European Debt Sales - Russia

European Debt Sales - Russia

An in-depth look into how the loan sale market performed in 2015 in Russia.

"The Russian debt sales market has recently demonstrated low activity due to a number of reasons, notably the overall immaturity of the financial markets, political and legal risks, and inefficiencies in processes and infrastructure for debt deals." – Robert Vartevanian, Partner, Corporate Finance, KPMG in Russia

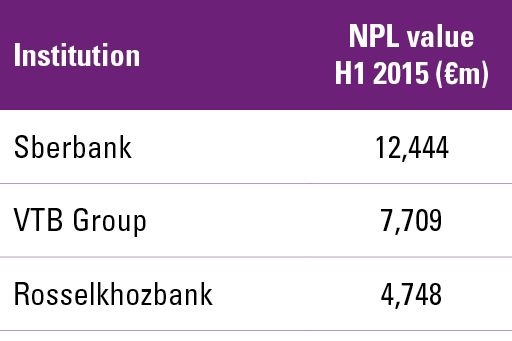

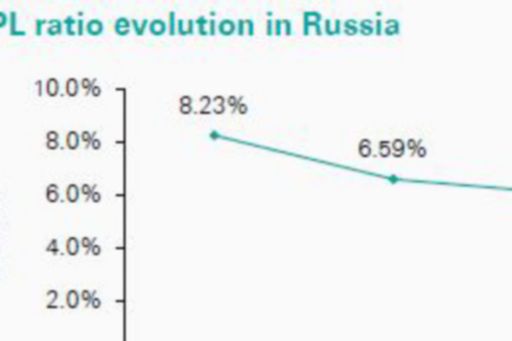

The Russian loan market has lately been characterised by the growth of both corporate and retail NPLs (in local currency) due to the recession caused by internal factors and the ongoing international sanctions.

Russian retail loan portfolios (primarily NPLs) are still in high demand by local collection servicers as they seek to shift from purchasing to servicing portfolios and collecting agent’s fees for their services.

Corporate loan portfolios have seen minimal activity on the market due to the absence of market experience and poor legal infrastructure to conclude deals with such underlying assets.

Other developments

The Russian securitisation market is still undeveloped, having being halted twice primarily by international sanctions, accompanied by the significant fall in demand from both international investors due to political risks, and domestic investors due to liquidity shortages and long-term financing difficulties. In 2015, the Russian rouble depreciated against international currencies, reaching a new low in Q3 2015 due to oil prices hitting a six-year low. This has resulted in capital flight from Russia and continued economic difficulties for Russian businesses.

Looking forward & KPMG predictions

International banks are expected to continue to reduce their exposure to Russiaas the Russian economy moved into its first recession in six years in Q1 2015, due to a sharp drop in international oil and commodity prices, and amidst ongoing international capital sanctions imposed by the European Union and the United States.

Investors and buyers in the Russian loan market are expected to be mostly domestic, as international buyers remain wary of the political risk surrounding investing in Russia. Internal deal activity in Russia is robust, especially as larger banks take advantage of favourable pricing to acquire smaller and weaker lenders, as a capital squeeze and an increase in NPLs have left the smaller banks vulnerable and in need to be rescued.

The growth of NPL volumes will cause pressure on regulatory capital levels,thus potentially also increasing deal activity with loan portfolios (primarily nonperforming).

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.