Malta Securitisation

Malta Securitisation

Malta is reportedly the fastest growing securitisation jurisdiction within Europe. Securitisation in Malta has enjoyed the support of successive Maltese governments and local authorities. Key benefits of Malta securitisation include tax neutrality, bankruptcy remoteness, limited litigious recourse, privileged claims of investors and securitisation creditors by operation of the Securitisation Act and light touch regulatory oversight, amongst others. KPMG Malta can assist you in structuring and implementing securisation transactions, in establishing Malta securitisation vehicles and with their ongoing obligations thereafter.

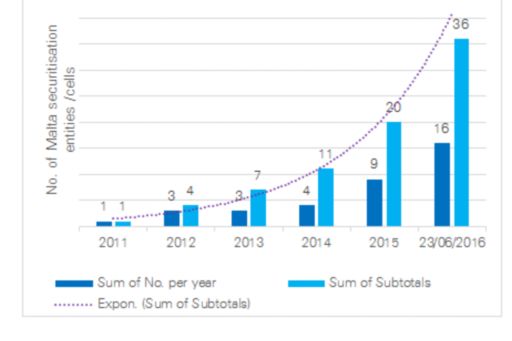

The activities of a Malta securitisation vehicle, a transfer of securitisation assets by its originator and income or gains received by its investors could achieve tax neutrality in Malta. Structuring Maltese securitisation transactions and the establishment of a Maltese SV are regulated by the Securitisation Act. This Act and its related statutes were purposefully drafted to make Malta a jurisdiction of choice for securitisation transactions. Their impact cannot be ignored, Malta reportedly is the fastest growing securitisation jurisdiction within Europe.

© 2024 KPMG, a Maltese civil partnership and a member firm of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.