KPMG International conducts an ongoing survey of tax leaders around the world, which considers ranges of responsibilities, department composition, budget structures and other data points to help tax leaders assess their departments today, and consider how to evolve them for the future. Below are some of the highlights of the survey by respondents from the technology and telecommunications industry.

Structure

Central tax departments most often fall within the:

Most Chief Tax Officers (CTOs) or Tax Leaders report to:

Over half of tax departments in the technology and telecommunications industry are responsible for global reporting while a high portion are responsible for domestic reporting compared to global averages (i.e. 61% global reporting and 74% domestic reporting):

Half of the tax departments in the technology and telecommunications industry use a shared service center (SSC), of which 50% have increased utilization.

Responsible tax

Half of tax departments have a code of conduct to frame their risk tolerance and tax decisions.

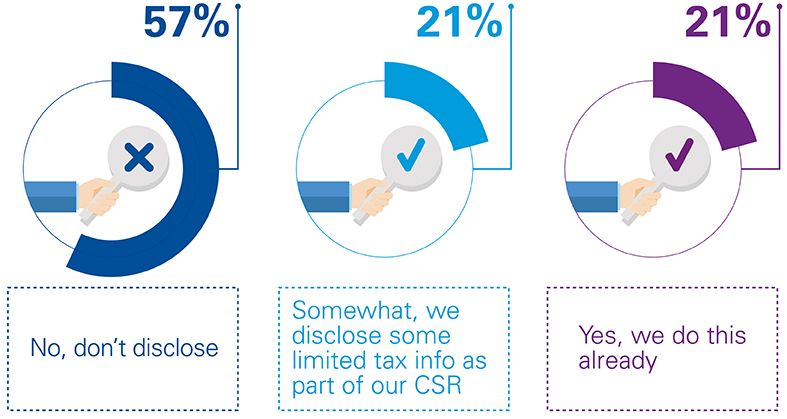

Public disclosures of tax information:

30% of the companies who don't currently disclose, plan to do so in the future.

Wish list

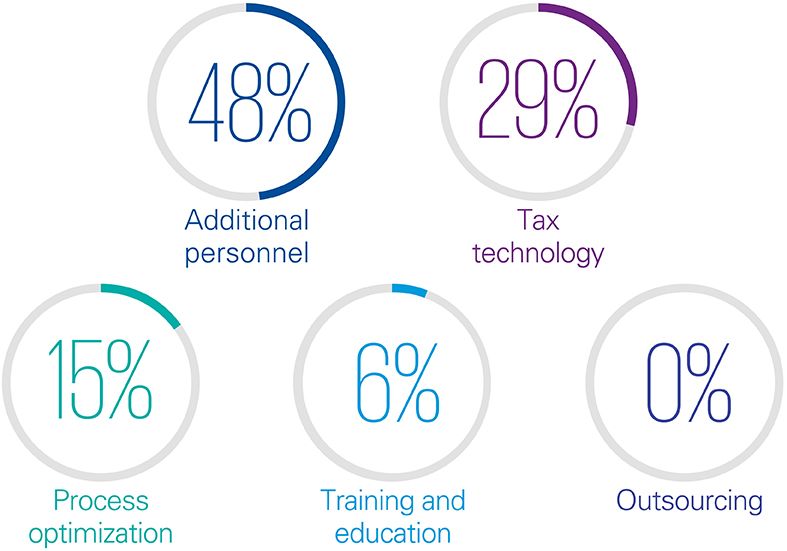

Additional personnel and tax technology topped the list for tax leaders when asked where they would invest if they had an additional budget.

Tax leaders ranked the following three process improvement priorities as important or very important over the next 5 years:

