interest received by the parent company, this triggers a shift in profits rather than debt. Globalization has enhanced the easiness with which firms shift profits by setting up a company in another country where profits are taxed at lower rates (Krautheim & Schmidt-Eisenlohr, 2011).

Despite the hypothesis that the tax-induced debt bias has promoted debt-shifting (Fatica et al, 2012), this is may not be the case for Malta. Most of the foreign-owned companies are financed with equity to benefit from the refund system. It is not beneficial for foreign-owned companies to base erode the profits in Malta when they can benefit from an effective 5% tax rate on dividend income.

Conclusion

This part of the article delved into the possible tax biases that the ITA may create and also assessed the implications on Maltese companies. However, does this tax-induced debt bias impact the Maltese economy? Should Malta address the debt bias? What corrective measure would be ideal to counter the debt tax bias? Such analysis is presented in part 2 of this article.

Article as published on The Accountant Autumn 2016 issue.

© 2024 KPMG, a Maltese civil partnership and a member firm of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.