IFRS 3 amendments – Clarifying what is a business

IFRS 3 amendments – Clarifying what is a business

Amendments provide more guidance on the definition of a business, but complexities remain

With a broad business definition, determining whether a transaction results in an asset or a business acquisition has long been a challenging but important area of judgement.

The IASB has issued amendments to IFRS 3 Business Combinations that seek to clarify this matter.

“The clarification and narrowing of the current, vague definition of a business is welcome. Some of the new tests, however, are quite complex."

Mike Metcalf

KPMG’s global IFRS business combinations leader

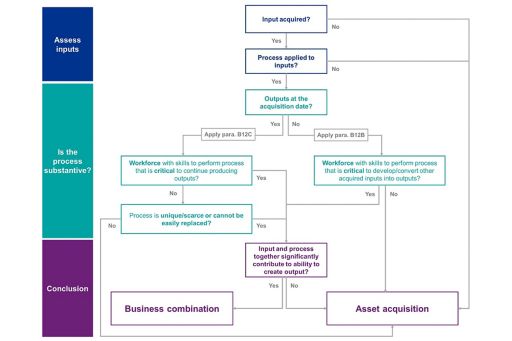

Optional concentration test

The amendments include an election to use a concentration test. This is a simplified assessment that results in an asset acquisition if substantially all of the fair value of the gross assets is concentrated in a single identifiable asset or a group of similar identifiable assets.

Assessment focuses on substantive process

If a preparer chooses not to apply the concentration test, or the test is failed, then the assessment focuses on the existence of a substantive process.

Narrower definition, potential complexity

The effect of these changes is that the new definition of a business is narrower – this could result in fewer business combinations being recognised.

The amendments may require a complex assessment to decide whether a transaction is a business combination or an asset acquisition. We outline the steps an entity takes for this assessment in the diagram below.

Click to enlarge diagram (JPG, 242 KB)

Effective date

The amendment applies to businesses acquired in annual reporting periods beginning on or after 1 January 2020. Earlier application is permitted.

Visit our IFRS – Business Combinations page for more information on the IASB’s consolidation suite of standards.

© 2024 KPMG, a Maltese civil partnership and a member firm of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.