Malaysia – Tax Measures Affecting Individuals in Budget 2021

MY – Tax Measures Affecting Individuals in Budget 2021

Malaysia presented the 2021 Budget proposals, announcing a slight reduction in the individual income tax rate by 1 percent for resident individuals at the chargeable income band of MYR 50,001 to MYR 70,000. There is also an increase, an extension, and an expansion of the scope of tax reliefs. Also proposed is a reduction in contributions made to the Employees Provident Fund. This newsletter covers these and other proposed measures.

Highlights

- Reduction in Individual Income Tax Rate

- Special Tax Rates under Approved Incentive Scheme (“AIS”)

- Expansion of Scope, Increased in Relief Limit, and Introduction of New Relief

- Extension of Period for Contribution to Private Retirement Scheme (PRS) and Net Savings in National Education Savings Scheme (“SSPN”)

Malaysia’s Minister of Finance (“MOF”) presented the 2021 Budget proposals on 6 November 2020, announcing a slight reduction in the individual income tax rate by 1 percent for resident individuals at the chargeable income band of MYR 50,001 to MYR 70,000.1 There is also an increase, an extension, and an expansion of the scope of tax reliefs – this includes the amendment in Finance Bill 2020 which was issued on 16 November 2020. Also proposed is a reduction in contributions made to the Employees Provident Fund.

WHY THIS MATTERS

These measures will have little impact on assignees into Malaysia or outbound assignees who remain subject to Malaysian tax and the cost of international assignments from the employer’s perspective. However, in cases where taxpayers claim the reliefs noted in this newsletter, they may find their tax burdens lightened to some degree.

Reduction in Individual Income Tax Rate

It is proposed that with effect from Year of Assessment (“YA”) 2021, the income tax rate for resident individuals will be reduced by 1 percent for the chargeable income band of MYR 50,001 to MYR 70,000. The reduction in the income tax rate will result in a tax saving of MYR 200 for those in the chargeable income band above MYR 50,001.

The nonresident individual’s income tax rate is maintained at 30 percent.

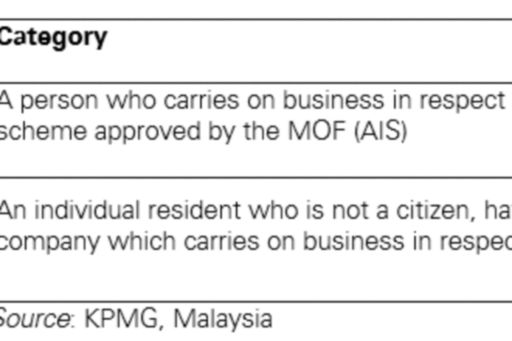

Special Tax Rates under Approved Incentive Scheme (“AIS”)

New sections have been proposed to provide special tax rates for the following persons:

A qualifying activity under the AIS (“AIS activity”) is defined to include any high technology activity in the manufacturing and services sectors, and any other activities which would benefit the economy of Malaysia. The Inland Revenue Board (”IRB”) has indicated that the special tax rates for the AIS activity are applicable to incentives for principal hubs, global trading centres, companies relocating their operations to Malaysia, and companies manufacturing pharmaceutical products as announced under National Economic Recovery Plans (“NERP”) and in the 2021 Budget.2

This proposal is effective from YA 2021.

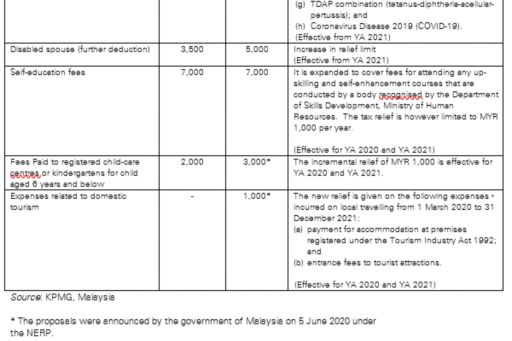

Expansion of Scope, Increased in Relief Limit, and Introduction of New Relief

It is proposed that the following existing reliefs and relief limits be expanded or increased and new reliefs be introduced:

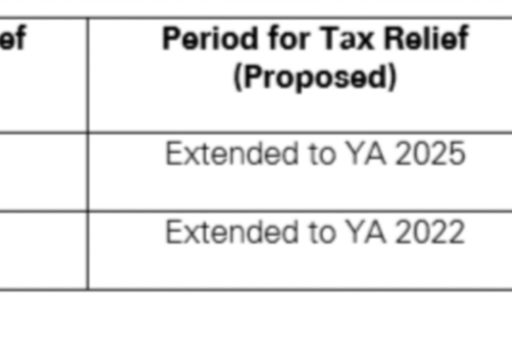

Extension of Period for Contribution to Private Retirement Scheme (PRS) and Net Savings in National Education Savings Scheme (“SSPN”)

To encourage taxpayers to continue contributing to these schemes for their future retirement and children’s education purposes, it is proposed that the period of claiming reliefs on contributions made to a PRS and net savings in the SSPN be extended as per the below:

KPMG NOTE

The proposed tax measures, as mentioned above, will benefit assignees in Malaysia if they qualify as tax residents in Malaysia, although the tax saving is not significant. In order to qualify as tax residents in Malaysia, the assignees should give consideration to their pattern of stay in Malaysia.

