European Debt Sales - Portugal

European Debt Sales - Portugal

An in-depth look into how the loan sale market performed in 2015 in Portugal.

“Although liquidity in the Portuguese NPL market has been increasing, it is still limited, with the inability of banks to take losses as they continue to focus on building capital." – Rodrigo Lourenco, Partner, Deal Advisory, KPMG in Portugal

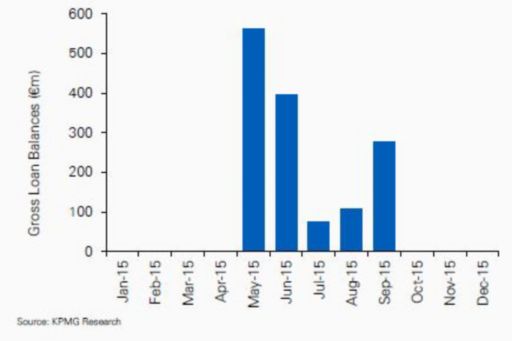

Although still limited, deal volumes have been increasing over the past three years, though the major limitation to higher deal flow continues to be the price gap and consequently the impact on capital of banks.

The Portuguese market has become more liquid and transparent, and discounts on NPLs are gradually declining as the country continues its economic recovery.

The Portuguese government is expected to continue to privitise Novo Banco, the “good bank” formed from the bail-out of Banco Espirito Santo. The bank had completed a €1.9 billion recapitalisation by transferring senior bonds to BES, the “bad bank”.

Other developments

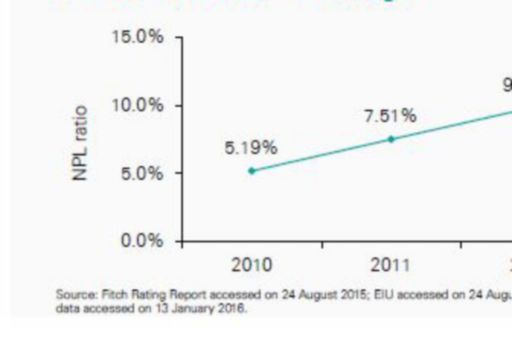

The deleveraging process for Portuguese banks has been driven by a reduction of the credit book (limited origination), rather than sales of loan portfolios. Also, the performance of banks has been penalised by significant impairment losses booked in the last few years, including the effect of the European AQR. Nevertheless, the NPL ratio of Portuguese banks has continued to grow, although at a slower pace, while coverage ratios continue to increase.

Looking forward & KPMG predictions

The volume of NPLs still held in the balance sheets of Portuguese banks reflect the low deal volume in recent periods. This is mostly due to the inability of banks to manage negative impacts on capital associated with divesting these assets. However, there are a number of variables which are evolving favourably, namely the positive economic context and subsequent improvement in bank performance, the narrowing of the price gap, and the added pressure from regulators, will contribute, in our view, to additional deal flow. We understand that banks are actively working on their divestment projects and plan to bring additional portfolios to the market in 2016.

Portugal continues to be a relatively unexplored market, attracting interest from both investors who are already active in Portugal, but also others looking to expand their investments to new European jurisdictions. The recent M&A activity observed for servicing platforms signals investors’ positive sentiment in regards to market prospects.

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.