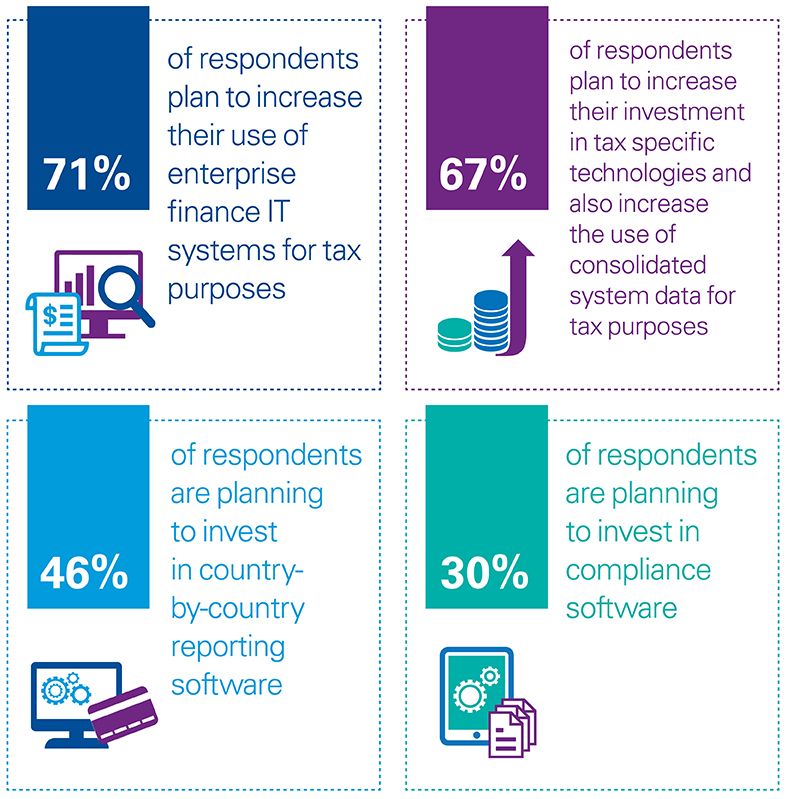

Technology

Department performance

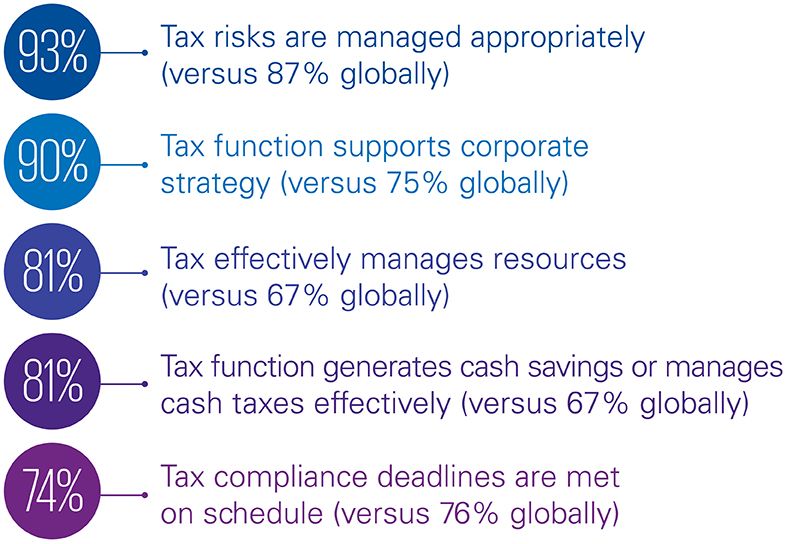

Performance is often measured by the impact the tax department has on the business across a range of metrics, with these five most often topping the list of importance:

Business impact

Half of tax departments have oversight from a board member (or board-level individual) as tax continues to rise in importance on the board agenda.

Today, tax departments are often consulted on the overall business strategy for the organization. 57% of the respondents have seen an increase in involvement in the last 2 years.

Less than half of companies have a tax strategy or overarching tax governance policy document that covers tax risks.

Assessing today and preparing for the future

As a seasoned tax leader, you make key decisions every day to evolve your tax department in order to keep pace with unprecedented pressures, disruptive technological advancements, heightened compliance obligations and more -- all while continually demonstrating value within your organization and beyond.

Benchmarking against comparable tax departments can be a powerful tool for reflecting upon the department you have today, and thinking about how you will transform it for tomorrow.

The KPMG Global Tax Department Benchmarking Survey is an ongoing initiative that is establishing a meaningful benchmark of data for tax leaders around the world. The future of tax is here.

To respond to the survey, please email tax@kpmg.com.

Source and notes

Global Tax Benchmarking Survey, KPMG International, 2019

*Notes:

- Percentages might not add up to 100% due to rounding

- Data as of 7 May 2019

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia