European Debt Sales - Romania

European Debt Sales - Romania

An in-depth look into how the loan sale market performed in 2015 in Romania.

“Romanian debt sales has the potential to continue to gain momentum going forwards, with significant interest shown by investors over the past 18 months in acquiring distressed debt." – Speranta Munteanu, Partner, Head of Restructuring in CEE, KPMG in Romania

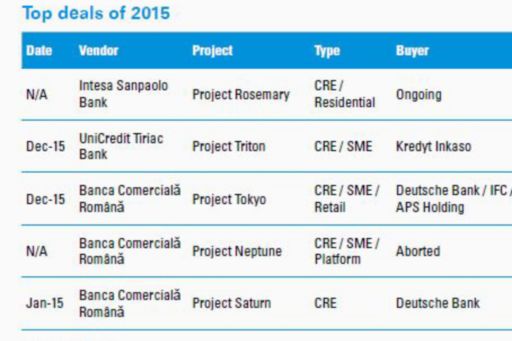

In 2013, the Romanian market saw its first successful secured loan portfolio transactions – Projects Mundabit and Holmes – sold by RBS Romania as part of RBS’s exit from Romania. In 2014, Volksbank Romania and Banca Comercială Română (BCR) followed suit and also successfully sold secured NPL portfolios with a combined value in excess of €700 million.

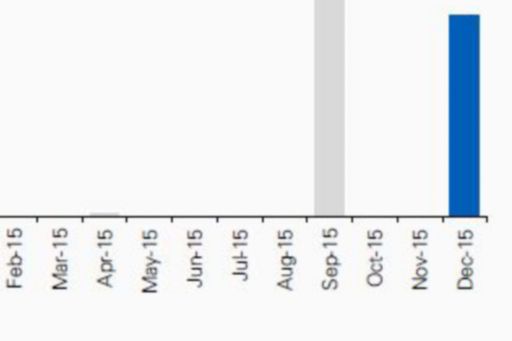

The largest loan portfolio brought to market to date in CEE has been the €2.7 billion Project Neptune from BCR (part of Austria’s ErsteGroup). It consisted of the bank’s remaining exposures in Romania, along with its servicing platform. The transaction was withdrawn from the market in September 2015.

Other developments

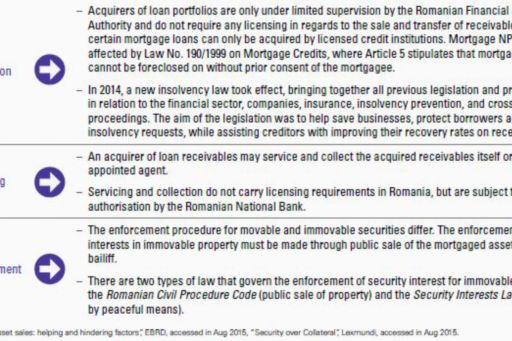

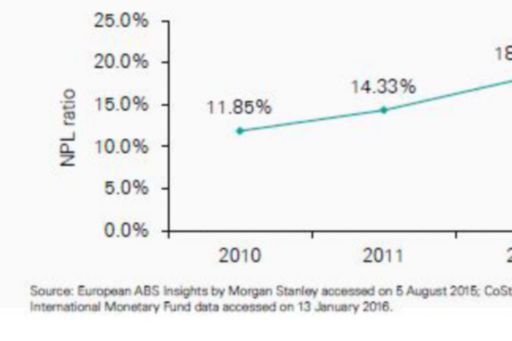

We expect the Romanian loan sale market to continue growing as more portfolios are brought to market amidst the continuing burden of high NPLs on bank balance sheets. However, challenges still remain, including investor uncertainty regarding the commitment of sellers to sell at market prices, lack of tax incentives upon transfer of loans, and complex and arduous legal barriers to sale.

Looking forward & KPMG predictions

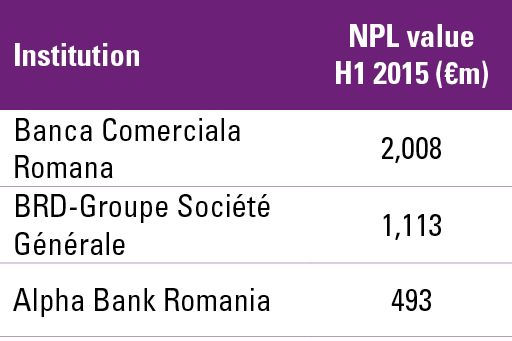

The NPL market in Romania is estimated at €12 billion, of which €3.5 billion has so far been sold to investors as of Q4 2015. Banks who have not yet brought NPL portfolios to market may now consider the chance to do so, due to recovering investor sentiment from successful transactions in Q4 2015. Romania is one ofthe few CEE countries which has seen successful loan portfolio sales.

Stringent increases in provisioning requirements by the central bank, and pressure on banks from their parent companies to cleanse their portfolios will encourage local lenders to step up NPL disposals and free resources to resume lending. The positive impact that this action by the central bank has had on NPL sale activity has been recognised by a number of other regulators in the region.

One of the challenges in the coming year will be investor scepticism towards the commitment to sell by the banks bringing portfolios to market, as four major portfolios – Project Donau (Volksbank), Project Ariadne (Bank of Cyprus), aportfolio from BRD/Société Générale, and Project Neptune (BCR) – have been withdrawn from market when their sales reached binding phase, primarily dueto bid-ask spreads. The latter portfolio has been particularly scrutinised as it was one of the largest NPL portfolios seen in CEE.

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.