European Debt Sales - Germany

European Debt Sales - Germany

An in-depth look into how the loan sale market performed in 2015 in Germany.

We expect a further increase of transactions, particularly in residential loan portfolios; however, the overall volumes continue to be small in comparison to the market potential.” – Sven Andersen, Partner, Head of Real Estate M&A, KPMG in Germany

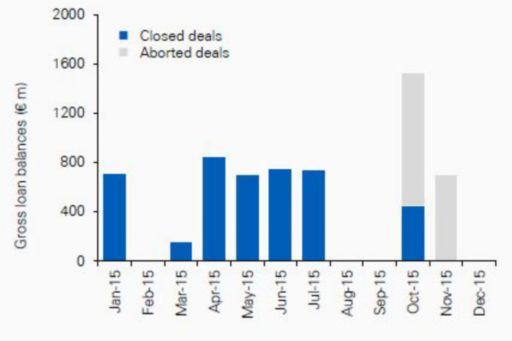

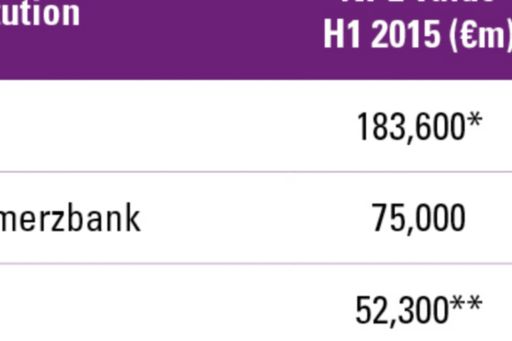

The overall volume of the loan sale market in Germany has remained significantly below expectations, despite a number of large transactions as a result of the winding down of Eurohypo AG (the real estate bank now 100 percent owned by Commerzbank).

Foreign banks in Germany have been more active in disposals of their German NPLs and non core-assets, such as with Goldman Sachs’ (Archon Group) disposal of two loan portfolios. Of its domestic banks, only Helaba has sold a portfolio in H2 2015, the €450 million Project Aurora.

The German bad banks, which include Erste Abwicklungsanstalt (EAA) and FMS Wert management (formed from the failed banks of WestLB and Hypo Real Estate, respectively), have not brought many German portfolios to market to date despite investor expectations.

Other developments

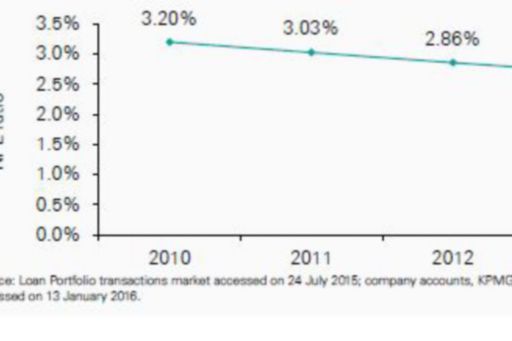

Sales of non-performing loans by German lenders are expected to pick up in the near future as banks are expected to offload distressed assets from their balance sheets, despite the limited number of disposals in recent years.

Cost-cutting measures are among the top management priorities for German banks. For this reason, NPL portfolio sales are expected to play an important role for banks to reduce internal workout costs in the medium to long term.

Looking forward & KPMG predictions

Improved market conditions and increased demand has forced government owned “bad bank” vehicles in Germany to accelerate the sale of loan portfolios. The two state-owned bad banks of Germany (FMS and EAA) are expected to continue to reduce their exposure outside of Germany in the coming year, but their deleveraging activity in Germany is expected to continue to be low. This has resulted in easing the government debt-to-GDP ratio to 75 percent of GDP in 2014, down from 77 percent in 2013.

The main drivers of impending NPL disposals for German banks are rising banking regulatory pressure and an increasing focus on achieving better cost efficiency. NPL portfolio sales are expected to play an important role in reducing internal workout costs for German banks in the medium to long term. Regional banks, which generally do not sell NPLs, constitute additional potential for growth embedded in the German market.

German banks are currently adopting either a hold strategy, or are focusing on disposals of non-German NPLs. Most banks have sold or are selling their shipping loans due to regulatory pressure from the ECB, while single name sales remain the preference of most banks. Sales activity will likely increase only if BaFin, the German regulator, pushes for balance sheet clean-up.

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.