Automatic Exchange of Information (AEOI)

Automatic Exchange of Information (AEOI)

The Common Reporting Standard (CRS) and US Foreign Account Tax Compliance Act (FATCA)

The Common Reporting Standard (CRS) and US Foreign Account Tax Compliance Act (FATCA)

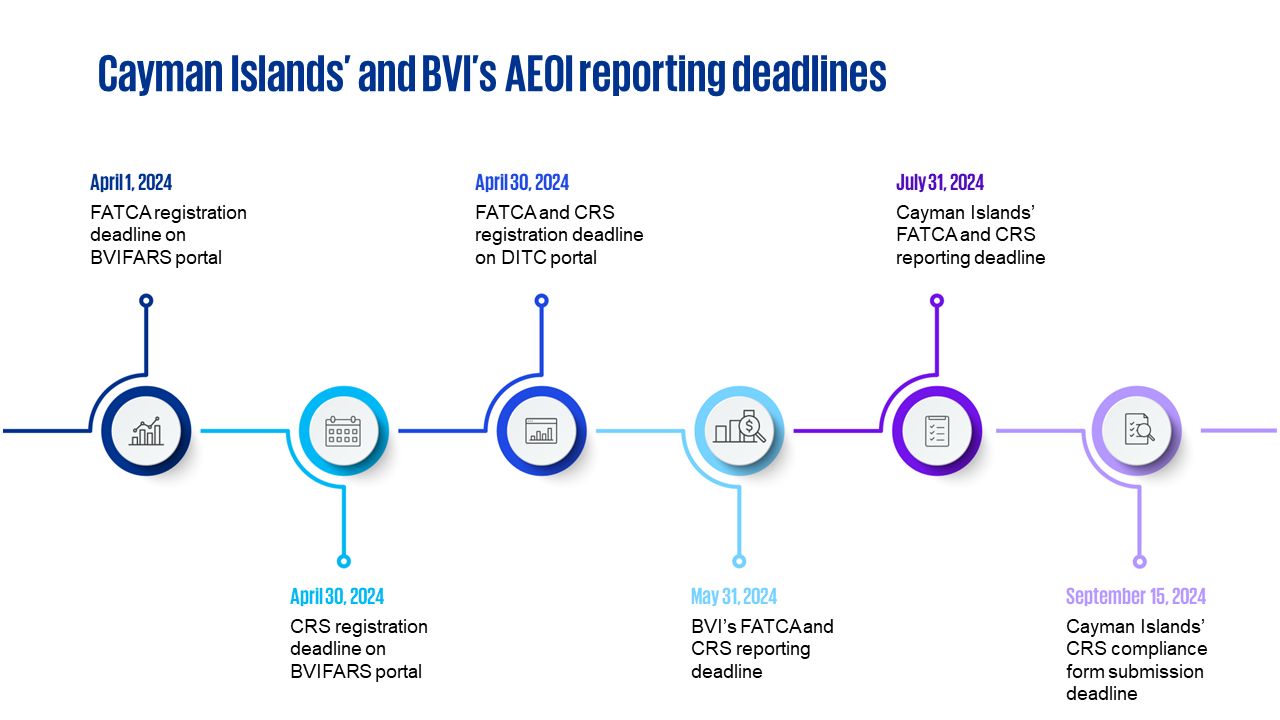

The Cayman Islands and the British Virgin Islands (BVI) are firmly committed to implement and enforce the automatic exchange of certain information under the CRS, FATCA and CbCR.

Following the implementation of FATCA starting from 2014, the relevant tax authorities in the Cayman Islands and the BVI implemented the CRS in 2016. Since their implementation, extensive guidance and FAQs have been issued by the tax authorities, which should help Cayman Islands and BVI entities to comply with the increased scope of the AEOI under both CRS and FATCA.

KPMG can support your organization in maintaining its compliance with the AEOI in this ever changing and fast moving environment.

KPMG has developed a number of services in order to assist Cayman and BVI Financial Institutions with the new issues of CRS and U.S. FATCA, including:

- Providing an analysis of CRS and FATCA’s impact on financial institutions.

- Assisting in filling out the appropriate self-certification/W series forms to certify AEOI status.

- Performing a Health Check, an investor or account holder review, including reviewing samples of classification for accuracy.

- Providing training to your financial institution to ensure you remain ahead of the latest developments and ensure compliance.

- Developing and drafting policies and procedures for you organization.

- Submitting the annual required reports to the Cayman Islands and/or BVI tax authorities.

Have questions?

KPMG in the Cayman Islands has an AEOI Help Desk for any questions you may have. Contact the KPMG Cayman AEOI team at aeoi@kpmg.ky or fatca@kpmg.ky.