To support their claims for relief, taxpayers are reminded to retain documentary evidence. In the event of a tax audit, the absence of documentary evidence could result in a disallowance of the relief and attract penalties of up to 100 percent of the tax under-paid.

Increased in Limit of Income Tax Exemption on Compensation for Loss of Employment

The current income tax exemption for compensation for loss of employment with the same employer or companies within the same group is MYR 10,000 for each full year of service.

To assist individuals who lost their jobs during the COVID-19 crisis, it is proposed that an additional sum of MYR 10,000 for each full year of service be allowed for an individual who has ceased employment on or after 1 January 2020, but not later than 31 December 2021.

KPMG NOTE

Extension of Period on Tax Incentive for Returning Expert Program (REP)

REP is a program intended to encourage skilled Malaysian professionals working abroad to return to Malaysia. The program is managed by the Talent Corporation Malaysia Berhad and approved by the government.

This program applies to an individual:

(a) whose application has been approved by the MOF; and

(b) whose income is received from an employment with any person resident in Malaysia.

It is proposed that the application period for the REP incentive be extended for another three years. Applications may be received by the Talent Corporation Malaysia Berhad from 1 January 2021 until 31 December 2023.

The employment income of an approved individual under the REP will be taxed at the flat rate of 15 percent for a period of five consecutive Years of Assessment.

KPMG NOTE

The REP application should be submitted when the applicant is still living and working abroad (after meeting certain conditions).

Reduction in Contribution to Employees Provident Fund (EPF)

Malaysian employees are required to be contributors to the EPF.

It is proposed that the statutory rate of the employee’s contribution to the EPF will be reduced from 11 percent to 9 percent of the employee’s wages beginning January 2021 for a period of 12 months to increase take-home pay.

The above proposal is effective from 1 January 2021.

Certificate and Request Preventing a Person Leaving Malaysia

Presently, the Director General of Inland Revenue may issue a certificate containing particulars of the tax, sums, and debts to a Commissioner of Police or Director of Immigration seeking assistance to prevent a taxpayer from leaving Malaysia unless all the tax due and payable is settled.

It is proposed that the notification of the certificate to Commissioner of Police or Director of Immigration may be issued through an electronic medium or by way of electronic transmission.

The above proposal is effective from 1 January 2021.

KPMG NOTE

Taxpayers will be allowed to leave the country if the amount of tax or debts due on the certificate has been settled in full. Documentary evidence or receipt must be submitted to show that the payment has been made. For immediate cancellation, the payment receipt is to be submitted to the Malaysian Inland Revenue Board branch office that handles the taxpayer’s income tax file.

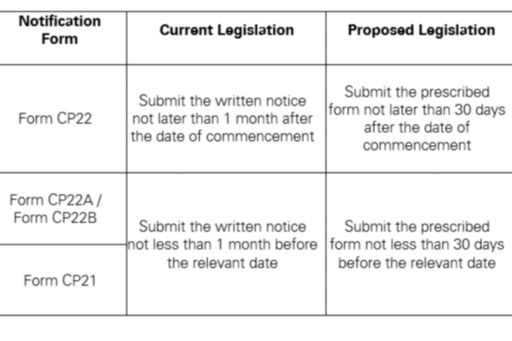

Notifications by Employer

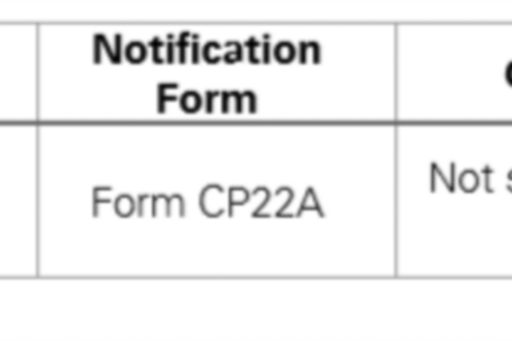

It is proposed that the current legislation on the notification deadlines be amended as follows:

Further, it is proposed that an employer be required to submit a prescribed form to the IRB within 30 days after being informed of the death of the employee.

The above proposal is effective from 1 January 2021.

KPMG NOTE

There are no significant changes to the notification forms to be submitted by the employer and the timelines pertaining thereto. It is proposed that the current legislation be amended to provide clarity on the notifications by employers.

FOOTNOTES

1 The Budget speech and related budget documents can be found on the “Budget 2021” Web page on the Web site for Malaysia’s Ministry of Finance (in English).

2 The Finance Bill 2020 can be found on the Official Portal of Parliament of Malaysia Web site, see: https://www.parlimen.gov.my/bills-dewan-rakyat.html?uweb=dr&lang=en#.

MYR 1 = EUR 0.203

MYR 1 = USD 0.246

MYR 1 = GBP 0.183

MYR 1 = AUD 0.33

VIEW ALL

The information contained in this newsletter was submitted by the KPMG International member firm in Malaysia.

SUBSCRIBE

To subscribe to GMS Flash Alert, fill out the subscription form.

© 2024 KPMG Tax Services Sdn Bhd., a company incorporated under the Malaysian Companies Act 1965 and a member of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.