Trends in ASEAN M&A - Newsletter Vol.1

Trends in ASEAN M&A - Newsletter Vol.1

We are pleased to present the first issue of our periodic newsletters on M&A market activities with a geographic focus on the ASEAN countries. While you have probably heard about M&A transactions which involves Japanese corporations from the media, we hope our newsletters will deliver practical insights on M&A activities in ASEAN, such as real-time information on M&A activities, industry trends, and updates on topical M&A deals, with views of the local members of KPMG’s deal advisory team.

Insights from KPMG’s deal advisory leaders in ASEAN countries

Here are firsthand insights on today’s M&A markets in the major ASEAN countries from KPMG’s deal advisory leaders in those countries.

Andrew Thompson / Singapore

Singapore’s M&A market started off the year on an optimistic note with overall transaction value at USD13.5bn in 1Q 2019, representing the strongest start since 2014 and subsequently finishing off 1H2019 at USD17.9b, bucking the overall downtrend of M&A activity in Asia ex-Japan. The largest deal during 1H2019 is CapitaLand’s USD8bn acquisition of Ascendas while other notable transactions include the USD 1.6bn acquisition of OUE Hospitality Trust by OUE Commercial Real Estate Investment Trust and Grab’s fundraising※1 of USD2.1bn. Both the real estate & TMT sector remains as key drivers of M&A activity in Singapore with activities in the disruptive technology space having been unique to the country’s M&A space. We expect this trend to continue moving forward.

Chan Siew Mei / Malaysia

Despite the wait-and-see approach adopted by investors amidst political uncertainties post the 2018 general elections, the M&A market in Malaysia remains relatively vibrant. The largest deal during 1H2019 is the USD2.2bn acquisition of Murphy Oil’s offshore O&G exploration blocks by PTT Exploration & Production PCL. Other notable transactions include the USD396m acquisition of Lafarge Malaysia by YTL Cement Bhd and the acquisition of F&B Nutrition Sdn Bhd by Southern Capital Group for USD219m. Further, the government has recently reinstated large scale projects which were previously thought to be cancelled. This will likely foster confidence amongst foreign investors, which in turn would drive appetite for M&A activities moving forward.

Ian Thornhill / Thailand

Year-to-date M&A activities continues to be active, with deals driven by a broad range of investors including MNCs, PE funds and domestic players. There appears to be appetite for consolidation in the Financial Services sector across banking and insurance, as signalled by the USD3bn sale of SCB Life to FWD, the ongoing discussions between TMB and Thanachart Bank (c. USD4.5 bn), and the merger of Allianz and Ayudhaya general insurance businesses. The replacement of the International HQ / Regional Operating HQ schemes with a new International Business Centre scheme has created some uncertainty in the market however we do not foresee a reduction in M&A activities as appetite for such activities remain healthy.

Michael Arcatomy H. Guarin / Philippines

M&A deals are anticipated to increase amid the country’s strong economic outlook and the stabilization of inflationary pressures from late 2018. Major deals in 1H2019 include San Miguel’s USD1.8bn acquisition of Holcim Philippines and AC Energy’s acquisition of a majority stake in Phinma Energy for USD231m. Further, Go-Jek Indonesia announced its acquisition of a majority stake in Coins.ph, a Philippine-based Fintech start-up, for a consideration of USD72m. The Philippines held its mid-term national elections in May 2019, which has brought about political certainty post elections. Also in April 2019, the Philippines’ long-term sovereign credit rating has been upgraded by S&P Global Ratings to a stable rating of “BBB+. This will likely foster investor confidence given the clarity in political direction moving forward.

