European Debt Sales - Spain

European Debt Sales - Spain

An in-depth look into how the loan sale market performed in 2015 in Spain.

“The improving macroeconomics of Spain point to a high growth rate which will lead to improved collateral valuation and portfolio pricing which will further encourage banks to sell, and investors to purchase.” – Carlos Rubi Montes, Partner, Financial Institutions Group, KPMG in Spain

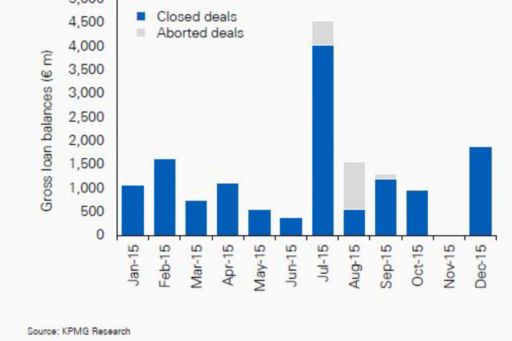

2015 saw a number of new sellers successfully bring loan portfolios to market, notably Caixabank and Ibercaja. Though investor sentiment for Spain is still positive, 2015 also saw a decrease in loan portfolios transacted as compared to 2014.

The Spanish market had a noticeable increase in the number of CRE loans and REO disposals in 2015, showing how an increasing number of Spanish lenders are taking advantage of ongoing positive investor sentiment.

SAREB continued its winding down strategy but sales by year-end 2015 accounted for less than €800 million by face value; it had withdrawn from market two portfolios (Projects Birdie and Silk) which had a combined face value of €1.5 billion.

Other developments

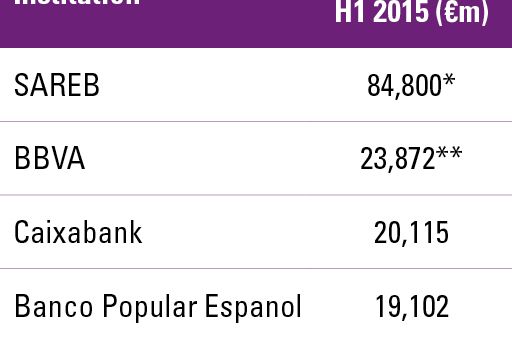

Spain is one of the most active jurisdictions in Europe for loan portfolio sales, having seen over €10 billion of loans primarily consumer or residential mortgage NPLs) brought to market by numerous sellers, ranking it third in Europe (behind UK and Ireland) for loan sale transactions.

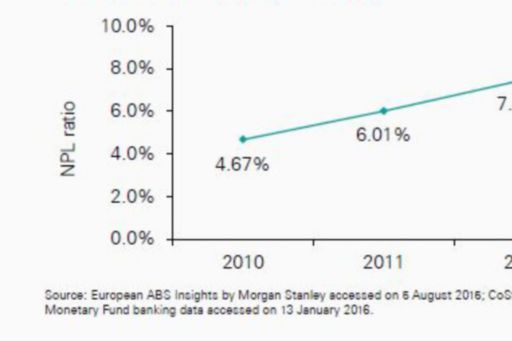

Spanish banks have fared relatively well in the European Central Bank’s Asset Quality Review stress test, which has resulted in more activity from the national banks, with many agreeing to take immediate measures to accelerate the clean-up of their balance sheets.

Looking forward & KPMG predictions

Though SAREB has been a major seller of secured loan portfolios in the past two years, we expect SAREB to be quieter for the first half of 2016. We expect SAREB’s activity to decrease in response to the new accounting rules and their impact on provisions, particularly within the current political landscape in Spain with a government in transition for H1 2016.

We expect a wave of mergers amongst financial institutions in H2 2016 as the Spanish banking market undergoes consolidation, though interest in mergers has been on hold until the current political uncertainty is resolved. The servicer market is expected to be robust as well, with smaller players catching the interest of international investors as an entry point into the Spanish market.

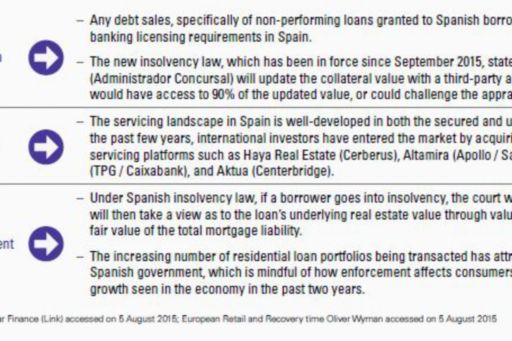

Revisions to Spanish insolvency law designed to curb the scale of liquidations across the broader economy is threatening to spook international investors competing on commercial real estate NPLs in Spain.

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.