The alternative investment industry is increasingly feeling the impact of digital technologies, but are hedge funds and private equity firms moving quickly enough to adapt to the digital world?

A new global report, Alternative investments 3.0 - digitize or jeopardize, from KPMG International and CREATE-Research, finds that the majority of 125 hedge funds and private equity firms in 19 countries surveyed are not yet capitalizing on the potential opportunities from digital innovation.

Focusing on the two key segments in the alternative investment industry most amenable to digitization -- hedge funds and private equity -- this report aims to:

- uncover the prospects for digital disruption and its dynamics

- assess the current state of adoption in the normal implementation cycle

- identify the drivers of digitization as well as its blockers

- highlight the likely impact and the factors that will differentiate winners from losers.

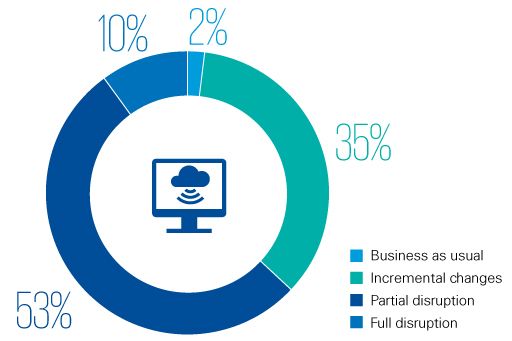

Figure 1.1 Which scenario summarizes your view on the impact of digitization on the alternative investment industry over the next 10 years?

Percentage of respondents | Source: © KPMG/CREATE-Research survey 2018

Digital leaders' to-do list

The report also offers a digital leaders' to-do list, with a set of actions alternative investment firms can take to kick-start digital innovation, including:

- Collaborate with fintechs with innovative ideas and tools that are hard to develop in a legacy environment.

- Form strategic partnerships with the best-of-breed third party administrators, if there is no enthusiasm for creating inhouse capability.

- Improve the human–machine interface to get the best out of both.

- Deepen and broaden the talent pool to have computer scientists and data specialists work alongside portfolio managers, risk specialists and client service teams.

- Develop people practices that further enhance self-regulatory behaviors and self-motivated creativity.

Embracing disruption

This age-old dictum means that alternative investment managers cannot afford to ignore the latest tide of innovations for long.

Indeed, our research suggests that they are already in the midst of a tectonic shift, with significant consequences

over the next decade.

History shows that at the dawn of each major IT innovation, ex ante predictions about its adoption and impact have invariably been proven wrong. They overestimated the adoption pace and underestimated the magnitude of the impact. The pace turned out to be slower but its eventual impact much larger.

By any measure, the industry has been highly profitable. But its members now face a stark choice: digitize or jeopardize. They must either embrace the revolution that is sweeping through their societies or risk becoming its unwitting victim.

We hope this report will provide a useful resource for understanding on how Alternative investments 3.0 will emerge, as new technology penetrates deeper into the industry value chain. If you would like to discuss our findings in more detail or learn what your organization can do to accelerate your digital innovation, please contact your local KPMG advisors.