David East / Indonesia

The first half of 2019 has been a rather outstanding period for the Indonesian M&A market. Notable deals in 1H2019 include MUFG Bank’s USD3.5bn acquisition of additional stake in Bank Danamon Indonesia, increasing its stake in Bank Danamon to 94%; Michelin’s USD700m acquisition of PT Multistrada Arah Sarana Tbk and GO-JEK series fund raising which raised USD920m. The May 2019 Presidential and Parliamentary elections were held in a positive manner in absence of any incidents. The incumbent remains in power which many believe will allow the infrastructure development story in Indonesia to take flight. News portals suggest that the government is planning to spend more than USD400bn in building projects, from constructing 25 airports to new power plants in the next 5 years, paving the path towards a stronger tourism industry and power capacity. A new Negative List was expected to be released in 1Q2019 but has been delayed. A stable, predictable regulatory regime is expected.

Dinh The Anh / Vietnam

Vietnam continues to receive strong interest from Korean conglomerate investors (known as the ‘Chaebols’). In May, one of Korea’s largest Chaebols, SK Group Consortium announced that it will invest USD1 bn in VinGroup via a private placement deal for 6.15% stake. Other major deals include Mitsui & Co’s USD152m acquisition of a 7.44% stake in Minh Phu Seafood Corp and Taisho Pharmaceutical’s acquisition of a 21.7% stake in DHG Pharmaceutical for USD128m. For the remaining of 2019, we expect to see 3 major trends: 1. consolidation in the retail sector driven by local players 2. the ongoing privatization of SOEs (e.g. Mobiphone, PVOil, etc.) and 3. increasing investments from Chinese investors to set up manufacturing plants in Vietnam. The latter is meant to take advantages of “China +1” strategy shifts worldwide.

Note : (1) Grab’s fundraising of USD 2.1bn is a sum of 1H2019 H series fundraising from Softbank Vision Fund, Tokyo Century and Invesco at USD1.46bn, USD350m and USD300m respectively.

ASEAN M&A market at a glance

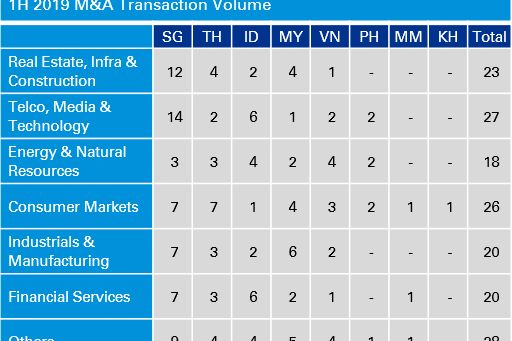

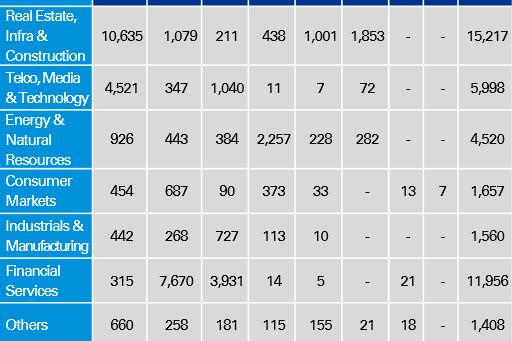

During 1H 2019, 162 M&A deals were announced in ASEAN with a total deal value of circa JPY 4.6 trillion in value (or USD 42.3bn, based on the publicly available information). In the first quarter of 2019, global market uncertainty resulted in a 31% fall in the number of deals from the immediate preceding quarter, however total deal value increased by 145% driven by mega deals in the region. In Q2, in absence of such mega deals, we see deal values normalizing in Q2 with deal volume showing a further 9% decline from Q1. This is due to the US-China trade conflict which has had a negative impact on ASEAN countries. Many ASEAN corporates have experienced weaker performance as a result of the economic downturn. Moreover, there were elections in some ASEAN countries during this period which reduced investors’ appetite towards new investments as they adopted a wait-and-see approach during a period of uncertainty.

At country level, Singapore experienced an increasing number of start-up financing deals, pushing up the number of TMT sector deals. In fact, Singapore had the highest number of M&A deals in the region for most sectors, contributing to one third of the region’s M&A transactions. Transactions in the Consumer Markets sector were the 2nd highest among sectors in ASEAN with Singapore and Thailand standing out in achieving one of the highest number of transactions in this sector. Also real estate, infra & construction sector saw a number of transactions during 1H 2019.

From a deal value standpoint, Singapore and Thailand accounted for circa 68% of all the deals in the region led by real estate, infra & construction and financial sector. However in absence of a mega deal in the sector, the TMT sector is be the key driver of transaction value moving forward, driven by start-up financing deals. During this period, Thailand and Indonesia also saw sizable transaction values in the financial service sector, driven by deals to be discussed in the following section. On the other hand, the contribution from consumer sector is much smaller in terms of average deal value.

Source : Mergermarket and KPMG analysis

Recent major deals in the ASEAN M&A market

In January 2019, CapitalLand, a leading real estate group in Singapore, completed a USD 8bn mega deal to acquire Ascendas-Singbridge that created a sensation in the market. Recent top mega deals revolve around the financial services sector, namely the merger of Thanachart & TMB, the increase in stake of MUFG bank in Bank Danamon and FWD Group’s acquisition of SCB Life Assurance. Further, there are a number of transactions involving commodity players, such as the acquisition of Murphy Oil’s interests in its Malaysian upstream business by Thailand’s PTTEP and the acquisition of Holcim Philippines Inc by San Miguel Corporation. Other than the above, financing deals by ASEAN unicorns like Grab and GOJEK, were also drivers for the M&A market’s growth.

Advanced cash management enabled by technologies

“CashTech”- a data-driven, interactive cash management tool

KPMG has developed its own interactive cash management tool, “CashTech”.This tool provides data-driven insights to businesses to support the optimization of its cash management. The insights are provided through: rapid analysis of internal and external big data; visualization of outcomes from the analysis; and the KPMG facilitation of discussions among stakeholders.

Many companies use CashTech, regardless of their size. They come from all industries and geographical areas. CashTech has been proven in a number of situations; even companies that are on track have found room to improve the efficiency of their cash management. Many companies desire to increase the amount of cash they hold, as they can invest it to the benefit of the business.

What is CashTech?

- a simple tool based on the basic idea of cash management

- enables the combined analysis of multiple data sources

- instantly analyzes big data, and visualizes such data in a impactful way

- provides user-friendly information that effectively communicates a situation to the user through data visualization; and

- factors in changes in several search criteria in the course of analysis, so as to offer compelling rationale to all stakeholders within an organization.

Usage of CashTech

- The first step of analysis using CashTech is to benchmark the organization’s historical performance to that of its competitors, with a focus on financial indicators related to trade payables, inventories, and trade receivables.

- Benchmarking with competitors provides an opportunity to understand the strengths and weaknesses of the organization, including contracts with its suppliers, its customers and processes related to inventory management.It presents an opportunity to revisit or revise a business model.

- Visualizations also present inefficient uses of cash. These can be related to management of purchases, inventories, and sales. The visualization also quantifies the amount resulting from the inefficient uses, which provides theoretical grounds for determining optimal timings of collections of receivables and settlements of payables and optimal inventory level.

- Persons involved during the course of data analysis are able to ensure that all stakeholder recognize and understand performance trends and issues faced by the organization. This is completed in a timely manner, which enables the business to come up with optimal and insightful solutions.

- In addition to changes of contractual terms, improvements in internal operations and processes can release trapped cash. For example, changes to processes around trade receivables, payables and inventories can increasing the amount of cash that can be used for other opportunities.

Good cash management is“to keep the basics correct and keep the right conditions”.If you are interested in CashTech and would like to see a demo, please feel free to contact at KPMG FAS.

© 2024 KPMG AZSA LLC, a limited liability audit corporation incorporated under the Japanese Certified Public Accountants Law and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. © 2024 KPMG Tax Corporation, a tax corporation incorporated under the Japanese CPTA Law and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.