European Debt Sales - Hungary

European Debt Sales - Hungary

An in-depth look into how the loan sale market performed in 2015 in Hungary.

“The market will find its feet over the next months and show volume. A key to maintaining the momentum will be successfully closed transactions. KPMG have now closed two corporate loan sales with another expected before year end.” – Tamás Simonyi, Senior Director, Head of CEE Financial Insitutions M&A, KPMG in Hungary

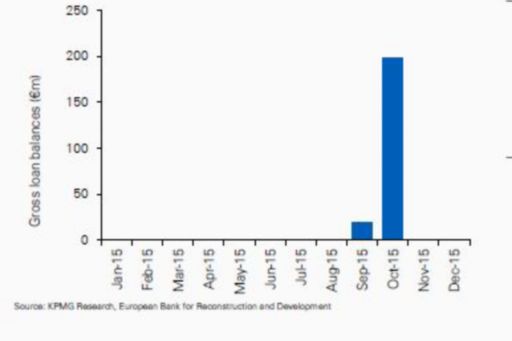

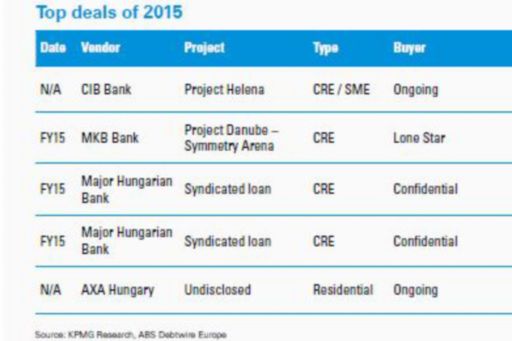

Though there has been growing investor interest in Hungarian loan portfolios, only individual, syndicated CRE-backed positions have been sold as large ticket items so far. Most of the other sales that have taken place to date have been consumer portfolios, or loan portfolios sold as part of an entire bank sale.

In November 2014, the National Bank of Hungary mandated the establishment of a bad bank, MARK Group, which is expected to buy project loans of over €2.2 billion and fore closed real estate above the value of €164.4 million from banks in Hungary in order to help them clean up their balance sheets. However, at the time of printing, MARK has not yet been operational.

Other developments

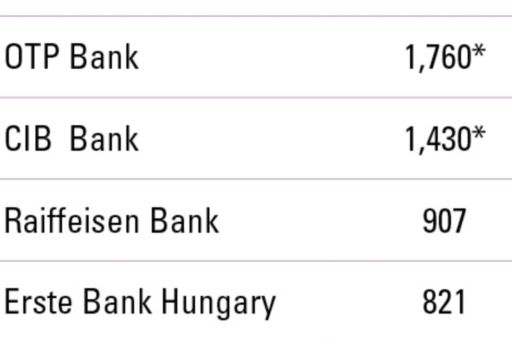

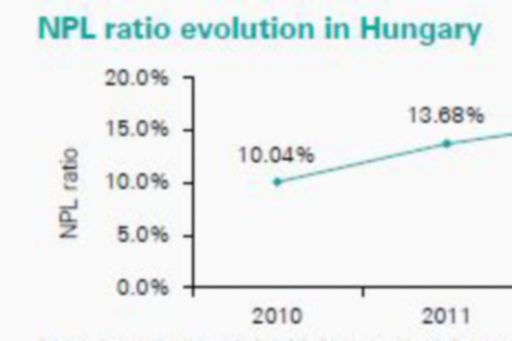

There have been several attempts over the past few years to kick-start the Hungarian debt sale market and open it to foreign investors. However, few Hungarian banks had considered bringing portfolios to market, as they believed that they could collect more efficiently than a foreign investor. In 2013, the average NPL ratio of the top 10 Hungarian banks was 18.4 percent. The Hungarian government responded to the NPL issue by establishing a bad bank (MARK) in November 2014 with the goal of acquiring distressed assets from Hungarian banks which had accumulated since the global financial crisis.

Looking forward & KPMG predictions

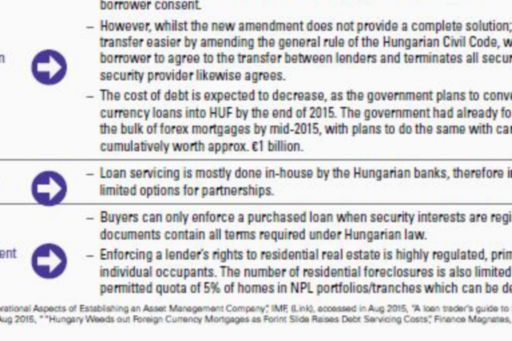

Though the Hungarian bad bank, MARK, has been formed, it is not yet operational at the time of printing. This uncertainty affects investor interest and pricing in NPL portfolios, as banks may hold out from bringing portfolios to market due to expected more favourable pricing for their assets should they be transferred to MARK. Until MARK gives a clear signal as to when and if it will commence operations, the uncertainty will negatively affect any potential Hungarian loan portfolio sales activity.

The National Bank of Hungary has introduced new regulation, the Mortgage Financing Adequacy Ratio (“JMM”), effective October 2016, which will reqiure banks to finance at least 15 percent of their outstanding household mortgage loans by long-term securities, mostly mortgage bonds. This will lead to new mortgage banks being established, and potentially kick-start the mortgage loan portfolio sale market in Hungary.

Recent changes in personal bankruptcy laws that allow private individuals or households with defaulted mortgages to declare personal bankruptcy in Hungary will allow borrowers to try to avoid liquidation on their properties. As part of this law, Hungarian banks can again enforce on residential properties mortgaged under defaulted loans, which, coupled with the JMM, may lead to the first residential loan portfolios being brought to market in Hungary in 2016.

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.